Big Alcohol lobbies against effective alcohol policy measures especially in the global south. By doing so the alcohol industry attempts to push for increasing alcohol availability in these countries that consume much less alcohol than western countries.

Big Alcohol lobbying to weaken alcohol taxes in India

Big Alcohol giant Pernod Ricard wants India to drop its import taxes on foreign liquor. This is not a new lobbying effort in India for Pernod Ricard, the world’s second biggest liquor producer.

As Movendi Internation reported in February 2022, the chief executive of Chivas Brothers – a Pernod Ricard brand – expressed hopes a free-trade deal between the UK and India would make it easier for their whisky products to be sold in India by cutting import taxes.

Currently, India has a 150% tax on imported liquor. But Big Alcohol has been lobbying to weaken this import tax for years.

India’s current import tax not only generates more revenue for the Indian government but also protects Indian society from being saturated with imported alcohol products and further accelerating alcohol harm in Indian communities.

Pernod Ricard doesn’t want to just reduce the import taxes in India. They want the taxes completely scrapped, so the alcohol giant can flood India with their products, drive higher consumption, and maximize profits.

Yes, yes, we should go after zero … the ultimate objective should be a 0%,” said Thibault Cuny, Pernod Ricard, South Asia CEO about import taxes in India, as per The Hindu.

Thibault Cuny, Pernod Ricard, South Asia CEO

Already, India is a “key market” for Pernod Ricard. As per IWSR analysis, India’s $20 billion alcohol market is set to grow by 7% each year, with whiskey and spirits sales increasing the fastest.

Big Alcohol practices have been creating an alcohol norm in India, a country where most people are still living alcohol-free. However, Big Alcohol’s push into India has started to make scotch and whiskey brands more popular. So much so that India is Chivas Regal’s biggest market by volume according to Jean-Etienne Gourgues, CEO of Chivas Brothers.

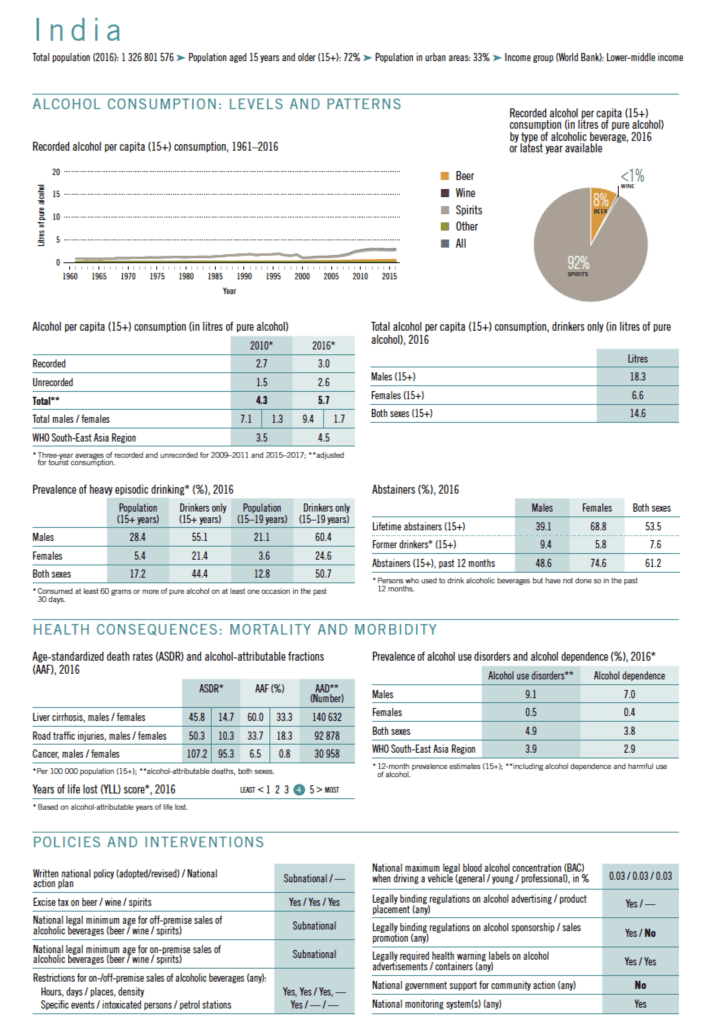

Alcohol harm in India – increasingly caused by Big Alcohol’s products and practices

The profits of Pernod Ricard and other Big Alcohol companies come at high costs to the Indian people. The World Health Organization reports that about half (50.7%) of alcohol using young people between 15 to 19 years engage in binge alcohol use.

