The Portuguese government decided to raise alcohol taxes by 4% in line with rising inflation in the country. However, the government is giving the wine industry a tax break.

The increased tax will not apply to wine but will be applied to sugary drinks. Tobacco products will see a 6% tax increase.

Lobby front groups for sugary drinks and alcohol industries in Portugal are already complaining about the tax increase.

But increasing the price of health harmful products, such as alcohol, through excise taxes is the single most effective intervention to protect more people from alcohol harm. The health, social and economic cost of alcohol to Portugal is enormous and alcohol policy solutions are urgently needed to promote health and well-being for people and communities.

Alcohol harm in Portugal

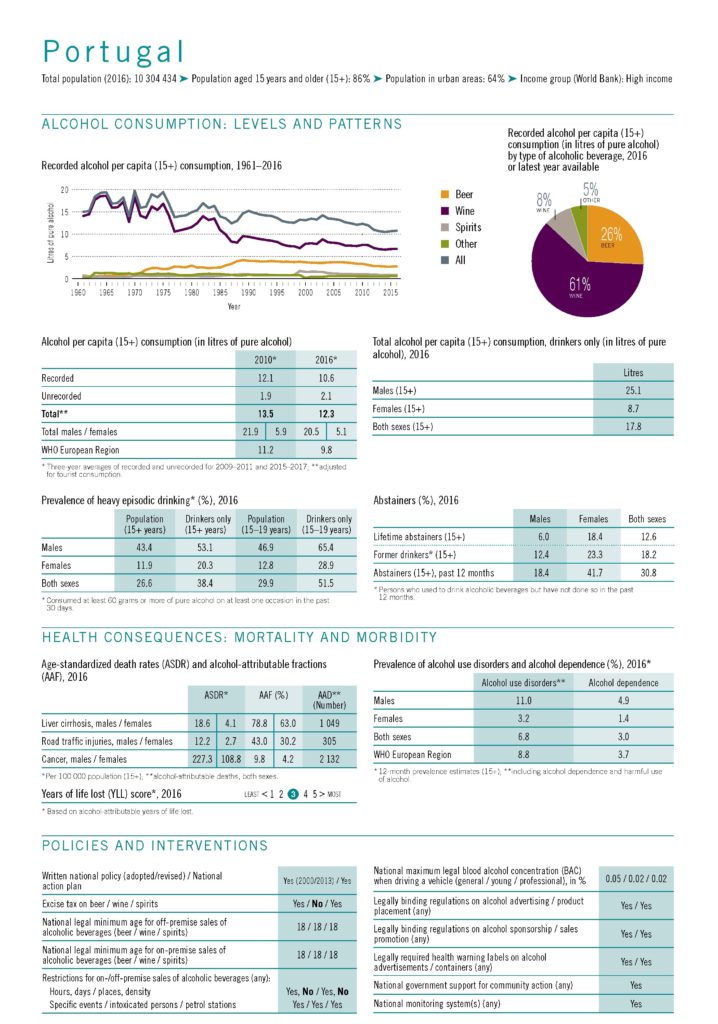

As the World Health Organization reported in 2018, in Portugal alcohol products caused

- 1049 deaths due to liver cirrhosis,

- 305 deaths due to road traffic injuries, and

- 2132 deaths due to cancer.

Portuguese males over 15 years of age who consume alcohol use about 25.1 liters of alcohol per capita. This is very high and is causing a heavy health, social, and economic burden. For example, in Portugal 11% of males suffer from alcohol use disorder, including 4.9% who are alcohol dependent.

Making wine relatively cheaper harm society and people

As WHO reported in 2018, 61% of Portuguese people who use alcohol consume wine.

Giving tax breaks to the wine industry while the excise tax and prices of other alcohol products increase is counterproductive. The most heavily consumed alcohol products in Portugal remain cheaper than other alcohol products.

Not to include wine in the excise tax increase is counterproductive because the decision makes wine comparatively cheaper than other alcohol products.

But wine, just like beer and liquor, contains ethanol which causes cancer, heart disease, addiction and other mental health conditions.

World class evidence shows that reducing affordability through alcohol pricing policies, especially through excise taxes, is the WHO’s most highly recommended policy solution to lower population-level alcohol consumption and to protect more people from alcohol harms. It is also part of the WHO SAFER package – a state of the art alcohol policy blue print to promote health and development with the help of proven alcohol policy tools. Despite this recommendation, the Portuguese government does not implement excise taxes on wine.

One possible reason for the lack of excise taxes on wine could be alcohol industry interference in Portugal. One study in 2019 found the alcohol industry in Portugal is known to influence alcohol policies as part of the national task force responsible for planning alcohol control policies.