Upgrading the benefits of the existing tax policy

The Canndian government plans to increase the federal beverage alcohol duty by 6.3% on April 1. Alcohol excise duties are imposed at the manufacturing level and adjusted annually based on inflation. The increase in the alcohol tax targets the manufacturers at the point of production. The tax is built into the price of the product and is magnified as it goes through the supply chain from the distributor to the retailer.

The purpose is for alcohol companies to pass on their rising expenses to the consumers through higher prices, making alcohol products less affordable.

The federal alcohol duty is separate from provincial liquor board fees and sales taxes.

In Canada, the federal government adjusts the excise tax on alcohol annually to account for inflation, as mandated by law. The escalator tax was put in place by the federal government in 2017.

This year, the newly announced tax is triple the rate as the usual tax increase. The new tax increase is 6.3% which is above the inflation rate of the last month, February (5.2%). The new tax increase has the potential to minimize the risk the alcohol industry would just absorb the tax increase, instead of passing it on to consumers so that alcohol became less affordable.

Absorbing tax increases is an economic strategy deployed by the alcohol industry to ensure alcohol consumption rises. This is a specific tactic to exploit low-income alcohol users. Mega-brewers such as the AB InBev owned Labatt beer brand could easily absorb the cost increase due to the alcohol tax escalator. But CBC reports that the beer giant is likely to pass the rising costs on to consumers.

“Their revenue was up last year 6% to $15 billion and their net income was $1.4 billion. Is it a million more in taxes? If they wanted to eat the cost, they could. But I imagine they will pass the increase on to the consumer,” Johnson says.

The pending tax rate in April has the potential to allow fewer loopholes for the industry to sustain the sales levels in the face of tax regulation.

Alcohol excise duty rates are adjusted by law on an annual basis to account for inflation,” said Adrienne Vaupshas, press secretary of Finance Minister Chrystia Freeland, in an email to CTV News.

The increase next month works out to less than a penny on a can of beer.”

Adrienne Vaupshas, press secretary of Finance Minister Chrystia Freeland

Alcohol beverage prices rose 5.7% in February compared with a year before, according to Statistics Canada.

The benefits of reducing alcohol affordability

Reducing alcohol affordability is one of the best ways to reduce alcohol use at the population level and in doing so prevent and reduce alcohol harm. Moreover, it specifically protects vulnerable groups like low-income alcohol users by encouraging cutting back or quitting alcohol consumption.

Low-income users are among the highly targeted consumer groups of the alcohol industry in a wide range of countries, including Canada.

Increasing the price of alcohol leads lowered affordability which encourages people and communities to buy and consume less alcohol, in order to reduce their expenses on alcohol. This in turn facilitates spending on healthier goods and services, instead of alcohol.

The rise in alcohol tax also generates more revenues for the government to support alcohol treatment and prevention programs.

Implementation of Alcohol Tax Policies with additional supportive initiatives

In Canada, the policy decision to increase the alcohol excise tax is coupled with the introduction of new health-focused low-risk alcohol use guidelines. The “Canada’s Guidance on Alcohol and Health: Final Report January 2023” by the Canadian Centre on Substance Use and Addiction (CCSA) provides people in Canada with accurate and current information about the risk of harms linked with alcohol consumption. And the new guidance also provides the evidence base for future alcohol policy in the country.

The 6.3% federal “escalator” alcohol excise tax together with the improved guidelines low-risk alcohol use guidelines help shape an environment and public discourse in Canada that promote health and helps prevent and reduce alcohol harm.

As per CBC reporting, Professor Jacob Shelley, the Head of the Health, Ethics Law and Policy Lab at Western University emphasizes that multiple interventions, such as tax policies and effective education material, create a more impactful and cohesive approach to address the issue at hand.

When there are efforts that attack the same problem from multiple angles, it informs the consumer more if it was just one intervention.”

Professor Jacob Shelley, Head of the Health, Ethics Law and Policy Lab at Western

The adoption of a multi-faced approach to the goal of protecting more people from alcohol harms has the potential to generate multiple positive effects for more people and communities.

The alcohol tax elevation reflects a more intensified and active role of the federal government from a policy perspective to better prevent and reduce alcohol harm in Canada.

