GlobalData reveals the world’s dominant beer brands for 2020.

In 2020 compared to the previous year, the beer volumes produced in all top 10 brands, except Skol and Brahma, declined. Bud Light managed to have the lowest decline by pushing on the flavored beer Rita. Using flavored alcohol’s is one strategy Big Alcohol uses to push their products on women and young people to maximize their profits.

The 10 dominant beer brands are:

- Snow, owned by China Resources Beer,

- Budweiser, owned by AB InBev,

- Corona Extra, owned by Constellation Brands in the U.S. and AB InBev everywhere else,

- Heineken,

- Bud Light, owned by AB InBev,

- Tsingtao,

- Skol, owned by Carlsberg worldwide (except of Africa and South America),

- Brahma, owned by AB InBev,

- Harbin, owned by AB InBev, and

- Coors, owned by MolsonCoors.

The top five in the list are multinational market brands.

- The brand Snow dominated in China, accounting for 100.26m of the brand’s total 100.3m-hectolitre sales in 2020.

- The second place Budweiser had sales volumes that were about half of Snow’s.

- Corona Extra dominates mostly in Mexico and the U.S., these two countries made up 80% of the brand’s 2020 sales.

After AB InBev, that dominates the list of the biggest beer brands, Heineken is the other beer giant aggressively expanding its reach.

The company has invaded into China with the 2019 joint venture with Snow-linked China Resources Enterprises. And as Movendi International previously reported, Heieneken has been exploiting the African region to increase their profits. The company recently aquired the South African Distell Group which has been an alcohol industry stronghold in the African region.

In the lower five of the list, Coors is a multinational market brand relying more on the U.S. while the rest are single market brands. Tsingtao and Harbin are in China while Brahma and Skol in Brazil are owned by AmBev, which is controlled by AB InBev.

Five waves of alcohol market concentration – often driven by the beer industry

The alcohol industry has seen large changes in its structure since the 1950s. The global alcohol market has been concentrating and today resembles oligopoly structures.

In 1960, the global alcohol retail market was dominated by North American alcohol producers.

- 70% of the alcohol sold in the leading companies came from North America,

- 23% of the alcohol sold in the leading companies came from Great Britain, and

- 7% of the alcohol sold in the leading companies came from the rest of the world.

In the beginning of the 21st century, the alcohol market had changed substantially. In 2005, the global retail market was dominated by alcohol companies from Great Britain, Western Europe (France, Netherlands, Denmark) and other parts of the world (Japan, South Africa, and Latin America). Their market, financial, and political power had increased dramatically, rivalling (and threatening) North American alcohol giants.

- 20% of the alcohol sold in the leading alcohol producers came from North America,

- 10% of the alcohol sold in the leading alcohol companies came from Great Britain,

- 30% of the alcohol sold in the leading alcohol producers came from Western Europe, and

- 40% of the alcohol sold by the leading alcohol companies came from other parts of the world.

There are five waves of alcohol market concentration since the 1950s.

1. The first wave of structural changes, mergers and corporate take overs swept Great Britain in the end of the 1950s.

Brewing giant Allied Brewers was created.

The liquor giant International Distillers & Vintners (IDV) was created.

2. The second wave of structural changes swept Western Europe in the end of the 1960s.

Heineken (Netherlands) took over the competitor Amstel.

Carlsberg (Denmark) took over its competitor Tuborg.

Grand Metropolitan (GB) took over IDV in 1971.

Moet & Chandon (France) merged with Hennessey.

The family-owned companies Pernod and Ricard merged (France).

3. The third wave of structural changes, mergers and corporate take overs in the alcohol industry occurred between 1985 and 1988, when mergers and take overs of national brands took place over national borders and extended the potential to dominate the world market.

Emerging markets in Africa, Latin America and Asia sparked increased interest of Western alcohol giants.

- 3.1 Family-owned alcohol companies (Anheuser-Busch, Bacardi, Heineken, Martini, Moet-Hennessey, and Carlsberg [owned by a foundation]) tackled increasing competition for emerging markets by specializing on concrete products in the beer, rum, champagne, or other alcohol industry categories.

- 3.2 Swedish Vin & Sprit had big success with its Absolut Vodka brand.

- 3.3 In other multinational alcohol corporations, financial interests took over and streamlined the product range.

- Guinness bought up several whiskey brands.

- Grand Metropolitan took over Heublein, the owner of Smirnoff vodka.

- In 1986, Allied Lyons (successor of Allied Brewer, see above) took over successful brands such as Canadian Club, Ballantine’s, Courvoisier, Kahlua.

- Moet Hennessey (owner of fashion label Dior) merged with Luis Vitton (owned champagne brands Veuve Clique, Canard Duchene) to form the mega corporation LVMH in 1987.

