WHO Launched New Webpage for Health Taxes

The World Health Organization (WHO) has launched a new webpage for health taxes.

The website consists of components to explain what health taxes are, their impact and how to design health taxes. It also consists of resources including fact sheets, data, guidelines, WHO resolutions and WHO teams on health taxes.

According to WHO,

- Health taxes are imposed on products that have a negative public health impact (e.g. taxes on tobacco, alcohol, sugar-sweetened beverages, fossil fuels).

- These taxes result in healthier populations and generate revenues for the budget even in the presence of illicit trade/evasion.

- These are progressive measures which benefit low-income populations relatively more, once health care costs and health burden are taken into account.

Alcohol taxation for health

In terms of alcohol taxation, the website cites, studies show that increasing the price of alcohol through higher taxes can reduce alcohol consumption and its related harms, and prevent alcohol use initiation.

Health taxes have the ability to generate stable, predictable revenues in the short to medium term and reduce health care costs in the long term.

Excise taxes are cited as the most effective for promoting good health.

In terms of alcohol, specific taxes are more effective that ad valorem because it reduces the opportunities for industry to manipulate consumer behavior and the likelihood that consumers will simply substitute cheaper products for more expensive ones. Furthermore, specific taxes on alcohol content (instead of per bottle or drink volume) are even more effective because they lead to lower consumption, less initiation among the young, and encourage the alcohol industry to offer lower alcohol content beverages.

Alcohol taxation and the SDGs

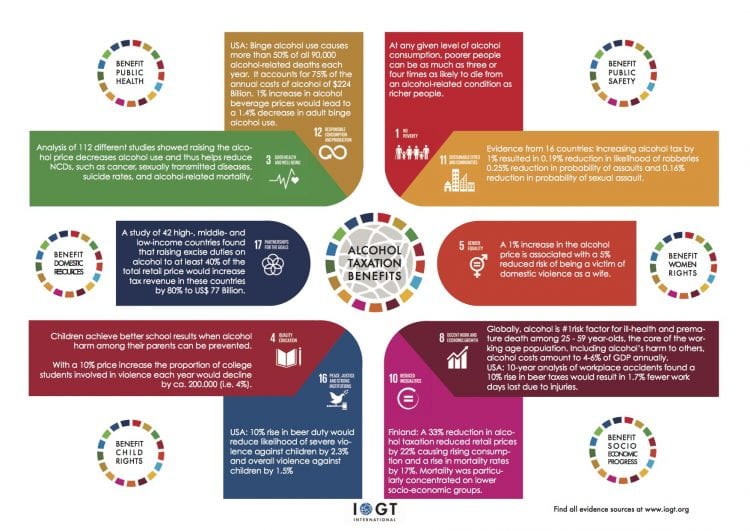

IOGT International has previously shown that evidence-based alcohol taxation is an effective tool to help achieve multiple SDGs.

A landmark report by IOGT International and the East African Alcohol Policy Alliance (EAAPA) details the benefits of alcohol taxation for development.

And a compelling infographic visualizes the vast and growing evidence that alcohol taxation holds massive potential for global health, for helping achieve the sustainable development goals and also for significantly contributing to financing health and development. The most cost-effective measures to prevent and address alcohol harm remain price interventions especially through taxation.