New research was presented by economist and researcher Arnis Sauka on excise tax policy in the Baltic states, Latvia, Lithuania and Estonia. Sauka stated that regional coordination of alcohol excise tax policy can remove incentives for cross-border trade that undermines a country’s alcohol tax.

One of the major fears among Baltic nations when implementing alcohol tax increases is cross-border trade. Movendi international has been reporting on the situation between Estonia and Latvia where the countries were competing to reduce taxes citing cross-border trade issues. Initially, in 2019 Estonia reduced its alcohol tax by 25%, possibly undoing all the benefits achieved by its modernized and evidence-based alcohol policy system established in previous year. As a response Latvia decided to limit their planned 30% tax increase to only 5% in order to keep the prices of alcohol cheaper than in Estonia.

Policy coordination would allow these countries to raise taxes and reduce the alcohol burden across the region without cross-border alcohol trade issues undermining effective alcohol policy solutions.

Both Latvia and Estonia fear the actions of the neighboring country. The discussion is political more than rational,” said Arnis Sauka, economist and researcher, as per LSM.LV.

Arnis Sauka, economist and researcher

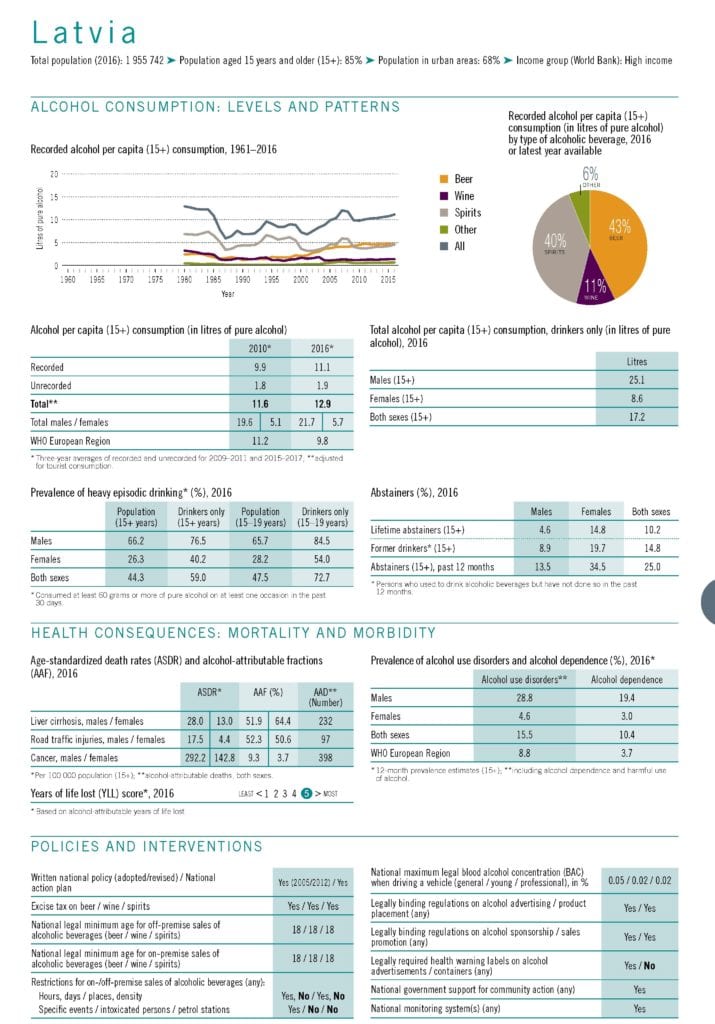

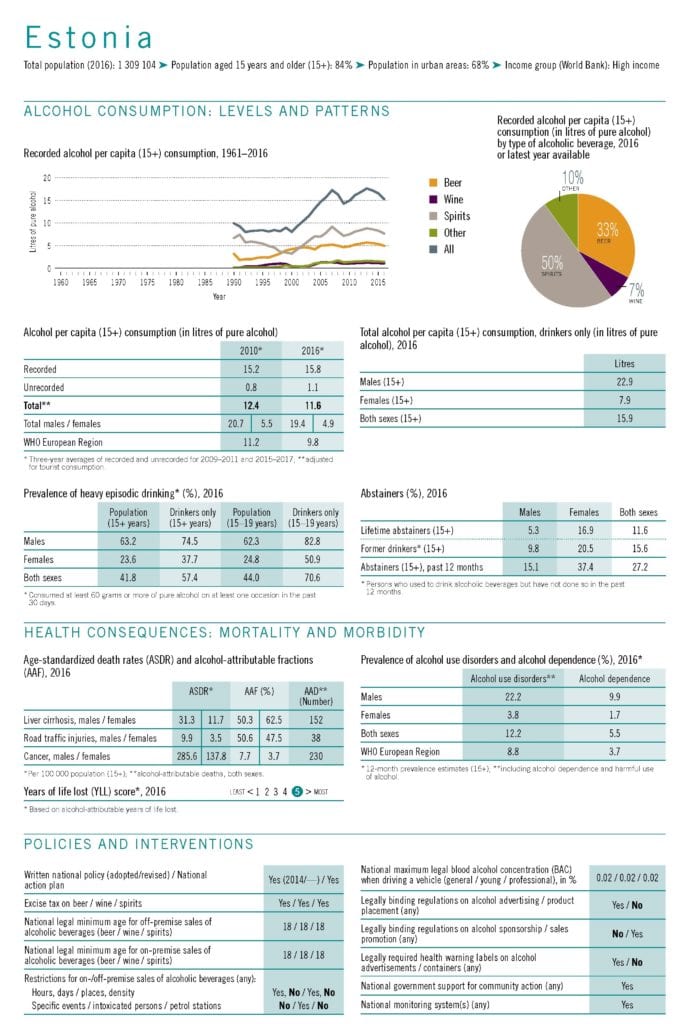

Alcohol Harm in Latvia and Estonia

As the World Health Organization (WHO) reports, total per capita alcohol consumption in Latvia is 12.9 litres which is above the average of the WHO European region – the heaviest alcohol consuming region in the world. Over half (59%) of alcohol users above 15 years of age and over two thirds (72.7%) of alcohol using youth between 15 to 19 years engage in binge alcohol consumption.

Latvian men are hit extremely hard by alcohol harm in the country with 28.8% suffering from alcohol use disorders and 19.9% dependent on alcohol.

