Latvia: Parliament Decides to Lower Alcohol Tax

The Latvian parliament has passed the amendment to the excise tax law to reduce taxes by 15% for strong alcohol. It was passed with 51 votes against 31 and will come into effect on August 1, 2019 and remain effective till February 29, 2020.

The alcohol tax reductions were argued as necessary because of the Estonian move to reduce their alcohol taxes, leading to alleged cross border trade problems for Latvia. The Ministry of Finance of Latvia projected the Estonian tax cuts would lead to a €92 million loss which they project can be reduced to €32 million loss with the Latvian tax cuts.

This worrying alcohol tax race to the bottom has been unfolding in the North-Eastern Europe region since Estonia announced tax cuts earlier in the year. Both countries are attempting to generate higher profits from cross border trade – and ignore the costs of alcohol harm to their societies.

Currently Latvian alcohol prices remain lower and Estonians and Fins specifically go to Latvia to purchase alcohol. Estonia is attempting to reduce Estonians purchasing alcohol in Latvia and gain back some Finnish trade.

North-East Europe: Escalating Struggle Over Alcohol Taxation

Evidently the public health impact of reducing alcohol taxes and the health cost has not been taken into consideration by Latvia. Reducing taxes makes alcohol more affordable and will inevitably increase the alcohol harm to the people.

Lawmakers might still decide on the tax rate’s regulation after February 29, taking into consideration agreements on budget legislation, but that will depend on Latvia’s talks with Estonia, which are necessary to prevent the situation where two countries engage into excise tax rivalry,” said Martins Bondars, chairman of the Budget and Finance (Taxation) Committee of Latvia, as per Latvian Information Agency.

Cross border alcohol trade and alcohol harm in Latvia

As Reuters reports, the cross-border alcohol trade is worth around €45 million for Latvia alone. Large liquor stores in the Latvian-Estonian border regions had sold 40.5 million liters of alcohol in 2018.

Estonia’s government expects a loss of €12 million in tax revenues this year due to its tax cut but sees rising sales volumes of €3 million a year, after this year.

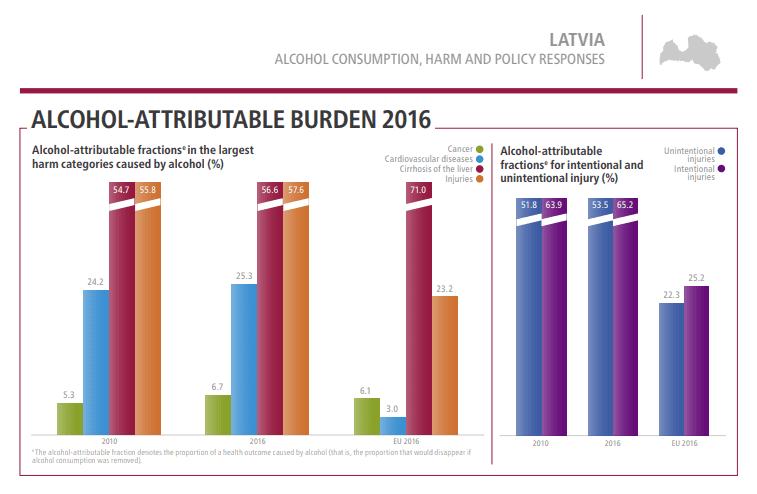

As the WHO reports, in Latvia (2016) alcohol is attributable to:

- 57.6% injuries

- 56.6% liver cirrhosis

- 25.3% cardiovascular disease

- 6.7% cancer

Evidently Latvia already suffers from pervasive alcohol harm. Recently the parliament made a positive move in announcing plans to bannalcohol ads, and institute other alcohol policy measures. As per WHO guidance, it would be beneficial if alcohol taxes were also increased as affordability directly links to consumption.

The cross border race will undoubtedly lead to an increase of alcohol harm rippling across the region. Governments should be focusing on safeguarding public health instead of prioritizing profits over people’s health and well-being. Specifically when health expenditure will increase in the long run through increased alcohol harm which would end up being a loss for the countries.

Short-sighted policies such as these that weaken alcohol control are a threat to health, well-being and overall development.