Nigeria: Government Raises Alcohol Taxes

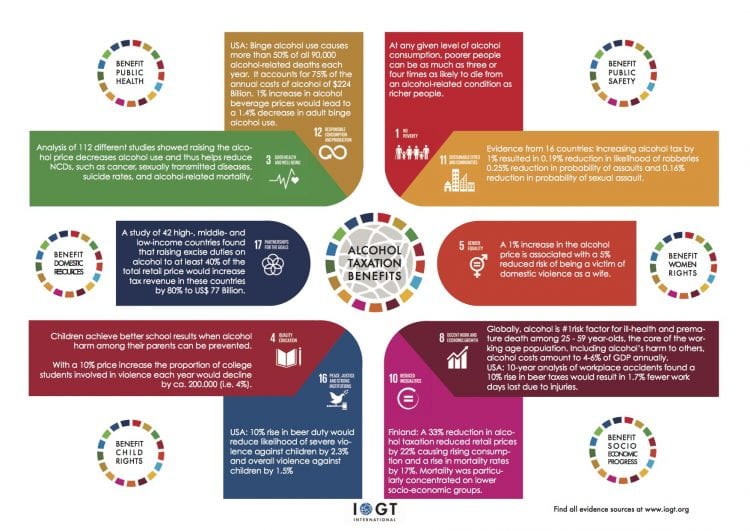

The tax raise adopted last year will see excise taxes for alcohol increase to about 67% to 35 naira ($0.10) per liter in the second half of 2019, as the government phases in the tax increase.

The Nigerian authorities raised taxes on beer and liquor last year to boost income as reaction to a decline in the price and output of crude. The West African nation’s main source of income is crude. The price and output decrease has seen revenue fall below targets in the past three years.

The alcohol tax increase is already successful in increasing alcohol prices, as a major beer maker has announced plans to raise prices this year due to the alcohol tax increase.

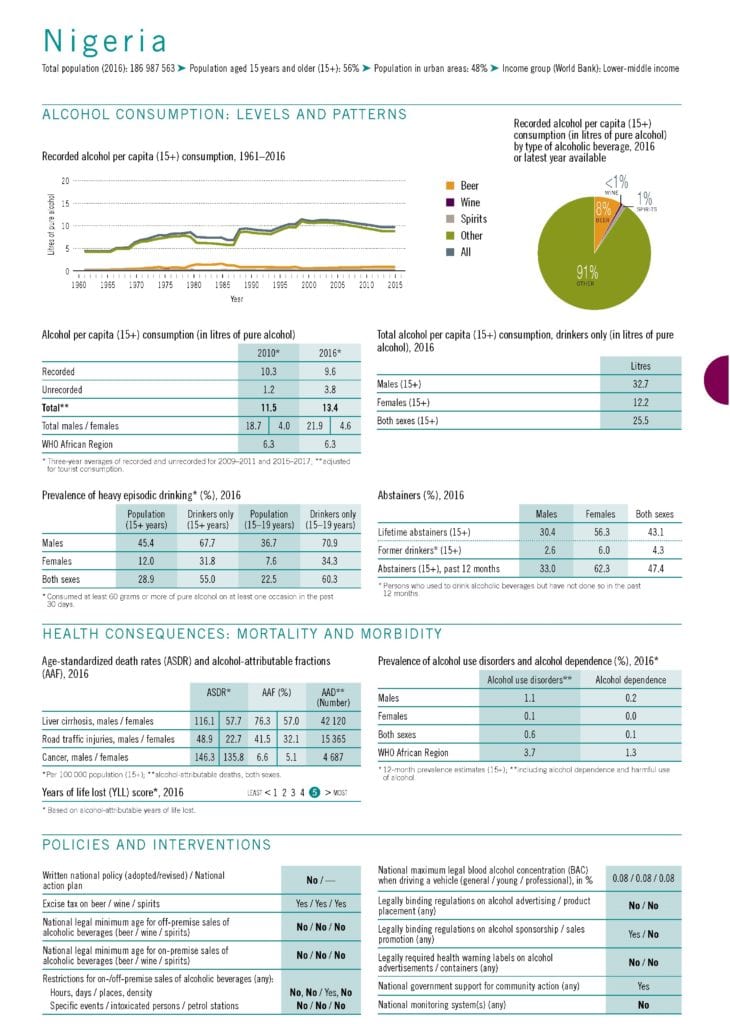

Alochol policy in Nigeria

WHO report Nigeria’s total per capita alcohol consumption at 13.4 liters which is significantly higher comparative to the WHO African regional average. A staggering 70.9% youth between 15 to 19 years who use alcohol binge on the substance. The harm caused by alcohol in Nigeria is high. Nigeria is rated highest for years of life lost due to alcohol.

- 42,000+ deaths from liver cirrhosis are alcohol attributable,

- 15,000+ deaths from road traffic injuries are due to alcohol,

- 4,500+ deaths from cancer are alcohol attributable.

Despite the growing harm of alcohol, Nigeria lacks a comprehensive alcohol control policy. The government has not implemented many of the recommended restrictions and regulations in controlling the alcohol harm such as a legal age for alcohol use, sales restrictions or advertising bans.

In this view the excise tax hike is a positive step by the government in preventing and reducing alcohol harm. Raising taxes is a WHO recommended best buy measure in reducing alcohol use. However, Nigeria needs to focus on formulating a strong alcohol control policy encompassing the key areas recommended by the WHO SAFER package, to reduce the growing alcohol harm in the country.

—