Tax on alcohol advertising

In the new Budget 2022/23, the Treasury Cabinet Secretary of Kenya, Ukur Yatani proposed a 15% tax on fees charged by television stations, print media, billboards, and radio stations for advertisements of alcohol products, gaming, and gambling.

Yatani stated that advertisements for these products and practices contribute to promoting unhealthy behaviors among Kenyans. Therefore, the tax on advertising fees aim to reduce the harm caused by these products and practices.

These habits are extremely addictive and can result in a variety of harmful repercussions, especially for the youth,” said Ukur Yatani, Treasury Cabinet Secretary of Kenya, as per The Star.

Their advertisements contribute to their usage.”

Ukur Yatani, Treasury Cabinet Secretary of Kenya

A County Dialogues Report from 2019 found that alcohol, other drugs, and gambling were leading causes for children dropping out of school in Kenya.

Tax increase on alcohol products

The Treasury Cabinet Secretary further proposed an excise tax increase of 10%, separate from the annual adjustment to inflation. The products included in this excise tax increase were not specified, but it is possible alcohol products will be included. Yatani was clear that this rise in excise tax does not apply to essential items.

The excise tax increase is among other tax measures proposed in the Budget to generate an additional Kenyan Shilling (Sh) 50.4 billion (approx. US$ 437 million) in revenue in the 2022/2023 fiscal year.

Regarding the annual excise tax adjustment to inflation, Yatani proposed to give the Kenya Revenue Authority (KRA) commissioner-general room to select products to be exempt from this adjustment according to prevailing economic conditions.

While it is necessary to take prevailing economic conditions into consideration when adjusting excise taxes to inflation, granting this much authority to the KRA commissioner-general could be exploited by the alcohol industry to circumvent the annual alcohol excise tax adjustment to inflation.

The Kenyan government will have to watch out for the alcohol industry’s interference in this regard. Already in 2019, East African Breweries Limited (EABL), a subsidiary of UK-based Big Alcohol giant Diageo, was lobbying to cut alcohol excise taxes in Kenya which are adjusted to the inflation rate.

Proposed change to taxation of liquid nicotine

A change was also proposed to the way liquid nicotine is taxed. Taxation for liquid nicotine was changed from the shilling per unit to an excise duty of Sh70 per milliliter.

Liquid nicotine is found in e-cigarette products. Yatani added that these novel tobacco industry products are making them more accessible even for underage children. The change in taxation aims to prevent and reduce the harm caused by e-cigarettes to young Kenyans.

The design of the products and their taxation regime has made them easily accessible to users including school children and youth, leading to nicotine addiction and consequently, drug use and addiction,” said Ukur Yatani, Treasury Cabinet Secretary of Kenya, as per The Star.

Ukur Yatani, Treasury Cabinet Secretary of Kenya

Alcohol harm in Kenya

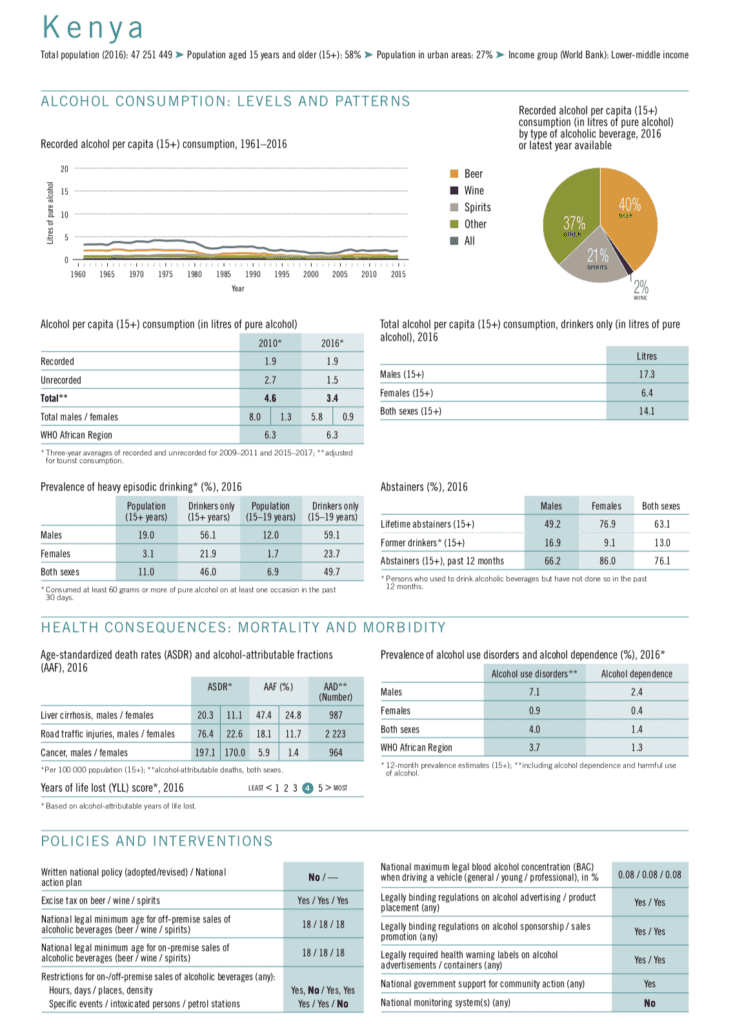

As the World Health Organization (WHO) reports, in Kenya, almost half (49.7%) of young people between 15 to 19 years of age who use alcohol engage in binge alcohol consumption. The figures are even higher (59.1%) for young boys. 7.1% of Kenyan men suffer from alcohol use disorders.

In 2016, the alcohol burden was heavily affecting Kenyan communities. The products and practices of the alcohol industry fueled:

- 987 deaths due to liver cirrhosis,

- 2223 deaths due to road traffic injuries, and

- 964 deaths due to cancer.

Despite the heavy harm caused by the products and practices of the alcohol industry Kenya does not have a written national alcohol policy.

The country did enact the “Alcoholics Drinks Act” in 2010. While the entire country was supposed to implement it, the new system of devolved government began in 2013. This led to the act being revisited and it is now up to the county governments to decide on how to make it into law. This Act is a good starting place for the Kenyan government to adopt a national alcohol policy.

Raising alcohol excise taxes and banning or comprehensively restricting alcohol advertising, sponsorship, and promotion are two of the WHO-recommended Best Buy alcohol policy solutions included in the WHO SAFER package to prevent and reduce alcohol harm.

Sources

Capital Business: “Gov’t Seeks A Pie Of Alcohol, Gaming, Gambling Ads In New Budget“

The Star: “Budget 2022/23: Yatani hammers gamblers, alcohol lovers with tax rise“

Business Daily: “Yatani targets beer, juice, water with higher taxes“

JDSPURA: “Kenya Budget 2022 – Summary“

YouTube: “Government proposes 15% excise duty on advertising Alcohol, betting & gaming“