Poland: Alcohol, Tobacco Tax Hike Generates 1 Billion Zloty

The increase in excise tax in 2020 will earn the Polish government PLN 353 million from alcohol and PLN 579 million from tobacco products, dried tobacco and so-called innovative products.

According to the APK – part of the Multiyear Financial Plan of the State presented for the years 2019-2022 – the Ministry of Finance will raise excise tax by 3% for alcoholic beverages, tobacco products, dried tobacco and innovative products.

The last change in excise duty for ethyl alcohol took place on January 1, 2013 and was 15%, and for cigarettes and smoking tobacco about 5% (also on January 1, 2013). The rate of increase by 3% is due to inflation increases since the last change,” said the Ministry of Finance as per, onet WIADOMOSCI.

This tax increase is however not applicable to liquid for electronic cigarettes (excise tax to be added from 2020), Cider and Perry.

Taking into account VAT taxation, the budget effect in 2020 will amount to PLN 1 billion. It was also assumed that the sale of excise goods subject to the tax increase will be maintained at the level of 2018.

IOGT International had previously reported about the Polish plans to increase the alcohol tax.

Alcohol harm in Poland

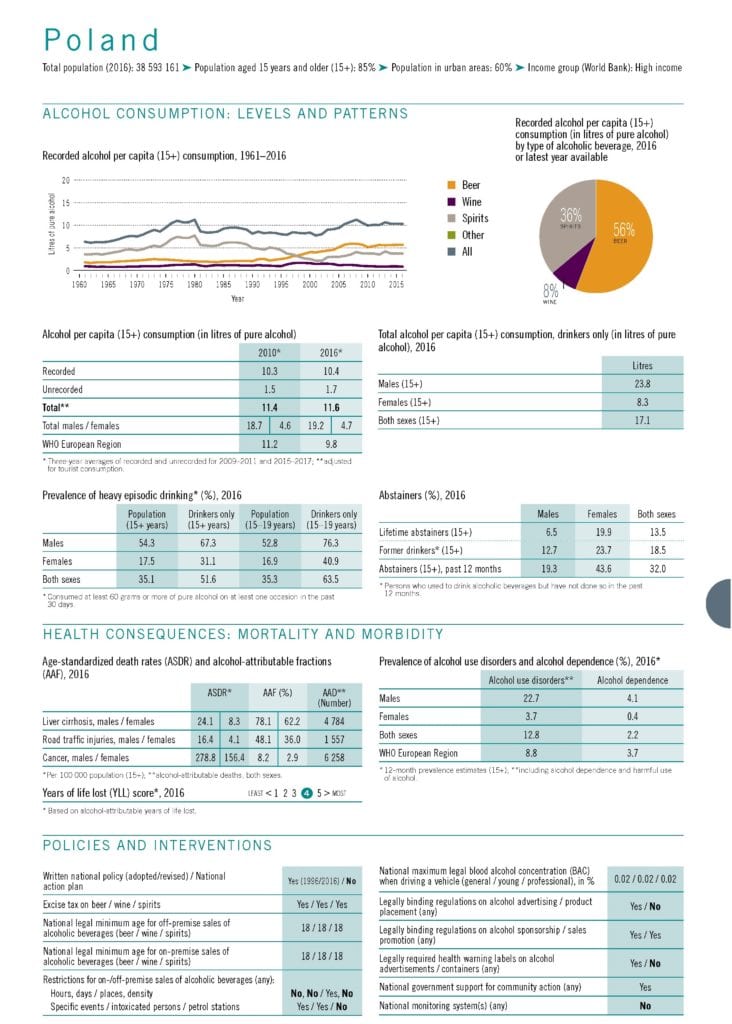

Poland’s alcohol per capita consumption is above the WHO European region average and shows an increasing trend. The alcohol harm in the country is pervasive.

- 52.8% of young boys engage in binge alcohol use.

- 12.8% of Polish people suffer from alcohol use disorders which is high above the WHO European region average.

- 4.1% of Polish men suffer from alcohol dependence which is comparatively above average for the WHO European region

- Poland is on the high end for years of life lost due to alcohol

- WHO reports, alcohol is attributable to more than 12,000 deaths from cancer, liver cirrhosis and road crashes in Poland, every year.

Despite the pervasive harm, Poland lacks evidence-based regulations of alcohol sale in several aspects. Poland urgently needs to implement a national plan and monitoring system for enforcement of the current alcohol policy as well as focus on strengthening the laws on alcohol control in the country.

In this view the tax increase is a positive step by the government to curb the alcohol harm in the country. Increasing excise taxes is one of the alcohol policy best buys recommended by WHO. The increased revenue for the government through tax hikes is also an example for utilizing alcohol taxation for achieving the 2030 Agenda for sustainable development.

—