The situation is not much better in Estonia either. But in recdnt years, the country has taken political action to turn the tide on their national alcohol problem. As the WHO reports, total per capita alcohol consumption in Estonia is 11.6 litres – which is also above the average of the WHO European region. Over half (57.4%) of alcohol users above 15 years and over two thirds (70.6%) of alcohol using youth between 15 to 19 years engage in binge alcohol consumption.

Estonian men are also hit hard by alcohol harm in the country with 22.2% suffering from alcohol use disorders and 9.9% being dependent on alcohol.

Both Latvia and Estonia are placed at the highest end for years of life lost due to alcohol. Evidently neither of the countries can afford to ignore their alcohol problem. Decreasing taxes to reduce cross-border trade is not an effective method of dealing with the issue, as it only increases alcohol consumption which will further increase alcohol harm.

Increasing taxes is a WHO recommended alcohol policy best buy solution which is proven effective in preventing and reducing alcohol harm cost-effectively.

Focusing just on the economic aspect of alcohol taxation such as budget revenue is a counter-productive approach from a public health and safety perspective and from a sustainability perspective – as the costs for alcohol harm dwarf the entire economic contribution of the alcohol trade.

As policies of one country affect the entire region in close-knit regions such as the Baltics, it is imperative that the countries collaborate across borders. With a coordinated plan the entire region can benefit from the prevention and reduction of alcohol harm, improved health, safety and economic productivity.

As Movendi International has documented when done right, taxing alcohol – a health harmful product – can fund development in countries. One positive example comes from the Philippines where the government adopted a tax increase for alcohol and tobacco aiming to use the revenues partly to fund a free healthcare programme.