The 2022 Financing for Sustainable Development Report identifies a great financial divide between developing and developed countries. While rich countries were able to support their pandemic recovery with record sums borrowed at ultra-low interest rates, the poorest countries spent billions servicing debt, preventing them from investing in sustainable development. The crippling cost of debt financing for many developing countries has hamstrung their recovery from the COVID-19 pandemic, forced cutbacks in development spending, and constrained their ability to respond to further shocks.

According to the Financing for Sustainable Development Report (FSDR), on average developed countries use 3.5% of revenue to pay interest on their debt, compared to the 14% of revenue for the least developed countries (LDCs). The number of LDCs and other low-income countries that are at high risk of or already in debt distress has doubled from 30% in 2015 to 60% in 2022.

Considering this gap in financing, the 2022 FSDR report recommends three key actions to help progress in bridging the finance divide:

- Financing gaps and rising debt risks must be urgently addressed.

- All financing flows must be aligned with sustainable development.

- Enhanced transparency and a more complete information ecosystem will strengthen the ability of countries to manage risks and use resources well and in line with sustainable development.

Alcohol taxation for domestic resource mobilization and reducing health inequalities

The 2022 FSDR report discusses alcohol taxation as a solution for increased domestic resource mobilization and reducing health inequalities.

Improving domestic resource mobilization has been an important priority ever since the adoption of the 2030 Agenda for Sustainable Development. But the COVID-19 pandemic has further increased the need to use all available tools for improving government revenue.

The report underlines:

Well-designed policies to diversify and broaden the tax base can raise growth, improve equity, help to manage revenue volatility, and finance an appropriate policy response.”

2022 Financing for Sustainable Development Report (FSDR)

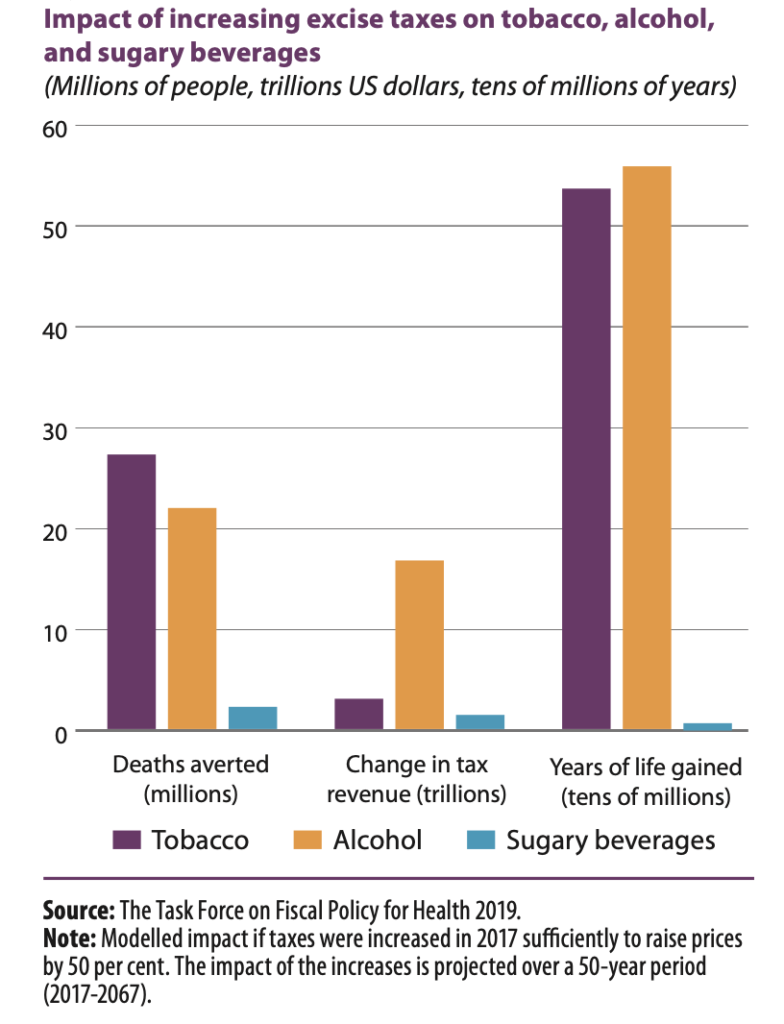

The report highlights the benefits of increasing excise taxes on harmful products, such as alcohol, tobacco, sugary drinks, and polluting energy sources. These health promotion taxes have lower volatility, fewer effects on investment in the country and support future growth.

Alcohol taxation is discussed as a solution to reduce health inequalities. The report states:

Excise taxes on tobacco, alcohol and sugar-sweetened beverages are pro-health taxes that reduce health inequities while increasing revenues.”

2022 Financing for Sustainable Development Report (FSDR)

People with lower socioeconomic status have a higher risk of being affected by non-communicable diseases and their risk factors. They are also at a higher risk of harm due to alcohol, tobacco, and sugar-sweetened products which further increases the risk of NCDs.

Dealing with these diseases poses a high economic burden for low-income households. Thus, the vicious cycle of NCDs, risk factors such as alcohol, and poverty continues.

Excise taxes on health harmful products such as alcohol can put a stop to this vicious cycle.

- Excise taxes can correct the highly inequitable distribution of death and income losses, and reduce catastrophic healthcare costs.

- Well-implemented excise taxes reduce consumption, particularly for lower-income groups, and are highly cost-effective policy tools for averting millions of deaths caused annually by these products, according to the 2022 FSDR.

Movendi International has been advocating for alcohol taxation to receive political attention commensurate with its potential to improve health, promote development and boost government revenue for many years.

As Movendi International resources demonstrate, alcohol is an obstacle to 14 of the 17 SDGs and alcohol taxation is a catalyst for achieving multiple SDGs.

Alcohol taxation is a triple win measure for global health and sustainable development. The infographic visualizes the vast and growing evidence that alcohol taxation holds massive potential for global health, for helping achieve the sustainable development goals and also for significantly contributing to financing health and development.

About the 2022 Financing For Sustainable Development Report

The 2022 Financing for Sustainable Development Report of the Inter-agency Task Force begins with an assessment of the global macroeconomic context (chapter I). The thematic chapter (chapter II) explores the “great finance divide”, the impacts of high borrowing costs for developing countries, and recommended remedies. The remainder of the report (chapters III.A to III.G and IV) discusses progress in the seven action areas of the Addis Agenda, and advances in data.

Each chapter gives updates on implementation and lays out the challenges and policy options at both the national and international levels, including in response to the current crisis and pandemic and climate risks. The report also responds to two specific requests included in the outcome of the 2021 Economic and Social Council Financing for Development Forum: it discusses the role of credit rating agencies (chapter II) and the potential use of the multidimensional vulnerability index (chapters III.C, III.E and IV).

About the Inter-Agency Task Force

The Inter-agency Task Force is made up of more than 60 United Nations agencies, programs, and offices, the regional economic commissions, and other relevant international institutions. The report and its online annex draw on their combined expertise, analysis, and data. The major institutional stakeholders of the financing for the development process—the World Bank Group, the International Monetary Fund, the World Trade Organization, the United Nations Conference on Trade and Development, and the United Nations Development Programme— play a central role, jointly with the Financing for Sustainable Development Office of the United Nations Department of Economic and Social Affairs, which also serves as the coordinator of the Inter-agency Task Force and substantive editor of the report.