The National Treasury released a report that shows the Kenyan government has lowered the amount of tax revenue lost due to tax exemptions for beer products made from sorghum, millet and cassava. The report reveals forgone revenue due to beer tax exemptions has dropped to a new low of Sh18.4 billion in the fiscal year that ended in June 2021.

Concerning the tax collection by the National treasury, reducing forgone revenue from beer taxes is an important achievement. In 2018, Kenyan society lost a record high of Sh42.2 billion due to tax exemptions for EABL beer products.

In Kenya, EABL’s Senator Keg is the only known beer made from sorghum and was first introduced into the market in 2004.

Diageo is one of the world’s biggest alcohol giants. It is a British multinational alcoholic beverage company, with headquarters in London, England.

Headquartered in Nairobi, Kenya, EABL manufactures branded beer, spirits, and non-alcoholic beverages.

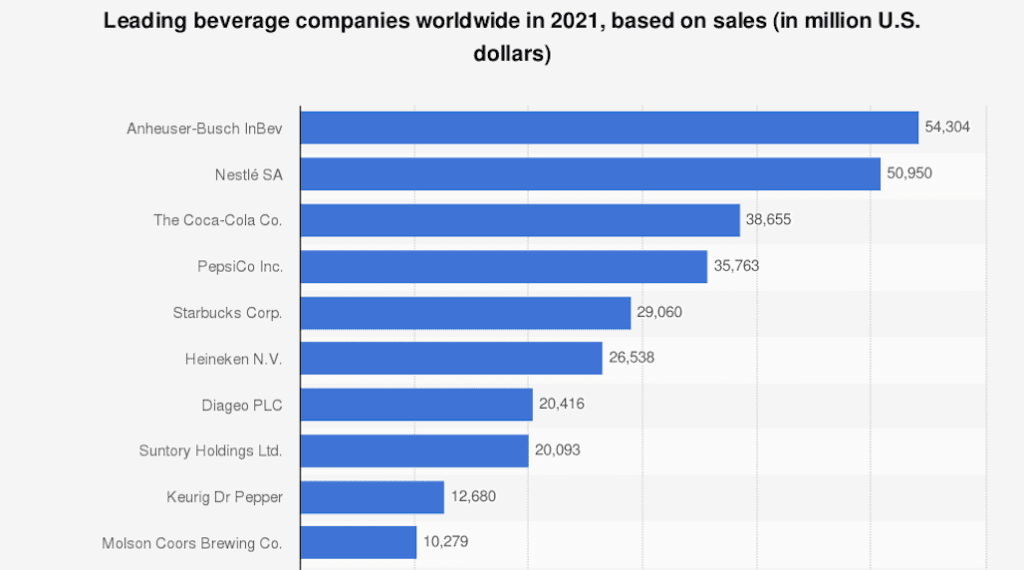

Based on sales, Diageo was the third leading alcohol company in the world in 2021, according to Statista.

Tax exemptions for Senator Keg – a Diageo brand in Kenya – have been declining due to a decision by the Kenyan government to cut excise duty remission, initially by 50% in 2013.

The decision to reduce tax advantages for the multinational juggernaut Diageo in Kenya exposed how much the alcohol giant was dependent on the tax exemption. The introduction of the 50% excise duty on Senator Keg led to Diageo and EABL deciding to stop production of the beer noting that it was not financially viable. EABL, which is majority owned by Diageo, originally launched the Senator beer brand to target Kenyan people and consumers from low-income and poorer socio-economic strata.

A history of preferential treatment for Big Alcohol in Kenya

The excise duty exemption was first introduced by the Kenyan government in 2006 at 100%. This preferential treatment for one of Diageo’s brand caused the beer to become widely consumed among low-income Kenyans.

Until 2016, EABL was benefiting from preferential treatment through massive tax exemptions for its cheap beer brand, Senator Keg, after the Kenyan government exempted excise tax on alcohol made from sorghum, millet and cassava by 95%.

President Uhuru Kenyatta signed the Finance Act 2016, effectively removing the key tax exemptions offered to the Diageo beer brand. The pricing of the beer, which was initially taxed at the rate of Sh10 per liter, was expected to rise by Sh90 to Sh100 a liter, to match the charges on other beer brands.

In 2018, the government further reduced the tax exemption to a rate of 80% three years later.

Since the launch of the cheap beer brand, except when the government introduced taxes on the beer product, Senator Keg controlled 40% of the Kenyan beer market. The reduction in excise tax remission triggered a price rise in low-end end beer.

This shows the important effects of effective alcohol taxation, to increase alcohol prices and reduce alcohol affordability. Cheap alcohol is especially harmful to already vulnerable people and communities. Diageo used the cheap beer brand to target low-income Kenyans, turn them into alcohol users and drive an alcohol consumption increase.

