The alcohol industry is pushing to weaken online alcohol sales regulations. Big Alcohol is claiming business downturn due to the COVID-19 pandemic to be the reason why South Korea’s alcohol policy protections need to be further eroded. However, sales data showed that the alcohol industry profited even during the pandemic.

According to data from the Korea Customs Service and the local liquor industry:

- South Korea’s imports of whisky soared more than 70% in the first 10 months of the year.

- The value of whisky imports amounted to US$93.21 million in the January-October period, meaning a rise of 73.1% from a year earlier.

- It represents the first on-year increase in the country’s whisky imports since 2014.

- Pernod Ricard Korea saw its turnover spike 31.6% on-year to 120.5 billion won ($101 million) in fiscal 2020 (July 2020-June 2021), with its operating profit shooting up 66.9% to 26.9 billion won.

- Sales of Diageo Korea Co. edged down 3.6% to 193.3 billion in the same fiscal year, but its operating income soared 85% to 37 billion won.

- South Korea’s wine imports rose to new heights in 2020, reaching $330 million, up 27.3% over the previous year.

- In 2021, wine imports from January to August amounted to $37.5 million (430 billion won), up 96.5% same period last year.

Rising alcohol use during pandemic benefits Big Alcohol but harms society

The rise in alcohol sales in South Korea is attributed to more people consuming alcohol at home. COVID-19 containment measures meant restaurants and bars faced closures and restrictions. However, alcohol use behaviors in South Korea switched to home alcohol use.

In South Korea, traditional Korean liquor sales and delivery are permitted via e-commerce channels. The alcohol industry is now pushing the government to weaken laws governing online alcohol sales.

In late September, the European Chamber of Commerce (ECCK) in South Korea disclosed its 2021 regulatory environment white paper pushing the National Tax Service that “smart ordering” for online purchases of alcoholic beverages ought to be expanded. This means Koreans would be able to order alcohol through mobile applications. Such measures would increase alcohol availability further in the country and exacerbate existing alcohol harms.

Problems that can arise from online alcohol sales in South Korea have been pointed out in a report by the National Assembly Research Service, a subgroup of the nation’s law-making institute responsible for legislation and policy research. They include:

- Underage alcohol purchases,

- Damage to the traditional liquor market, and

- Problems with protecting the competitiveness of the local liquor industry.

The research group further pointed out that South Korea’s alcohol regulations in terms of access to alcohol are weak and outdated compared to the OECD average. For example, other member countries of the Organization for Economic Cooperation and Development (OECD) implement limits on hours or days of alcohol sales, limits on the number of local alcohol outlets, and bans on alcohol advertising. Currently, South Korea has no alcohol availability regulations, other than the legal age limits and the regulation of online alcohol sales.

Alcohol harm and policy in South Korea

But reducing the physical availability of alcohol is a Best Buy solution recommended by the World Health Organization to prevent and reduce alcohol harm.

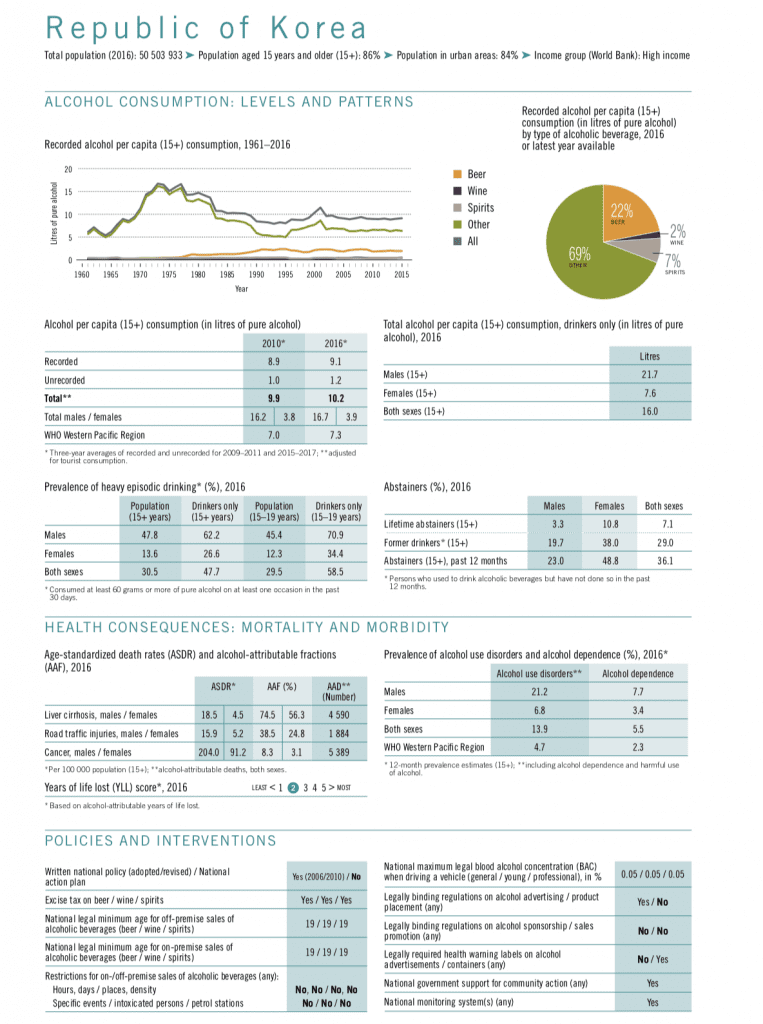

According to the World Health Organization, South Korea’s per capita alcohol consumption in 2016 was 10.2 liters. This is higher than the average of the WHO Western Pacific Region. South Korean men who use alcohol consume a very high amount of 12.7 liters of pure alcohol per capita. Youth binge alcohol use is also very high with over half (58.5%) the alcohol consuming youth between 15 to 19 years engaging in this harmful practice.

The harm caused by the products and practices of the alcohol industry to South Korean men is evident from the fact that 21.2% are experiencing an alcohol use disorder.

In South Korea more people die from cancer caused by alcohol (more than 5,300 people every year) than from liver cirrhosis (4,590 deaths due to alcohol annually).

The country does not have modern written national alcohol policy and has no national action plan at all. Especially alcohol marketing regulations and alcohol availability limits are weak. They are not in line with WHO recommendations, as outlined in the SAFER blue print for alcohol policy.

South Korea has easier access to alcohol compared to other nations including the U.S.,” said Jeong Ji-yeon, secretary-general of the Consumers Union of Korea (CUK), as per The Korea Bizwire.

Jeong Ji-yeon, secretary-general, Consumers Union of Korea (CUK)

Communities argue that alcohol policies should be developed prioritizing public health rather than the private profit interests of Big Alcohol.

Sources

The Korea Bizwire: “Liquor Importers Bet Big on Deregulation of Online Alcohol Sales“

Yonhap News Agency: “S. Korea’s whisky imports jump over 70 pct this year“