Indian men face the highest health harm due to alcohol: 9.1% of Indian men have some alcohol use disorder and 7% are dependent on alcohol.

In 2016, in India alcohol caused,

- 140,632 deaths due to liver cirrhosis,

- 92,878 deaths due to road traffic injuries, and

- 30,958 deaths due to cancer.

India is a country that is placed on the higher end for years of life lost due to alcohol.

Despite the heavy alcohol burden, alcohol policy in India remains subnational. This has led to various different alcohol laws across states. Evidently, decreasing import taxes on alcohol for Big Alcohol profits could endanger the Indian people’s health even more.

Already Big Alcohol is known to exploit the loopholes in India’s alcohol policies to make alcohol more affordable and increase sales and consumption for more profits.

- Recently, three major alcohol multinationals were exposed for price cartellization.

- The companies were Carlsberg, AB InBev acquired SABMiller, and Heineken-controlled United Breweries (UB).

- Before that Carlesberg was exposed for bribery and child labour in India.

- In the state of Assam alcohol was used to bribe voters during elections.

- During COVID-19, Big Alcohol has been pushing state governments to allow home delivery of alcohol products. This led some states to trial various online sales methods, including a token system.

Big Alcohol lobbying against alcohol taxes in Kenya

Kenya is a different country on a different continent than India. But also in Kenya, multinational alcohol giants are deploying similar strategies and tatics as in India, for instance in the lobby campaign against alcohol taxes.

Movendi International has previously revealed that Big Alcohol deploys four key strategies across the African region to drive profits:

- Marketing alcohol products as cool and as a way to forget everyday problems;

- Aggressive exploitation of largely unregulated alcohol advertising and other alcohol trade aspects (taxation, availability) across the region;

- Corporate interference in public health policy making across African countries; and

- Extreme availability and affordability of alcohol.

Lobbying against tax increases in the region is one way in which Big Alcohol influences public health policy making to make alcohol more affordable in the region.

In Kenya, East African Breweries Limited (EABL) – a subsidiary of Diageo, the world’s second largest liquor maker, has been relentless in its lobbying against tax increases and effective tax policy in the country.

Despite the pressure from the alcohol industry Kenya has been implementing effective policies to reduce the heavy alcohol burden in the country.

- In 2018, the Kenyan Treasury introduced changes to the law, and Excise Duty will now be reviewed annually, with the rate pegged to the average rate of inflation for the past year. This is recommended as one of the best buy alcohol policy measures by the World Health Organization (WHO).

- More recently, in April 2022, the Kenyan government proposed a 15% tax on alcohol advertising in the 2022/23 budget.

- The Kenyan government also proposed a 10% hike on excise taxes in the 2022/23 budget. Separate from the annual adjustment to inflation.

Treasury Cabinet Secretary Ukur Yatani proposed to raise the consumption tax on beer by Sh12.15 per liter to Sh134, wine by Sh20.80 to Sh229, while spirits like whisky, gin, rum, and vodka will generate Sh47.60 additional tax to Sh335.30 per liter.

EABL has launched a new lobbying frenzy against the proposed 10% excise tax hike. EABL lobbying relies on old, worn-out and disproven talking points and claims that the alcohol industry makes irrespective of the country or circumstance.