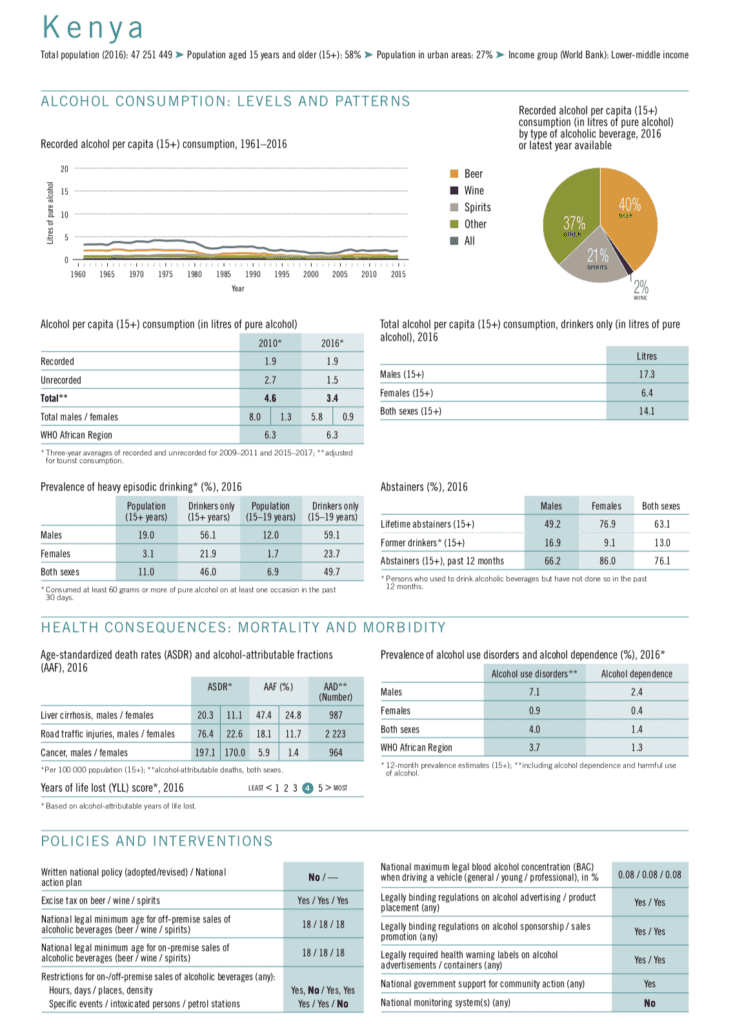

But 76% of Kenyan adults live free from alcohol, in the past year, according to World Health Organization data.

Without the preferential treatment in beer taxation, Diageo was not able or willing to maintain consumption rates of Senator Keg.

The alcohol producer increased the price, market share declined, profit margins vanished, and ultimately Diageo and EABL discontinued the cheap beer brand.

The new President established further measures to protect people from alcohol harm and provide a solution to the prevailing economic issues

William Ruto has been the country’s vice president for the last ten years. He became Kenya’s fifth leader since independence, after being elected by the people as the new President of Kenya on September 13, 2022.

President Ruto took steps to increase the excise tax on alcohol and to adjust the tax rate to inflation.

Kenya is saddled with onerous debt, largely due to financing of large-scale infrastructure projects. Inflation is climbing, the currency continues to depreciate against the dollar and food and fuel prices are skyrocketing as consequences of the war in Ukraine. Four back-to-back seasons of below-average rainfall have left over four million Kenyans exposed to food and water insecurity.

This is the context and urgency in which the Kenyan Revenue Authority announced the increase of specific rates of excise duty by up to 6.3% in September 2022. This would be the average inflation recorded in Kenya in the 2021/2022 financial year. The measure aimed to prevent taxes from being eroded due to imported inflation.

Once the inflation adjustment raises the excise taxes the prices of alcohol products will rise in Kenya.

- Beer tax will rise from Sh. 134 for every two bottles to Sh. 142.4.

- Taxes on wine will rise from Sh. 229 to Sh. 243.4 for every 208 liters.

- Taxes on spirits will increase from Sh. 335 to Sh. 356.4 for every 278 liters.

Also being clear on his intention to denormalize alcohol in the parliament, President Ruto has stayed true to his stance and no longer serves alcohol at official functions of the government.

Alcohol harm, policy and alcohol industry interference in Kenya

As the World Health Organization (WHO) reports, in Kenya, almost half (49.7%) of young people between 15 to 19 years of age who use alcohol engage in binge alcohol consumption. The figures are even higher (59.1%) for young boys. 7.1% of Kenyan men suffer from alcohol use disorders.

In 2016, the alcohol burden was heavily affecting Kenyan communities. Alcohol caused:

- 987 deaths due to liver cirrhosis,

- 2223 deaths due to road traffic injuries, and

- 964 deaths due to cancer.

Despite the heavy harm caused by the products and practices of the alcohol industry, Kenya does not have a written national alcohol policy. But since 2010, the comprehensive “Mututho Law” is in place – the best alcohol law in the African region. While the Mututho Law is a model policy for other African countries and Kenya benefits from its implementation since 2010, more can and must be done to protect Kenyan society from alcohol harm.