Our Press Release about the new beer behemoth that is a threat to global health and sustainable development has garnered some attention, both in the social media and among journalists. Also Kristina’s more detailed blog post on the subject is popular. Both press release and blog article have started a conversation. And we’ve received some excellent questions from a number of journalists who want to understand the issue more in depth.

Here, I provide some more detailed answers:

1. “Why is it worse to have one gigantic alcohol company instead of two big ones?”

In general, there are major problems related to profit interests being part of the alcohol trade. Countries that eliminate profit interests from alcohol trade, have in general better public health and social welfare outcomes – like in the case of Sweden and its retail monopoly, compared to Denmark and the absence of an alcohol retail monopoly; or in the case of US control states compared to federal states without a retail monopoly. The kind and degree of retail monopoly varies but the overall point is that public health is best protected if there are no profit interests involved in the alcohol trade. From that starting point, the major difference is actually whether there are or are not profit interests allowed in the alcohol trade.

However, there are perspectives that need to take into account societies where profit interests run the alcohol trade, and where those profit interests are largely unregulated. In these societies, like in Sub-Saharan Africa, it does matter who the actors are and how much of the market they dominate.

- It is worse to have one gigantic company because of market concentration and related negative consequences.

- It is worse to have one gigantic company because of amassed political power in the hands of a few corporate actors.

- It is worse to have one gigantic company because of increasing influence on consumer choices, alcohol norm and environment.

The problem with market concentration

Market concentration is usually the trend towards a decrease in the number of companies that produce a specific commodity or service, the result being that remaining corporations become bigger, more influential and powerful, dominating bigger shares of the market and often driving smaller competitors out of business.

The alcohol industry has witnessed a tremendous market concentration since the late 1970s. Between 1979 and 2006, the ten largest global beer producers more than doubled their share of the global market, from 28% to 70%.

Research from Euromonitor International estimates that the mega-merger would account for 29% of global beer sales, after selling assets to win regulatory approval. In terms of sales, it also would be more than three times as large as its next closest competitor Heineken.

| 5 Biggest Beer Producers | Market Share in % |

| AB InBev | 20.8% |

| SABMiller | 9.7% |

| Heineken | 9.1% |

| Carlsberg | 6.1% |

| China Resource Enterprise | 6% |

This type of market concentration in the alcohol industry has created Big Alcohol – where decisions about what to produce, how to market those products and who to target with corporate communication are left in the hands of very few major corporations, their executives and shareholders. At the same time, the power of governments to shape markets and protect consumers is diminishing.

Signs for abuse of power

AB InBev has been working for years to dominate the alcohol market and signs of abuse of its power are apparent. For instance, the U.S. Justice Department is currently probing allegations that AB InBev curbs competition by buying distributors. If AB InBev controls distributors, it makes it harder for micro breweries to get their products on store shelves. In fact, AB InBev has bought five distributors in three states in recent months. Government authorities are also reviewing micro brewers’ claims that AB InBev bullies some independent distributors to only carry the company’s products and end their ties with the micro brewing industry.

Anheuser-Busch InBev was created seven years ago in a move orchestrated by 3G Capital, Anheuser-Busch InBev’s largest shareholder. The founding partners of 3G used AmBev, their Brazilian company, to merge with InterBrew of Belgium and then orchestrate a surprise takeover of Anheuser-Busch, in 2008.

AB InBev has a long record of acquisitions – a major strategy of the corporation to generate profits and grow from a relatively small player in Brazil to the world’s largest brewer.

An unholy alliance for political power

Market concentration, as aggressively pursued by AB InBev, leads to concentration of political power in the hands of a few top executives and their main shareholders.