Alcohol harm and the need for better alcohol policy

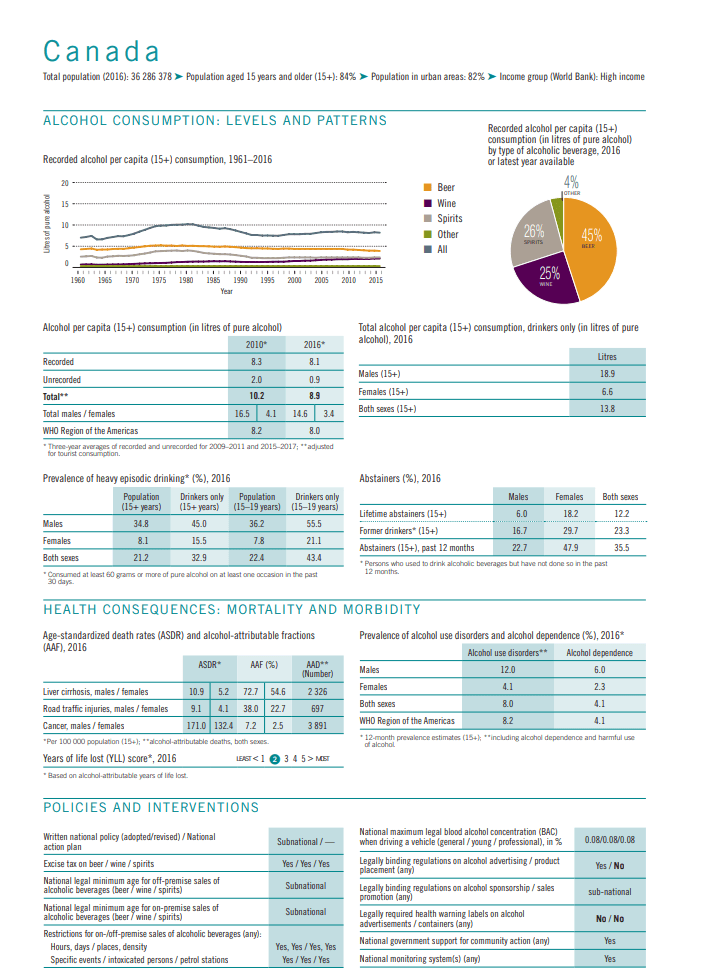

In 2017, alcohol caused 18,000 deaths in Canada. That same year, the costs associated with alcohol in Canada were $16.6 billion, with $5.4 billion of that sum spent on health care.

According to a report by the Canadian Institute for Health Information, more and more women are dying due to alcohol harm. Between 2001 to 2016 the rate for death related to alcohol rose by 26% for women comparative to 5% for men.

The most recent available data show that alcohol causes nearly 7,000 cancer deaths each year in Canada, with most cases being breast or colon cancer, followed by cancers of the rectum, mouth and throat, liver, esophagus and larynx. According to the Canadian Cancer Society, consuming less alcohol is among the top ten behaviours to reduce cancer risk.

Canada does not have an alcohol policy at the federal level. Instead alcohol policies are governed by provinces and territories. The absence of an adequate alcohol policy system at the national level has caused several provinces and territories to worsen their alcohol policies due to pressure of the alcohol industry. This way, more and more people in Canada, including children and women, are exposed to rising alcohol harms.

Data from the World Health Organization shows, for instance how pervasive alcohol use disorder is among Canadian men. It also shows that even more people die due cancer caused by alcohol than from liver cirrhosis caused by alcohol.

And the WHO country profile for Canada from 2018 illustrates the areas where urgent alcohol policy improvements are needed, such as a national alcohol policy and action plan, a national legal age limit, a reduction in the legal level for blood alcohol concentration, a national alcohol advertising ban, health warning labeling, and more.

With more than 150 articles about Canada on the Alcohol Issues News Center, Movendi International is documenting the alcohol harm and policy situation in Canada systematically. As alcohol harm is rising, comprehensive and ambitious alcohol policy action is need and increasingly requested by people and their representatives in Parliament.

Especially the federal alcohol policy is needed to better protect people and communities from the harms caused by the products and practices of the alcohol industry.