Growing Attention for (Alcohol) Taxation

There is growing attention for (alcohol) taxation, with increasing evidence showing the effectiveness of health promotion taxes to not only reduce (alcohol) harm but boost revenue and fund development. Across the globe, countries and international institutions such as the International Monetary Fund (IMF) are increasingly outspoken about the need to use taxation for domestic resource mobilization.

The triple benefits of alcohol taxation

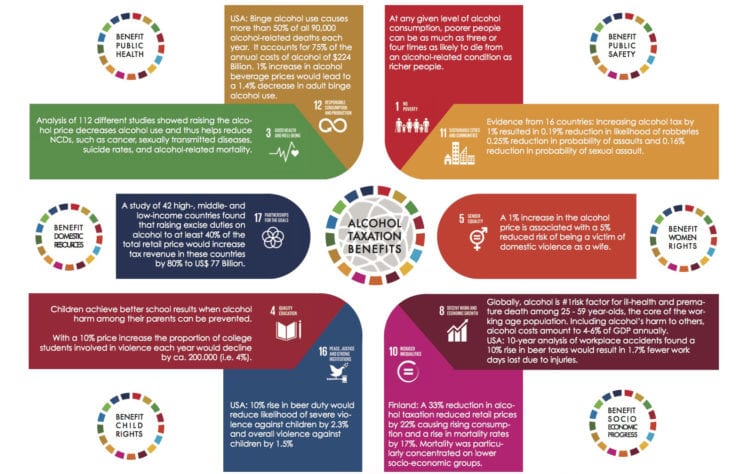

Raising taxes on alcohol is one of the 3 best buy policy measures to prevent and reduce alcohol harm, recommended by the World Health Organization (WHO).

According to WHO and the United Nations Development Programme (UNDP), implementation of the three best buys would result in a return on investment of $9 for every $1 invested. Over 50 years, a 20% global increase in alcohol taxes alone could avert nine million premature deaths. Revenues from excise tax, alcohol company taxes, and licensing fees could also help cover, or even meet, the costs of a comprehensive alcohol control programme, the prevention and treatment of disorders caused by alcohol use, as well as contributing to the funding of other health and development priorities.

- A 20% increase in the price of alcohol through higher taxes could accumulate as much as $9tn in increased revenues globally over 50 years.

And alcohol taxation is not the only health promotion tax with scientifically proven effects. Recently, WHO launched a new and comprehensive webpage resource for health taxes. It provides evidence and technical guidance, citing excise taxes on tobacco or alcohol as the most effective for promoting good health.

Health taxes such as excise tax on alcohol have the ability to generate stable, predictable revenues in the short to medium term and reduce health care costs in the long term.

A landmark report by Movendi International and the East African Alcohol Policy Alliance (EAAPA) details the triple benefits of alcohol taxation for development.

Further, Movendi International has demonstrated the growing evidence for the potential of alcohol taxes in helping achieve the Sustainable Development Goals (SDGs).

Alcohol taxation case studies: The don’ts

The Kenyan government recently gave a 95% excise tax exemption to East African Breweries Ltd (EABL) – a subsidiary of alcohol giant Diageo – on alcohol made from sorghum, millet and cassava. The exemption is scheduled to take effect from July 2019, despite being published in only in December 2019. This means that EABL will be getting refunds for the taxes already paid from July to December in 2019.

The reduction means keg-brew which is cheaper and targeted at lower-income groups will become even cheaper in Kenya. The public health ramifications of this will be grave as reduced prices are known to increase harm and health inequality.

In United Kingdom, the Tories promised a review of the alcohol tax – to lower or freeze taxes on spirits – and now after winning the election, alcohol industry groups rejoice while public health will take a hit if the promised review and further reduction of alcohol taxa takes place.

The alcohol industry group Scotch Whisky Association (SWA) has already started the lobby campaign aiming to continue the tax freeze for spirits since 2018 autumn or to get an additional reduction. Movendi International has previously reported how Big Alcohol interferes with public health policy in the UK.