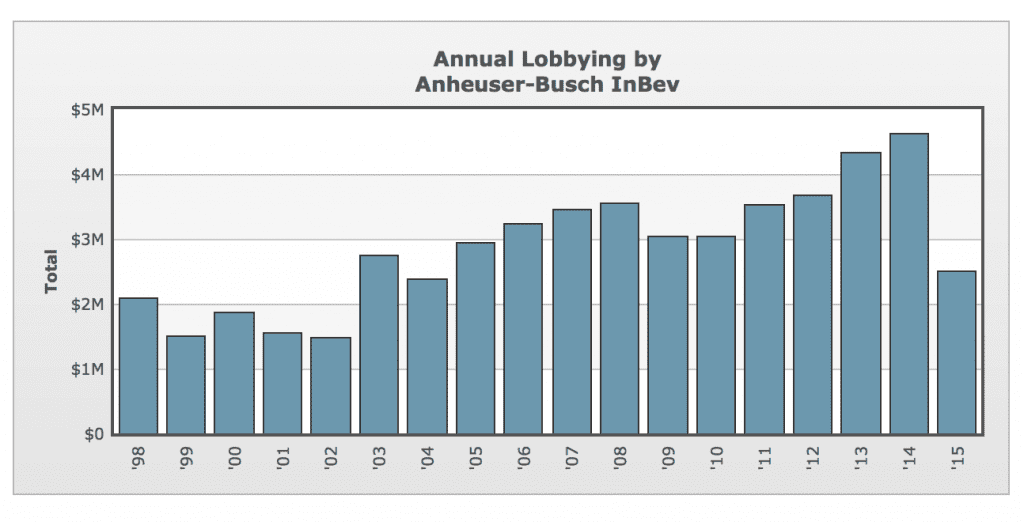

The new beer behemoth exemplifies how the largest multinational corporations get together in their pursuit of profits and ever more political power. AB InBev has so far spent $2.5 million on lobbying in the United States alone. SABMiller has spent more than $1 million this year, so far. Altria has invested $4.5 million this year in the United States alone.

