IOGT International welcomes new alcohol taxes introduced in Peru

Düsseldorf, Germany, May 10, 2018 – The government of Peru has just introduced new taxes to address harms caused by alcohol, tobacco and sugar-sweetened beverages. IOGT International welcomes these new measures and commends the Peruvian government for their leadership to protect the health and wellbeing of their people.

Alcohol taxation is a triple-win measure as it reduces alcohol consumption, eases the burden of alcohol harm, and helps raise domestic resources for health promotion and sustainable development,” says Kristina Sperkova, International President of IOGT International.

On behalf of the members of IOGT International, I congratulate the government of Peru, for putting the wellbeing of their people and the welfare of society first. These health promotion taxes will reap major benefits across the Sustainable Developments Goals.”

Good for development

Evidence shows that alcohol adversely affects 13 of 17 of the Sustainable Development Goals, such as poverty eradication, gender equality, good health for all, reducing violence, crime and inequalities, economic growth or sustainable cities. [1]

- Alcohol use contributed to more than 300,000 deaths in the region – with more than 80,000 of those involving deaths that would not have occurred if alcohol had not been consumed.

- Peru is among the countries experiencing the highest number of years lost due to ill-health, disability or early death.

- Around 14,000 deaths of children and youth under 19 were attributed to alcohol in 2010 in the Americas. [2]

Good for public health and the economy

There is strong evidence that raising alcohol taxes is an effective strategy for reducing alcohol consumption and related harms. [3] Evidence also suggests that alcohol tax increases not only reduce alcohol harms, but may also lead to a net increase in employment. This matters because alcohol is an obstacle to economic development. [4]

- Alcohol is the leading risk factor for death and disability among people aged 15 to 49 years in the Americas. This is the age range in which people are typically at their most productive economically.

- Alcohol harm likely results in billions of dollars of productivity and wage losses every year. [2]

The Peruvian government is right to introduce alcohol taxation because it is an evidence-based, cost-effective, and high-impact measure to reduce alcohol harm and achieve positive outcomes in other areas of society,” says Kristina Sperkova.

We know for example that alcohol tax increases are very positive for the well-being of children and youth, something that really matters in Peru, where the onset age for alcohol use is extremely young.”

Higher taxes, higher prices, less harm, more development

Very recently, the Lancet Taskforce on NCDs and economics highlighted the role of fiscal policies in encouraging healthy lifestyles to reduce and prevent the largest contributors to preventable NCDs—namely, tobacco, alcohol, and obesity. [5]

We commend the government of Peru for increasing alcohol taxes to address the burden of alcohol harm,” says Kristina Sperkova.

Alcohol taxation is scientifically sound, economically smart, morally right and highly cost-effective to promote health and help achieve sustainable development.”

— END

Notes to the editors

Who is IOGT International?

IOGT International is the premier global network for evidence-based policy solutions and community-based interventions to prevent and reduce alcohol-related harm. Founded in 1851, IOGT International has 151 Member Organizations in 60 countries and works with the most comprehensive approach to promoting development through addressing alcohol harm, by working with prevention, treatment and rehabilitation as well as policy advoccacy.

What are the Sustainable Development Goals?

Adopted in 2015 by the governments of the world, the 2030 Agenda contains 17 Sustainable Development Goals with 169 targets. The 17 SDGs cover all three aspects of sustainable human development: the social, environmental and economic dimension.

Alcohol taxation and the SDGs

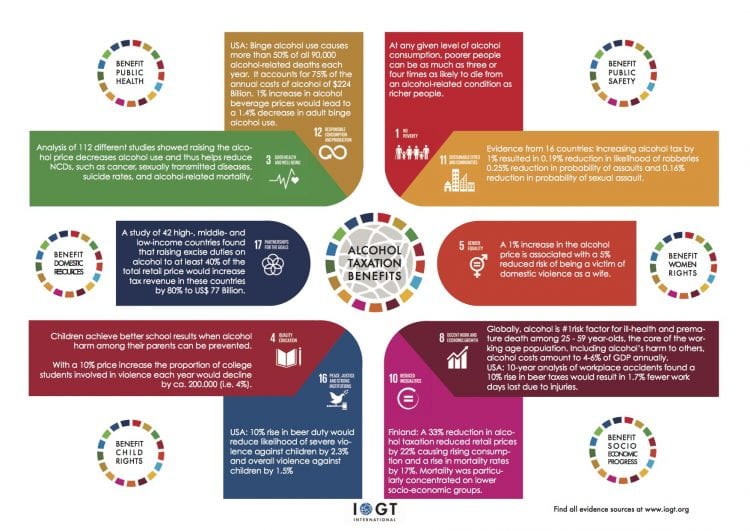

The infographic visualizes the vast and growing evidence that alcohol taxation holds massive potential for global health, for helping achieve the sustainable development goals and also for significantly contributing to financing health and development.

List of references:

[1] Alcohol and the SDGS – Major obstacle to development, IOGT International booklet, 2017, https://movendi.ngo/wp-content/uploads/2015/03/Alcohol-and-SDGs_new.pdf

[2] 2015 Regional Status Report on Alcohol and Health in the Americas, by PAHO and WHO Americas

[3] The Guide to Community Preventive Services, Preventing Excessive Alcohol Consumption: Increasing Alcohol Taxes. February 23, 2015 [cited 2015 November 30]; Available from: Preventing Excessive Alcohol Consumption: Increasing Alcohol Taxes.

[4] Higher Alcohol Taxes Create More Jobs, Maik Dünnbier, 2014, https://movendi.ngo/blog/2014/11/20/higher-alcohol-taxes-create-more-jobs/

[5] Taxes for health: evidence clears the air, Summers, Lawrence H., The Lancet, 2018, https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(18)30629-9/fulltext

Download:

Find he the new Peruvian law (PDF)