Alcohol Policy Best Buys Are Top Investments For Promoting Development, Health, And Economy

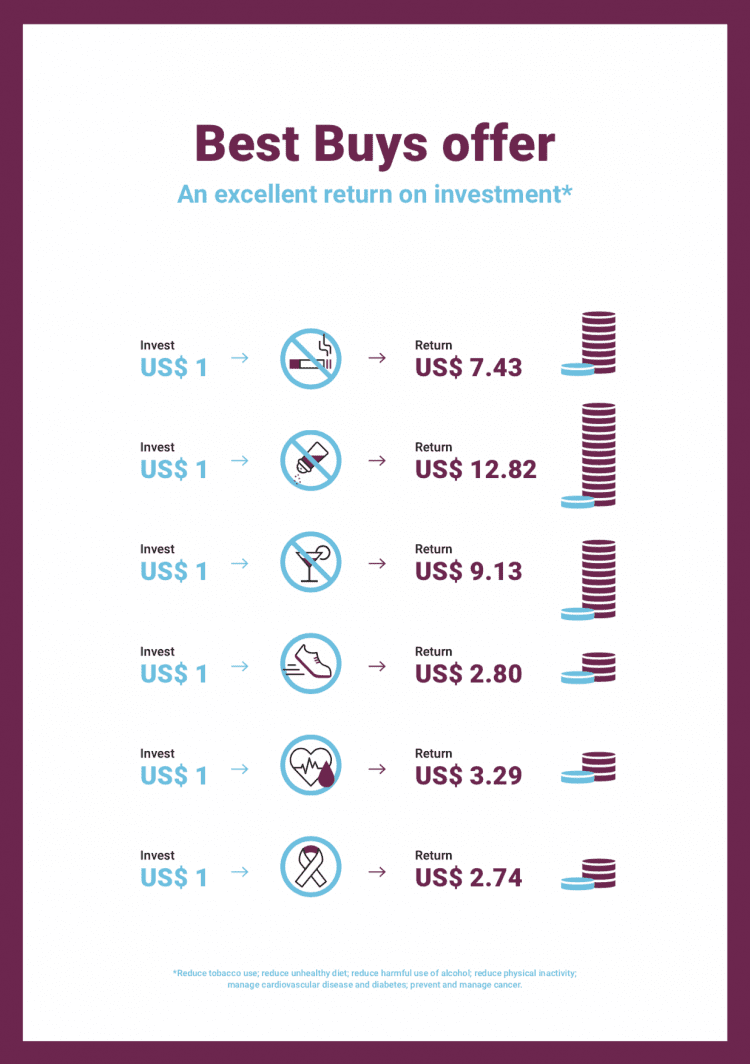

A new World Health Organization (WHO) report shows that the alcohol policy Best Buys generate top returns on investment for positive health impact and economic returns in low- and lower-middle-income countries.

“Saving lives, spending less: a strategic response to noncommunicable diseases“ reveals, for the first time, the financing needs and returns on investment of the WHO cost-effective and feasible “Best Buy” policies to protect people from noncommunicable diseases (NCDs), the world’s leading causes of ill health and death. It shows that for every US$ 1 invested in the alcohol policy best buys, there will be a return to society of at least US$9 in increased employment, productivity and longer life.

The report was funded by Bloomberg Philanthropies.

Best Buys are best investments to beat NCDs

The Best Buys are both cost-effective and feasible for countries to implement. They cover six policy areas:

- Tobacco use,

- Alcohol use,

- Unhealthy diet,

- Physical inactivity,

- The management of cardiovascular disease and diabetes, and

- The management of cancer.

Within these areas there are 16 targeted interventions. These interventions show the best evidence of generating impact and value – for health, the economy and other areas of national sustainable development.

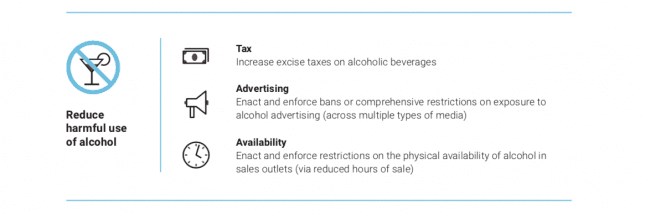

For alcohol policy, the three best buys are

For alcohol policy, the three best buys are

- Increasing alcohol taxation,

- Decreasing alcohol availability, and

- Comprehensively restricting or banning alcohol advertising, sponsorships and promotions.

These policies are stronger and more beneficial when implemented in an integrated approach.

Countries can select a single intervention based on their need and build on this with additional interventions. As the number of interventions that a country implements increases, there is a compound increase in benefits.

Alcohol policy best buys generate 2nd biggest returns on investment

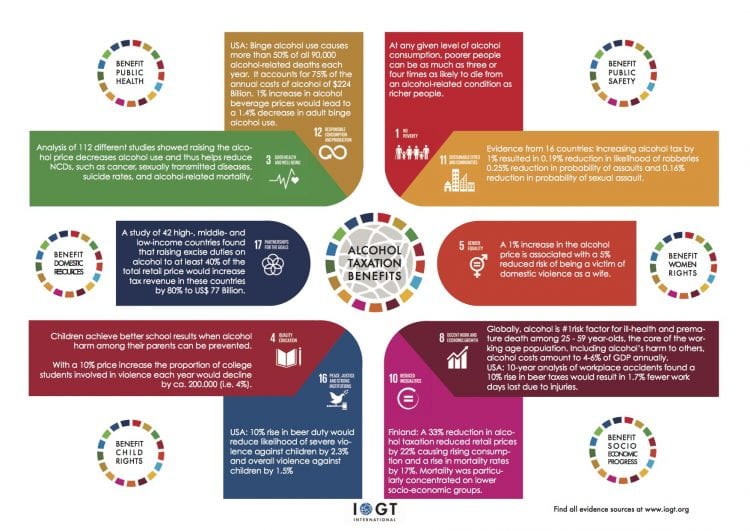

The report provides evidence on the impact-fulness and cost-effectiveness of using taxation to prevent and reduce alcohol and tobacco harm.

Raising taxes on tobacco and alcohol is a proven, efficient and cost-effective way for governments to reduce consumption and to raise additional revenue,” the report argues.

The Addis Ababa Action Agenda 2015 recognizes that tax measures on tobacco can be an effective means to reduce tobacco consumption and health-care costs, and represent a revenue stream for financing for development. Taxation of tobacco and alcohol are both Best Buys. In 2016 WHO analysis estimated that raising cigarette excise in all countries by 1 international dollar (PPP$) per pack (about US$ 0.8/pack) would increase cigarette excise revenue by 47%, from PPP$ 402 billion to PPP$ 593 billion, giving an extra PPP$ 190 billion (US$ 141 billion) in revenue.

Compared with tobacco taxation, the potential for domestic resource mobilization through alcohol taxation could be even bigger since taxes on alcohol tend to be lower in most countries. A study of 42 high-, middle- and low-income countries found that raising excise duties on alcohol to at least 40% of the total retail price would increase tax revenue in these countries by 80% to US$ 77 Billion.

Expressed as a proportion of total current spending on health, it is low-income countries that have most to gain (additional receipts would amount to 38% of total current spending on health).