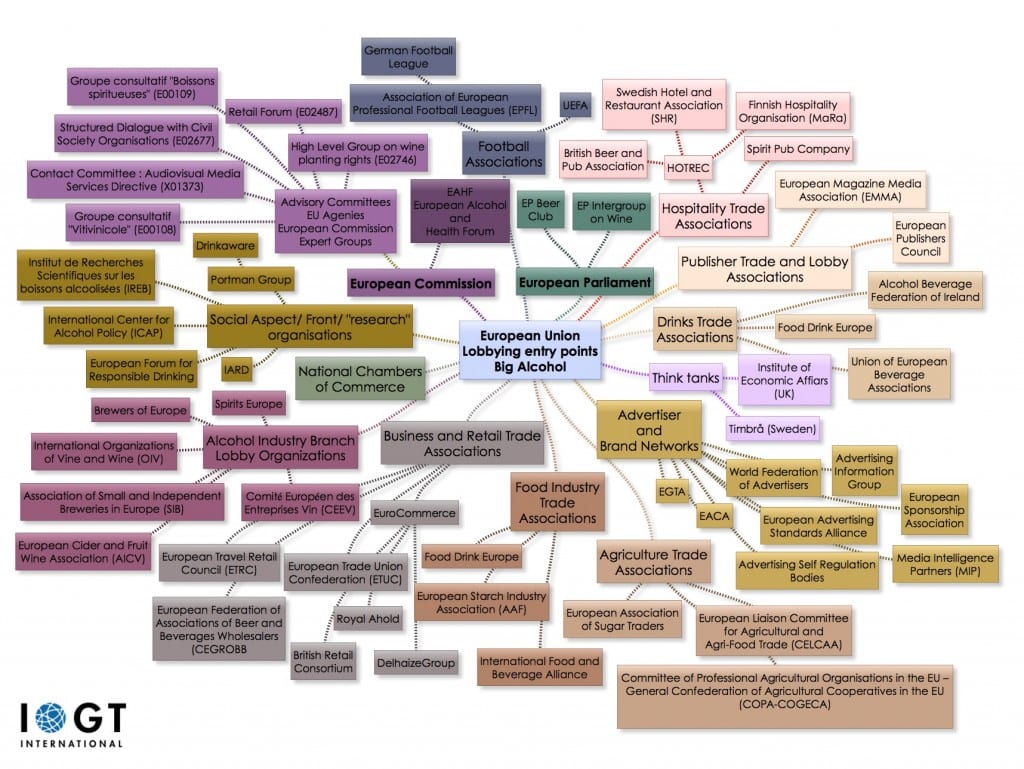

The entry points for Big Alcohol lobbyists are already numerous – just consider the example of the European Union. And what this type of political power can do, we could all see in Brazil where the government had been bullied by AB InBev and Fifa, football’s corrupt world governing body, to scrap its law banning alcohol from football stadiums in order to reduce and prevent violence.

This type of market concentration in the last decades has created Big Alcohol, and is now creating Big Beer Behemoth – where decisions about what to produce, how to market products and who to target with corporate communication is left in the hands of a few major corporations, their executives and shareholders. At the same time, the power of governments to shape markets and protect consumers is diminishing and is being systematically eroded by Big Alcohol.

2. “Why is it a concern for emerging markets in Africa and Asia? Why isn’t this a concern for Europe as well?”

The Financial Times reports that “AB InBev has sought [SABMiller] for its strength in faster-growing emerging markets, such as Africa, as sales in many developed markets are slowing due to changing consumer tastes.”

Big Tobacco, that has a track record of targeting developing countries and youth in those countries, has been a driving force of this mega-merger. And Big Tobacco is set to receive seats on the board of the new behemoth. Tactics of the Big Tobacco playbook are certainly being employed to pursue profits for executives and shareholders – no matter the human costs.

SABMiller has a workforce of close to 70,000 people in more than 80 countries, and global annual sales of more than $26 billion. AB InBev has a workforce of 155,000 and global revenues of more than $47 billion. Both are massive global corporations that are pursuing profits ruthlessly.

Unethical tactics exposed: Profit over Human Rights

For example, ActionAid has exposed SABMiller for its unethical tax schemes in Sub-Saharan Africa. ActionAid estimates that SABMiller’s tax dodging schemes may have lost governments in developing countries as much as $30 million, which is enough to put a quarter of a million children in school.

SABMiller has also been exposed to employ aggressive tactics in lobbying against a public health bill to ban alcohol advertising in South Africa.

AB InBev is under investigation by tax authorities in Europe for a tax agreement that ”allowed” AB InBev to transfer 140 million euros of profit from around the world over three years to a Belgian company that exists only on paper.

AB InBev is also infamous for its love affair with corruption-riddled Fifa, football’s world governing body. Budweiser, an AB InBev product, is a long-time sponsor of the Fifa World Cup. In aggressive lobbying, Fifa and AB InBev forced Brazil to abandon legislation to prevent and reduce alcohol-related violence around football matches, only to allow alcohol being sold inside World Cup stadiums.

Coming after African youth as “promising emerging market”

The mega-merger will secure AB InBev a target it has long coveted. SABMiller’s African brands are actually one of the main reasons AB InBev pursued the gigantic deal so aggressively. Carlos Brito, the chief executive of AB InBev, called Africa a “key piece” of the mega-merger. Brito said AB InBev decided to make a move after carrying out research on Africa where SABMiller is dominant, owning ca. 40 brands and having its historic roots. AB InBev brands on the other hand are largely concentrated in the Americas and Europe. It was the growth of SABMiller’s African brands that really attracted AB InBev.

With 200 million people aged between 15 and 24 (the youth bracket), Africa has the youngest population in the world. By 2045 this figure is projected to double, according to the 2012 African Economic Outlook report.

It is in Africa, with its vast young population and growing middle class where Big Alcohol aims to cash in. The alcohol markets in Europe and the United States are largely saturated. But in low- and middle income countries, a majority of the people often is not using alcohol.

