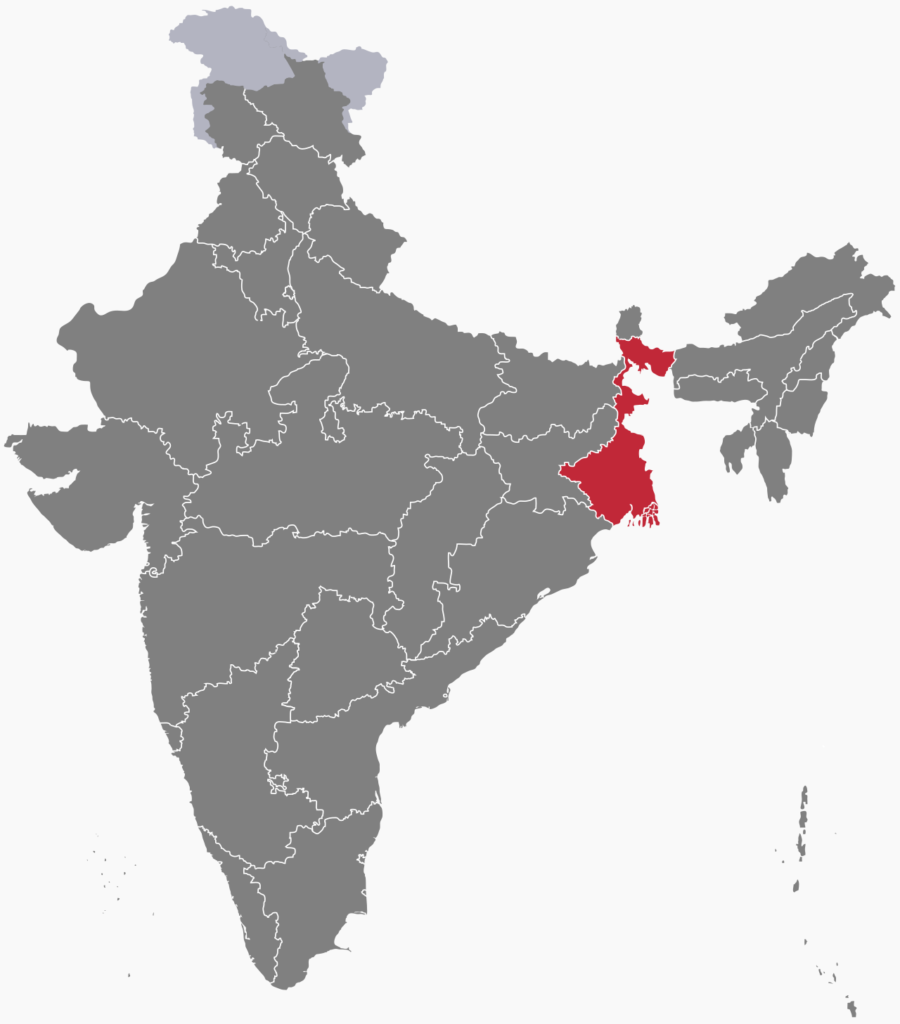

West Bengal is an Indian state in the east of India bordering the Bay of Bengal. It’s home to 91 million Indians making it the fourth most populous state in the country. The capital of West Bengal is Kolkata, the seventh largest city and third largest metropolitan area of India.

The West Bengal State Beverages Corporation (Bevco) has announced beer prices in the state will be reduced from the week of October 19. This would be a 25% to 40% reduction for low strength beer and a 15% to 20% reduction for strong beer.

The price decrease in beer is due to a change in alcohol taxation policy in the state. Unlike the earlier practice of levying excise duty and sales tax on the maximum retail price (MRP), the rate of excise duty and additional excise duty will now be based on the ex-distillery price (EDP) of the liquor on “bulk litre” basis. There are 32 slabs, categorized as per the EDP of mild and strong beer, to demarcate the rate of excise duty.

A similar system for Indian Made Foreign Liquor (IMFL) is set to be announced by November, categorized in 22-slabs based on which the excise duty will be fixed.

Big Alcohol is pushing for even more benefits to themselves. Reportedly, the alcohol industry lobbying body, Confederation of Indian Alcoholic Beverage Companies (CIABC) is lobbying the State Excise Directorate and is also looking to influence the newly appointed Finance Secretary on an allowance of 30% variation with that of the lowest EDP for IMFL.

The World Health Organization advises to increase alcohol taxes to tackle alcohol harm and promote health and development for all. The best practice for alcohol excise taxation calls for a simple comprehensive mechanism. Nevertheless, the West Bengal government is doing the opposite of this while reducing alcohol tax with a complicated excise tax system.

Alcohol harm costs West Bengal and India massive amounts

Previously West Bengal increased alcohol taxes by 30% in April, 2020. According to the Excise Directorate consumption of alcohol reduced dramatically along with the tax increase. For beer 78%, for liquor 45% and for country spirit 40% reductions were reported.

But due to the state’s dependency on alcohol revenues the West Bengal government does not pursue this public health and evidence-based approach to alcohol taxation and instead focuses on short-term income, instead of mid- and long-term harm and economic losses.

A modelling study found that economically India loses 1.45% of its GDP every year due to alcohol. This is more than the country’s entire health spending, which amountsbto 1.28% of its GDP. In numbers, between 2011–2050 India stands to lose US$2.2 trillion – accounting for tax revenues – due to alcohol costs.

Alcohol is an obstacle to 14 of the 17 Sustainable Development Goals (SDGs). Evidence shows that when done correctly, alcohol taxes can be used to boost development which is specifically important for low and middle income countries.