Undersecretary of the Treasury, Claudia Sanhueza, recently delivered a presentation to public officials and academics, according to T13 reporting. In the presentation Ms Sanhueza outlined the approach the Government envisions to achieve Tax Reform.

For the current exploratory stage, the Treasury has identified three specific taxes to review:

- tobacco/cigarette,

- alcoholic beverages, and

- sugary beverages.

The third project, on corrective taxes, was to be submitted by the end of 2022, as previously announced by the Government. For this type of tax, 0.4% of GDP would be collected under the regime, according to the Treasury. But the ministry emphasizes that it has not yet decided to send this project to Congress, since it is still in the process of elaboration.

As a general justification, Undersecretary Sanhueza stated on December 5:

… healthy taxes seek to modify people’s behavior, aligning economic incentives with the social costs and benefits associated with the consumption of products that are harmful to health […,] in addition to increase the revenue of the Treasury.”

Claudia Sanhueza, Undersecretary, Treasury, Chile

| Product | Specific tax | Expected effect of increase |

| Cigarettes | 0,0010304240 UTM | Per cigarette, a 30% tax increase in the retail price, including taxes. |

| Liquors and distilled spirits | 31,5% | Base price |

| Wine and beer | 20,5% | Base price |

| Non-alcoholic drinks | 18,0% | Base price. If a drink has less than 15 grams of sugar per 240 milliliters, the rate is 10% of the base price. |

| Pure cigarettes | 52,6% | Retail price, including tax |

| Processed tobacco | 59,7% | Retail price, including tax |

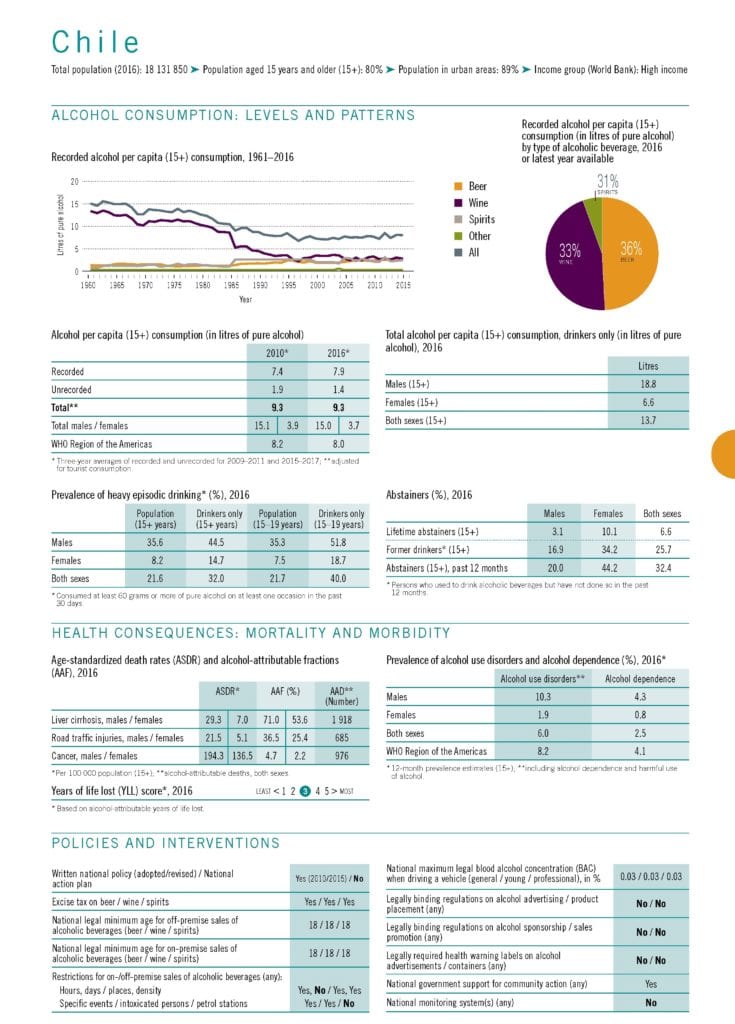

Alcohol harm and policy in Chile

A 2020 study found that Chile has enacted alcohol policies in all WHO-recommended policy domains. Nevertheless, Chile has not adopted policies with highest cost-effectiveness.

Regarding the most cost-effective policies,

- Chile has made limited use of taxation,

- has not regulated alcohol marketing and

- has worsened alcohol availability limits.

And in early November, new figures were released by the National Service for the Prevention and Rehabilitation of Drug and Alcohol Consumption in Chile. The report showed that there is a high prevalence of alcohol intake among Chilean university students and a high-risk consumption pattern.

Chile’s alcohol per capita consumption is above the regional average of the WHO Americas region. More than 3500 deaths from just three diseases or injury conditions, reveal the heavy alcohol burden on Chile.

At the same time, the national alcohol policy has been last updated in 2015 and there is no national alcohol plan in place. More than 10% of Chilean males have an alcohol use disorder.

It is clear that the country would benefit from more ambitious alcohol policy making, especially considering to use the full potential of public health oriented alcohol excise taxes.

The potential of alcohol taxation for better health and development for all in Chile

Alcohol taxation is the single most cost-effective policy tool that governments can use to generate revenue that can be invested in health promotion.

As Movendi International has been reporting, implementing alcohol taxation reaps a triple positive effect:

- Domestic resource mobilization

- Alcohol taxation generates government revenue for financing development and health promotion such as NCD prevention.

- Reducing alcohol’s health and development burden

- Alcohol taxation reduces population level alcohol use and thus reduced the overall public health, social and economic harm caused by the products and practices of the alcohol industry.

- Prevention of alcohol initiation and health promotion

- Alcohol taxation helps maintain high-levels of alcohol abstention rates in low- and middle income countries.

There is strong and growing evidence that pro-health taxes on health harmful products, such as tobacco, alcohol, and sugar-sweetened beverages, are highly impactful and yield significannt return on investment.

A landmark study confirmed this in 2020:

Excise tax increases on tobacco, alcohol and SSB can produce substantial health gains by reducing premature mortality while raising government revenues, which could be used to increase public health funding.”

Summan A, Stacey N, Birckmayer J, et. al. The potential global gains in health and revenue from increased taxation of tobacco, alcohol and sugar-sweetened beverages: a modeling analysis. BMJ Global Health 2020

1. Harnessing the full potential of alcohol taxation

2. Understanding the economic costs of alcohol harm

3. Understanding the social costs of alcohol harm

4. The vast and untapped potential of alcohol taxation for investment in health and development

Taxing alcohol, tobacco, and sugar-sweetened beverages is an effective but underutilized policy for promoting health and preventing disease. They could also assist in raising more funds for the government to support investments and programs that benefit the entire population and improve equity. Alcohol taxation is a win-win-win measure for public health and the economy specifically in recovering from the COVID-19 pandemic.

5. Case studies about the positive impact of alcohol taxation for investment in health and development

More and more governments and organizations are waking up to the potential of alcohol taxation for investment in health and development.

The latest Financing for Sustainable Development report by the UN Inter-Agency Task Force highlights the importance of alcohol taxation.

The Alcohol Issues Podcast

S1 E15: Understanding Alcohol Taxation: Design, Potential and Window of Opportunity

In this episode host Maik Dünnbier talks with Dr. Evan Blecher of the World Health Organization focusing on pro-health taxes and specifically the design, potential, and window of opportunity for better alcohol taxation.

Evan and host Maik go deep into the weeds of health taxes, focusing more specifically on alcohol excises taxes. They discuss different terms for health taxes and what they reveal about the purpose and potential of health taxes.