- 3.4 In 1988, Stella Artois merged with Piedboeuf-Interbrew to form Interbrew.

- 3.5 In the North American market the importance of brands started dominating corporate strategies

- American Brands took over Jim Bean and National Distillers.

- 1987, Seagram took over the liquor brand Martell to get access to the alcohol market in East Asia.

4. The fourth wave of structural changes in the global alcohol industry came in the end of the 1990s and the beginning of the 2000s.

The leading alcohol giants continued to buy up the most successful brands, and focused on cost cutting and increasing effectivity in established markets.

- 4.1 In 1997, Guinness and Grand Metropolitan merged to form Diageo. The new alcohol giant was compelled to sell off one of its whiskey brands and one of its gin brands in order for the merger to be allowed by European and United States competition regulators.

- 4.2 In 2001, Diageo and Pernod Ricard divided up Seagram among themselves.

- 4.3 In 2005, Pernod Ricard continued its expansion by dividing up Allied Domecq (successor of Allied Lyons, successor of Allied Brewers) with Fortune Brands (United States.

- 4.4 In the beginning of the 2000s, the beer industry accelerated its internationalization.

- In 2000, Brazilian beer brands merged to create the Ambev corporation, that then controlled 70% of the Brazialn market.

- In 2004, Interbrew (Belgium) and Ambev merged, forming InBev, the world’s largest beer giant.

- In 2001, Interbrew (Belgium) took over the beer brands Becks (Germany) and Bass & Whitbread (GB).

- Scottish & Newcastle (biggest brewer in GB) expanded internationally by taking over Kronenbourg (France), Hartwall (Finland), Central de Cervejas (Portugal), as well as beer producers in Italy, Russia, and India.

- In 2005, Molson (Canada) and Coors (U.S.) merged.

5. The fourth wave of structural changes, mergers, and corporate take overs swept through the alcohol industry between 2006 and 2010.

The leading alcohol industry giants intensified their expansion through investments in the “emerging markets” of India, China, Thailand, other South-East Asian countries and Latin America.

The accelerating concentration of the alcohol industry is facilitated by technological developments, infrastructure improvements, communication advances and logistics. It is driven by immense investments into alcohol marketing.

The alcohol market concentration is further accelerating by internationalization and thirst for expansion by the profit interests of the alcohol giants, whose lobby success led to de-regulation of trade rules.

- 5.1 In 2008, the Swedish government sold Vin & Sprit to Pernod Ricard (France), with the biggest prize of deal being the Absolut vodka brand – one of the most valuable brands in the alcohol industry.

- 5.2 Scottish & Newcastle was divided up and taken over by its two biggest competitors in the European market, Carlsberg (Denmark) and Heineken (Netherlands).

- Heineken took over S&N markets in Western Europe and its stake in Indian United Breweries, part of the UB Group.

- Carlsberg took over control of Baltic Breweries, that targets the growing Russian market.

- 5.3 The race was about both to take over competitors and their brands as well as consolidating the power base in existing markets, as the wave of mergers and take overs accelerated. South African Breweries was one of the most aggressive alcohol corporations in this fifth wave of market concentration.

- In 2002, South African Breweries (SAB) took over Miller (U.S.) from Big Tobacco giant Philip Morris. SABMiller was formed.

- SAB was able to grow under nearly monopolistic circumstances in South Africa had already taken over beer producers in Africa and Europe and now also gained access to the American market, securing distribution of brands such as Castle and Pilsner Urquell.

- In 2007, SABMiller took over Grolsch (Netherlands).

- SABMiller continued expanding by agreeing to collaborate with Molson Coors, another beer giant, to compete with Anheuser-Busch.

- 5.4 Anheuser-Busch aggressively joined the expansion drive in the beginning of the 2000s.

- In 2000, they took over the controlling majority in Grupo Modelo, the leading beer maker in Mexico, with Corona as the biggest brand.

- In 2002, they became the second biggest shareholder in Chinese beer giant Tsingtao.

- 5.5 In 2008, world leader InBev took over the number two beer maker in the world, Anheuser-Busch, for more than US $50 billion.

- 5.6 Also in 2008, the merger of InBev and Anheuser-Busch was completed. The combination resulted in the creation of one of the top five consumer product companies in the world, Anheuser-Busch InBev (AB InBev).

6. The arrival of the world’s first “beerhemoth”

During the year 2016, Anheuser-Busch InBev took over SABMiller for US $107 billion – the third largest acquisition in the corporate history.

- By January 2017, the ”beerhemoth” controlled approximately 500 beer brands in 50 countries.

- AB InBev acquired operations in virtually all the major beer markets and a portfolio consisting of global, multicountry, and local brands.

- The merger allowed AB InBev to have a strong presence in key emerging markets in Africa and Latin America.

- The merger resulted in an alcohol industry giant which accounted for 30% of the global beer sales.

