Cameroon Increases Alcohol taxes

The Cameroonian government has issued the new Finance Act 2019, in it providing for an increase in alcohol prices as of January 15, 2019.

Cameroon has one of the highest alcohol consumption rates in Africa, and related alcohol harms and costs are staggering. The National Times reports that with pressure on the government to increase domestic revenue in light of falling in oil prices and civil war in the Anglophone region of the country, the alcohol tax increase is a triple win:

- Tackle Cameroon’s alcohol problem,

- Improve government revenue,

- Promote health and sustainable development by reducing alcohol harm.

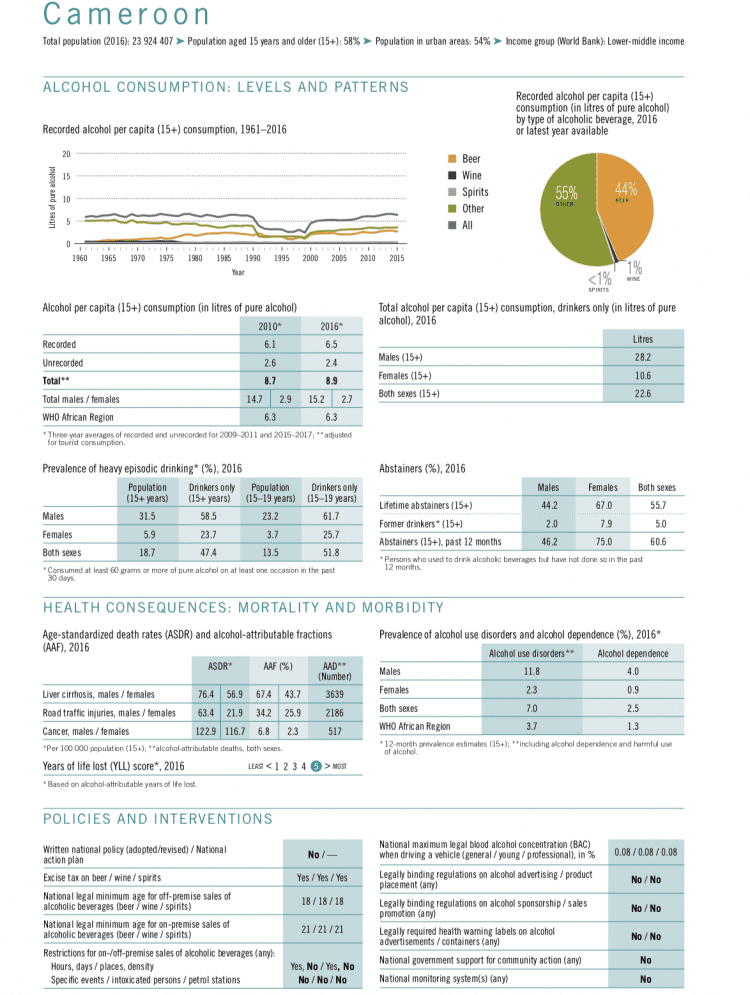

In Cameroon, 60% of the adult population did not consume alcohol in the past year. But among alcohol consumers, per capita alcohol use is very high, according to World Health Organization data, with alcohol intake of more than 22 liters per person per year. Almost 12% of Cameroonian males have an alcohol use disorder, the regional average being 3.7%. Cameroon also does not have a national alcohol policy to systematically tackle pervasive alcohol harm.

Big Alcohol lobbying against alcohol tax increase

The Cameroon Alcohol Producers Association (CAPA) is lobbying heavily to avert the looming tax increase, demanding they be consulted in the decision about how much the prices should increase, according to report from the Cameroon Tribune.

Brewers, among them Diageo’s Guiness, threaten to “trim staff, stop sourcing commodity from local suppliers, freeze local investments”, if the government ignores their proposals,

The alcohol industry is concerned about an increase in their tax burden, which in 2017 had already reached 60%. CAPA members also believe that the government could lose out, as an inevitable increase in beverage prices would weigh on consumers’ purchasing power and therefore reduce sales and revenue volumes, thereby reducing tax revenues from the sector, reports Business Cameroon.

Alcohol taxation – a best buy alcohol policy solution

In contrast to Big Alcohol claims, alcohol taxation is endorsed by the World Health Organization as a best buy measure in reducing and preventing alcohol-related harm.

For example, a study of 42 high-, middle- and low-income countries found that raising excise duties on alcohol to at least 40% of the total retail price would increase tax revenue in these countries by 80% to US$ 77 Billion. Expressed as a proportion of total current spending on health, it is low-income countries that have most to gain (additional receipts would amount to 38% of total current spending on health).

Implementation of evidence-based alcohol taxation is also likely to have a net positive effect on employment, as consumers divert their spending on other (healthier) products, services and needs.