The new Big Beer Behemoth means trouble also in Europe and the United States, for its increasing lobbying power and hegemonic position exerting massive influence on people’s environments, values and preferences. It is already difficult to hold the alcohol industry accountable for violations of laws – like the broadcasting of alcohol ads from the UK to Swedish audiences in Sweden, despite an alcohol advertising ban.

For Big Alcohol great power doesn’t mean great responsibility, but massive unethical conduct.”

Maik Dünnbier

As the example above already alluded: in the US, Big Alcohol is attacking the 3-tier system by eliminating the distributor tier – a system that was put in place to protect public health from alcohol harm.

But the real threat is posed to the people in Africa and Asia, to countries where no alcohol legislation exists and/ or where government resources are so scarce that enforcement of existing rules and regulations is largely non-existent.

3. “What kind of trouble could this mean for those markets? Do you assume that alcohol consumption will increase, and if so, why?”

In Movendi International, we are deeply concerned about the mega merger for a number of reasons.

- The merger would mean substantial gain in power and influence.

- The merger would create a beer behemoth, dominating large parts of the world, including developing countries.

- The merger means ever more aggressive practices to make the blockbuster deal profitable.

- The merger is a serious threat to global health and sustainable development.

This merger and the new Big Beer Behemoth mark another aggressive step by Big Alcohol to target emerging markets in Africa and Asia.

The troika of two Big Alcohol giants plus the Big Tobacco giant Altria spells trouble for people in developing countries and for the newly adopted Agenda2030.

Their track record of unethical practices putting profit over Human Rights is well known.”

Maik Dünnbier

Alcohol kills 3.3 million people worldwide, every year. It is the fifth leading cause of death and disability worldwide and a major risk factor for global epidemics of gender-based violence, infectious diseases like HIV/ AIDS and tuberculosis as well as for non-communicable diseases like cancer, heart disease and diabetes.

Mega deal, mega risk, mega everything

The legal deal was only made possible after Olivier Goudet, chairman of AB InBev, stepped in and promised that his company would raise its cash offer for a fifth time. It’s clear that this is an expensive and risky investment for AB InBev and its executives.

SABMiller’s top executives will share a potential $2.1bn payout of shares and options if the deal is completed. Alan Clark, SABMiller’s chief executive, is likely to receive more than £80m. The deal is risky and lucrative beyond believe for the top executives involved. It is obvious to see that AB InBev executives will do everything they can to pursue mega returns on their mega investment and the mega risks attached to the mega merger.

The gigantic deal would create a company generating more than $70bn of annual revenue from brewing 80bn litres of beer a year. The giant corporation will have big operations in Europe, north America, Latin America and the Asia Pacific region, and will give AB InBev access to the fast-growing African beer market.

It is in those markets where the new beer behemoth needs to cash in. For Big Alcohol to be able to rake in profits, there needs to be a massive increase in alcohol consumption, especially among the parts of the population that does not use alcohol currently. But with rising alcohol use, alcohol-related harm is also increasing, and thus the costs to families, communities and society at large.

Alcohol consumption is likely to increase because the new Big Beer Behemoth is set to invest in aggressive alcohol marketing strategies. They are also increasing their lobbying to attack existing alcohol regulation, block developments of drafting evidence-based alcohol control policies, and forever prevent the adoption of cost-effective alcohol policy measures. As shown above, both corporations have not been hesitant to use unethical means for creating evermore profits. This blockbuster deal will set off blockbuster advertising campaigns and ruthless lobbying in the most vulnerable communities and societies around the world. The consequences, we know that much, will be catastrophic for people, their homes and families, communities and society at large.

For further reading

This Bud’s for Congress: Anheuser-Busch InBev Burns Cash in Washington

Anheuser-Busch InBev spends record $4.3 million lobbying in 2013, much of it geared toward a bill that will never pass.