Alcohol taxation case studies: The do’s

In South Africa, President Ramaphosa’s proposed Amendment of Revenue Laws Bill includes an increase of alcohol taxation. This is a positive development for the country to boost government revenue and fund development.

Bhutan recently introduced the Goods and Services Tax (GST) Bill which will charge a flat 7% GST to replace all indirect taxes, and impose 20% Excise Equalisation Tax on unhealthy goods and 100% tax on alcohol and tobacco.

With the growing availability of alcohol in Bhutan, alcohol harm has been increasing. The new taxation measures prove a sustainable mechanism to prevent and reduce the rising alcohol burden.

Taxation in the African region: Needs and problems

African governments are now trying to collect more tax as it gets harder to rely on aid or natural resources. According to the IMF, government revenues average about 17% of GDP in sub-Saharan Africa. While taxes were not as important before, with lower oil prices and the aid flows halving since 1990s the continent is now interested to boost revenue through taxes.

The biggest problem for the region is taxes which are never collected.

Data from the OECD for 26 African countries show that over half of their tax revenues come from taxes on goods and services. Only a quarter comes from personal income tax and social-security contributions. From 2008 to 2017 the ratio of tax receipts to GDP rose by 1.5 percentage points, but in many countries this was offset by falls in non-tax revenues, such as fines, rents and royalties from resource extraction.

While large corporations grumble they are footing the bulk of the taxes this is not necessarily true. Analysis of corporate tax returns in Ethiopia reveals that small firms pay the highest effective rate, possibly as larger corporations have accountants to find gaps in the tax code.

Another problem in taxation within the continent is tax avoidance. It is estimated the region loses 2% of tax revenue due to tax avoidance and another 1-2% due to individual wealth stashed off-shore. Tax avoidance, tax schemes and other unethical business practices exploiting the region has been proven true for Big Alcohol companies such as Heineken and AB InBev.

Another way tax revenue is lost in the region is due to tax treaties and exemptions. Heineken, for example, has been caught for using agricultural programs under the failing aid and trade policy to negotiate tax reductions with African governments, for example in Mozambique and Burundi.

According to the IMF taxation capacity, African governments could increase their revenues by 3-5% of GDP, which is more than they receive in aid. With a massive funding gap to reach the SDGs, the African region is now more than ever in need of using (alcohol) taxation as a tool to fund health and development for all.

IMF support tax increases

In the 1990’s the IMF supported the Washington consensus, a free market approach including the cutting of taxes for the wealthier. The approach hoped for trickle down benefits with more innovation and growth.

But the IMF has shifted its stance due to evidence of weak growth, a concentration of wealth among the top 0.1% of the population, and a falling share of national output going to workers. In a report last year, Oxfam said a global wealth tax on the richest 1% of the population would raise an estimated $418bn a year – enough to educate every child not in school and provide healthcare that would prevent 3 million deaths.

Now the IMF is supporting tax increases, as Kristalina Georgieva, the IMF’s managing director, shared with The Guardian. Taxation is a key tool to reduce inequality and achieve the SDGs. The IMF has also recognized the social spending policies such as for education and healthcare and stressed the need for less well-off nations to increase social spending in order to achieve the SDGs.

Progressive taxation is a key component of effective fiscal policy,” said Geoirgieva, as per The Guardian.

Health promotion taxes such as on alcohol – as outlined above – are precisely such progressive taxation tools which help reduce inequalities, increase social spending and realize the SDGs.

—

Sources:

The Guardian: “IMF boss says raise taxes on the rich to tackle inequality“

The Economist: “African governments are trying to collect more tax“

Movendi International: “Prioritising Action On Alcohol For Health And Development“

Movendi International: “WHO Launched New Webpage for Health Taxes“

Standard Digital: “Boon for brewer as ‘sin’ tax is slashed“

The Spirits Business: “How the Tories’ election victory could impact UK spirits“

Fin24: “Ramaphosa has signed 5 key tax and revenue-related bills – here’s what that means“

Tax Scan: “Bhutan Introduces Revolutionary GST Reform“