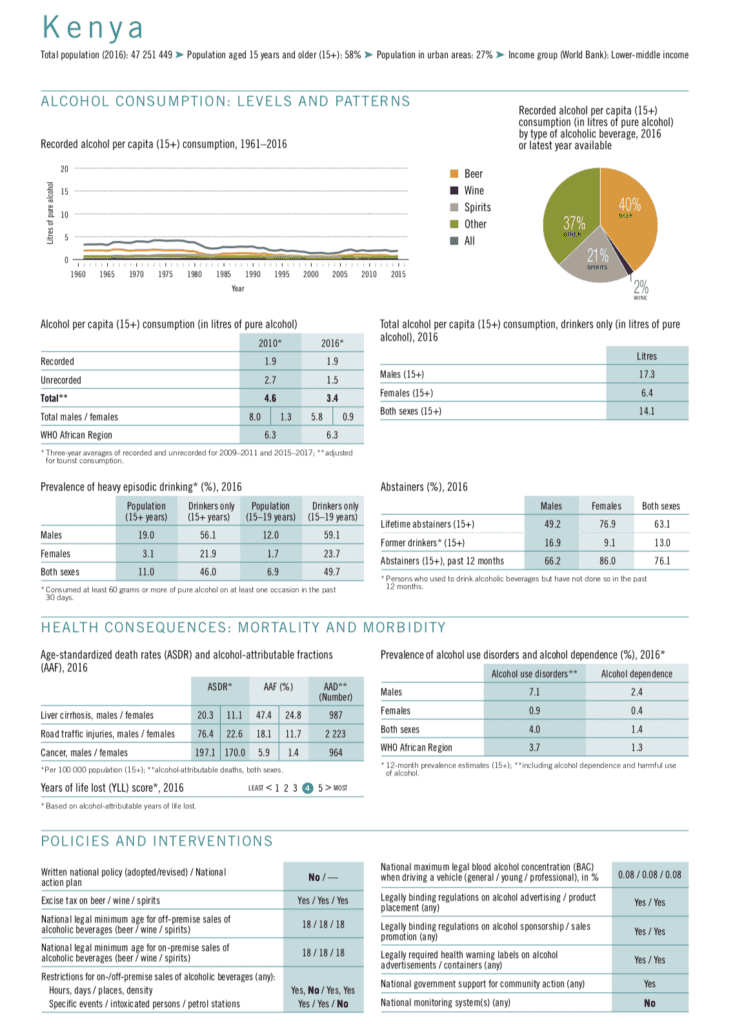

But the health, social and economic costs of alcohol burden Kenyan society severely.

- In Kenya out of the 50 million population, an estimated 2 million people are alcohol dependent.

- Alcohol is the most harmful drug in the country, specifically affecting youth in Kenya.

- Children as young as 4 years old get already exposed to alcohol.

Alcohol harm in Kenya – increasingly caused by Big Alcohol’s products and practices

As the World Health Organization (WHO) reports, in Kenya, almost half (49.7%) of young people between 15 to 19 years of age who use alcohol engage in binge alcohol consumption. The figures are even higher (59.1%) for young boys. 7.1% of Kenyan men suffer from alcohol use disorders.

In 2016, the alcohol burden was heavily affecting Kenyan communities. The products and practices of the alcohol industry fueled,

- 987 deaths due to liver cirrhosis,

- 2223 deaths due to road traffic injuries, and

- 964 deaths due to cancer.

In 2019, when EABL was lobbying against tax increases in Kenya with the same arguments as today, a coalition of Kenyan Civil Society Organizations (CSOs) in a joint letter addressed the flawed arguments of Big Alcohol.

Taxes are NOT the singular cause of illicit trade in tobacco and alcohol. Other complementary measures, such as strengthening of tax administration and effective implementation of electronic goods management systems (EGMS) can be adopted to control any perceived or real concerns,” stated the letter by CSOs.

Kenyan Civil Society Organizations (CSOs) including the International Institute for Legislative Affairs (ILA), the Alcohol Control and Policy Network (ACPN), the Kenya Tobacco Control Alliance (KETCA), and the Non- Communicable Diseases Alliance of Kenya (NCDAK).

Sources

Market Screener: “East African Breweries Urges the Government to Reconsider Its Taxation Measures“

The Hindu: “Pernod says India should drop its high foreign liquor taxes“

Yahoo News: “Pernod says India should drop its high foreign liquor taxes“