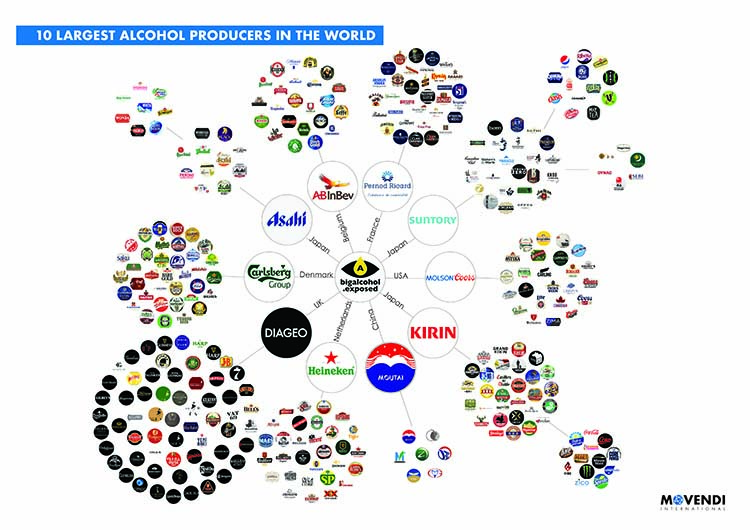

The map depicts the ten biggest alcohol producers in the world and their global and regional brands. The ten largest alcoholic beverages companies worldwide are ranked according to total annual sales (domestically and internationally), as of December 2018. Company sales may include products other than alcoholic beverages – which is also illustrated in the map.

It is largely these companies and brands that fuel pre-mature death and disease, for example cancer, cardiovascular disease, or diabetes; or infectious diseases like HIV/ Aids or tuberculosis.

Moreover, the practices and products of Big Alcohol fuel accidents, injuries and violence, mental ill-health and suicides, and cause loss of quality of life – the costs are staggering. The economic burden of alcohol worldwide is substantial, accounting for up to 5.44% of Growth Domestic Product in some countries.

Beer market concentration fuels alcohol harm

In September 2021 Movendi International reported that over half the beer made in the world is controlled by just six alcohol industry giants, according to data from BarthHaas.

Big Alcohol and especially Big Beer market concentration is becoming an increasing threat to public health and democracy.

Market concentration gives the control of a product to a few, powerful, often transnational companies.

What this does is concentrate all profits among a few alcohol industry giants. Thus, market concentration fuels the concentration of financial resources and with it advertising spending power, political lobbying power and most importantly the ability to sell alcohol cheaper than the competition.

Thereby, these few powerful companies can dominate the market, rendering small alcohol producers unable to compete and eventually unable to survive. Further these transnational corporations become a threat to democracy itself by buying and influencing national policy making in their favor.

Big Beer and Big Alcohol market concentration is becoming an increasing threat to competition as demonstrated by recent investigations into the matter in the United Kingdom (UK) and the United States (U.S.).

- Last year a £780m merger between Marston’s and Carlsberg’s UK brewing operations created the Carlsberg Marston’s Brewing Company. The UK competition regulator, the Competition and Markets Authority (CMA), launched an investigation into the merger.

- This year U.S. President Biden issued a broad executive order titled “Promoting Competition in the American Economy.” Big Alcohol was specifically targeted by the order. Investigations by the Treasury Department and the Alcohol and Tobacco Tax and Trade Bureau (TTB) are currently underway.

A recent study by David Jernigan and Craig S Ross revealed the public health problems associated with the size, structure, and practices of the transnational alcohol industry.

The oligopoly structure of the producing industry helps to generate high profits per dollar invested relative to other industries. Advertising expenditures are high and advertising is widespread. Stakeholder marketing and CSR campaigns assist in maintaining a policy environment conducive to extensive alcohol marketing activity.”

Jernigan D, Ross CS. The Alcohol Marketing Landscape: Alcohol Industry Size, Structure, Strategies, and Public Health Responses. J Stud Alcohol Drugs Suppl. 2020 Mar;Sup 19(Suppl 19):13-25. doi: 10.15288/jsads.2020.s19.13. PMID: 32079559; PMCID: PMC7064002.

Alcohol marketing is a structural element of the alcoholic beverage industry that shapes alcohol availability and norms, drives consumption and profits, but also impacts the policy environment to advance the interests of Big Alcohol.

Worldwide, alcohol sales totaled more than $1.5 trillion in 2017. Control of alcoholic beverage production and marketing is concentrated globally in the hands of a small number of firms.

The Movendi International mapping shows (see above), the oligopoly structure of the alcohol industry. The Big Alcohol oligopoly helps to generate high profits per dollar invested relative to other industries, which in turn fund marketing expenditures that function as barriers to entry by other firms.