Czechia: Government Plans Stronger Alcohol Policy

The Czech government is taking concrete steps to implement stronger alcohol policy measures, in response to high societal costs. In addition to alcohol tax increase, the Health Minister of Czechia is preparing a draft bill that would better regulate advertising of tobacco and alcohol in electronic media.

Alcohol and tobacco are among the top causes of preventable deaths in the country. Minister Vojtěch noted that some children have their first experience with alcohol at the age of 12.

Broader effort to tackle health risk factors

Health Minister Adam Vojtěch is preparing the bill as part of a broader effort to address health risk factors such as alcohol. The Czech government is for example also intent on raising taxes on tobacco and alcohol, as reported by IOGT International in May 2019.

Finance Minister Alena Schillerova explained the move towards health promotion taxation on Twitter:

Plníme programové prohlášení vlády a jsme aktivní i v boji proti závislostem. Připravili jsme novelu, která upravuje zdanění tabákových výrobků, tvrdého alkoholu a hazardu. Reagujeme tak na zvyšování dostupnosti návykových látek způsobené růstem životní úrovně v České republice.

— Alena Schillerová (@alenaschillerov) September 8, 2019

In her tweet, it says:

We fulfill the government’s policy statement and are also active in the fight against addiction. We have prepared an amendment that regulates taxation of tobacco products, hard alcohol and gambling. We are responding to the increase in the availability of addictive substances caused by rising living standards in the Czech Republic.”

According to Minister Schillerova, the societal costs of alcohol and tobacco addiction amount to CZK 160 billion (€6 billion) annually. According to the Minister, alcohol has become cheaper relative to purchasing power in the last decade. While the average wage increased by almost half between 2009 and 2018, the alcohol excise duty has not increased since 2010.

Health promotion taxation, like alcohol and tobacco taxes, are WHO and OECD recommended measures that help reduce health risk factor, promote health and raise domestic resources.

The government has pushed through the lower house a bill to raise the tax on alcohol and tobacco which should come into effect next year.

Alcohol burden in the Czech Republic

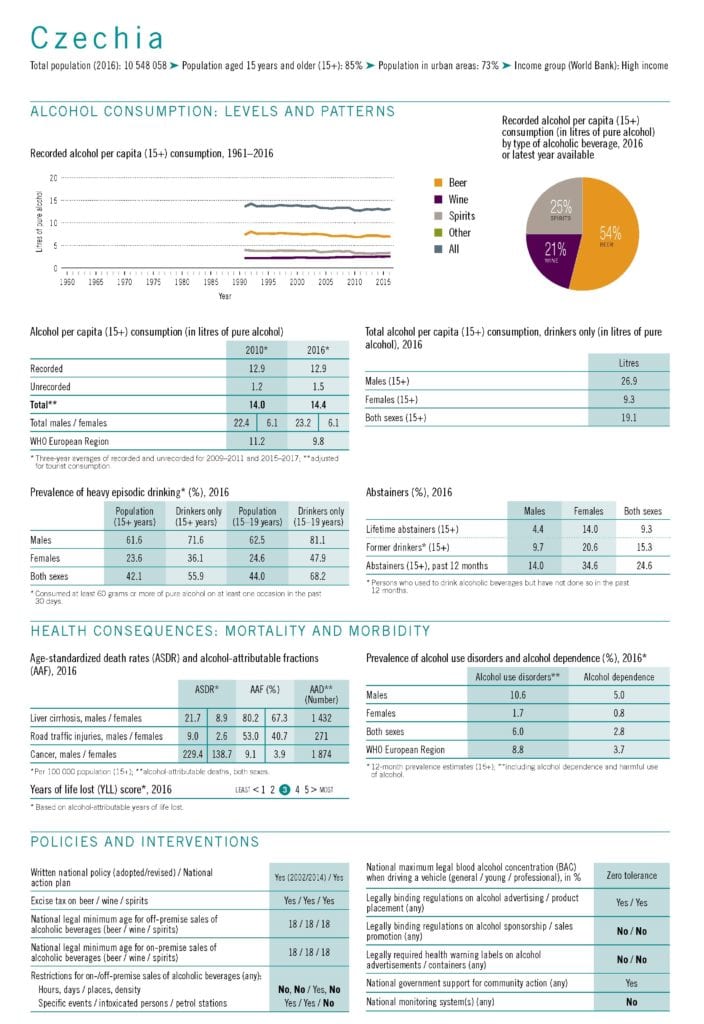

The total per capita alcohol consumption in Czechia is 14.4 litres which is significantly above the average of the WHO European region. Binge alcohol consumption is staggeringly high with over half (55.9%) the alcohol users over 15 years engaging in this harmful behavior.

In fact, the recent WHO Europe alcohol status report 2019 shows that Czechia belongs to the countries where heavy episodic alcohol use among adults is most prevalent.

Banning alcohol advertising, promotions and sponsorship as well as alcohol tax increases are two of the alcohol policy best buys recommended by the WHO – for example in the SAFER package – and as such would have a significant positive impact if implemented properly, by preventing and reducing alcohol harm in the country.

—

For further reading:

https://movendi.ngo/the-issues/the-problem/aiap/alcohol-policy-best-buys/