Distilling the distillers: examining the political activities of the Distilled Spirits Council of the United States

Research article

Abstract

Background

Understanding of the alcohol industry’s means of influencing public policy is increasingly well established. Less is known, however, about the specific organisations that lead the political strategies of the alcohol industry. To fill this gap, this paper explores the Distilled Spirits Council of the United States (DISCUS), a key trade association in the United States (US), which also operates internationally.

Methods

This study explores how DISCUS is organised and the main political activities it pursues to advance its policy interests. The study triangulates data from several sources, including DISCUS documents, as well as federal lobbying and election expenditure data.

Results

This study demonstrates that DISCUS is a key political actor in the US and global alcohol policymaking context. There are identifiable strategies used by DISCUS to shape alcohol policy debates, including framing and lobbying.

The researchers also find key synergies between these strategies and identify their operation at varying levels of policy decision-making.

Conclusions

Generating more secure inferences about the nature of the alcohol industry’s efforts to advance its interests, and with what success and at what cost, requires researchers to investigate other trade associations in different contexts, and use other data sources.

Big Alcohol’s trade associations

The alcohol industry comprises a formidable set of political actors that operate within and across several jurisdictions. Public health researchers have identified the web of actors and activities comprising the alcohol industry within certain countries. Like other industries, trade associations have been used as the main vehicles to organise political activities. Trade associations (TAs) allow erstwhile economic competitors to collaborate to advance shared interests in the political sphere. TAs enable individual companies to acquire information about socio-political issues and access resources which “transcend” organisational boundaries.

In the alcohol field, TAs tend to be organised by sector, such as spirits or beer, or role in the supply chain, such as producers or retailers.

Examples:

- The Distilled Spirits Council of the United States (DISCUS),

- Brewers of Europe, and

- British Beer and Pub Association.

A key function is to represent interests in both domestic and international political processes allowing alcohol companies to “speak with a single voice” on matters of policy. Increased concentration of ownership within the sector has made such coordination easier.

There are sound reasons to study the operation of these organisations. In other contexts, including the tobacco, asbestos and chemicals industries, in-depth analyses of TAs and their activities have demonstrated how they serve as vehicles for protecting corporate interests in the face of regulatory or political pressure.

When it comes to alcohol, there is currently insufficient understanding of the various functions of TAs in different political contexts, as well as the extent of their activities.

DISCUS

DISCUS is a trade association representing the distilled spirits supply chain including producers, marketers, and exporters. It is one of the leading alcohol TAs in the US and for the spirits sector, DISCUS plays a key role in monitoring relevant policy concerns across varying levels of governance.

For example, in the 1980s, DISCUS partnered with tobacco interests and other allies to mobilise against attempts to raise federal and state excise taxes.

DISCUS has also been active in influencing international trade and global health policy agendas. DISCUS has also been identified as a key player in other attempts to shape alcohol policy and science.

Notwithstanding these studies, there is limited understanding of how DISCUS operates and the tools it uses to engage in the political process.

Self-presentation of goals, contexts and Organisational structure

DISCUS presents itself as the leading voice for distillers “on policy and legislative issues in [Washington DC], state capitals and foreign capitals worldwide”.

Three main activities underpin DISCUS’s approach to alcohol policy.

- DISCUS advocates for any legislative, regulatory and public affairs issues at the state, federal and international level that affect its members. This means working to “ensure the spirits sector is leading the discussion and setting the agenda with public officials and regulators.”

- DISCUS actively promotes the sector by “raising awareness and opening markets in the United States and around the globe.”

- DISCUS promotes “moderate and responsible consumption of distilled spirits” through a range of “evidence-based” approaches to alcohol policy. DISCUS has a conventional departmental structure and employs just under 50 full-time staff.

Today, DISCUS principal members comprise several leading spirits producers and marketers, specifically Bacardi, Beam Suntory, Brown-Forman, Campari Group, Cie, Constellation Brands, Diageo, Edrington, Hotaling & Co, Jagermeister, MGP, MHW, Moet Hennessy, Ole Smoky, Pernod Ricard, Remy Cointreau, and William Grant & Sons.

DISCUS members have key incentives to maintain membership, including a weekly newsletter, updates on “state legislative and tax issues” and access to a website outlining laws and regulations relating to the sale and distribution of spirits across the US. Companies may benefit from a TA’s lobbying efforts without incurring the direct costs of membership (i.e., free riding). DISCUS provides individual benefits for paying members. For its principal members, this allows these large multi-national companies to claim that they represent a wide membership, including small and medium businesses.

Using corporate social responsibility (CSR) initiatives also represents a key strand of DISCUS’s approach to policy. In 2019 DISCUS took over the Foundation for Advancing Alcohol Responsibility (FAAR), which runs Responsibility.org. FAAR was created in 1991 as the Century Council, and since then it has been primarily funded by the major spirits companies. Such CSR activities had originally been located within TAs prior to the advent of dedicated organisations. FAAR and DISCUS have overlapping personnel; the President and CEO of DISCUS now serves as the head of FAAR and several other key leadership roles have shared responsibilities across both organisations. FAAR has nonetheless been retained as a separate organisational brand. The rationale for more tightly integrating these organisations is unclear.

Framing policy debates

DISCUS is active in shaping how policymakers approach alcohol as a policy issue at the domestic and international levels.

Framing is distinct from lobbying in that it aspires to narrow decision makers’ attention toward a specific dimension of a policy issue, with a view to managing salience.

At the domestic level, DISCUS has relied upon framing to advance its policy goals.

First, the economic dimensions of alcohol, as opposed to health and social costs considerations, are regularly emphasised in particular ways. DISCUS actively highlights the economic costs borne by the sector during policy debates:

[t]he distilled spirits industry faces legislative and regulatory challenges that impact responsible adult consumers, including punitive taxes, international trade barriers and tariffs, and restrictions on consumer convenience.”

DISCUS

DISCUS materials make little mention of the public health or social costs and consequences of the use of its products. Moreover, in its communications with lawmakers, the organisation regularly cites the contribution of the industry to the state or local economy:

[The spirits industry] is a major contributor to the state of Maryland, generating nearly $2.3 billion in economic activity and $292 million to local communities and the state in taxes.”

DISCUS

DISCUS regularly emphasises the well-being of smaller producers and retailers in its advocacy efforts. For example, in a recent debate over reducing federal taxes on spirits producers, DISCUS claimed:

This… critical piece of legislation… will protect jobs, boost communities and get these small businesses back on a path of stability and growth… The reduced tax rates… will serve as an economic lifeline for beleaguered small distilleries that have had their tasting rooms shut down for months.”

DISCUS

DISCUS is adroit at linking frames and issues. For example, there was a recent debate over whether the United States Postal Service (USPS) should be allowed to deliver alcohol. In making its case for supporting this legislation, small producers are identified as the main beneficiary of the policy change:

This legislation would… support producers that have struggled during the COVID-19 health pandemic and government-mandated business closures and/or limits… these producers have experienced dramatic declines in revenue as fewer Americans go out for dinner or a drink, gather for events, or travel.”

DISCUS

The language used in its communications appears highly consistent and is preserved when working in coalitions, giving particular priority to focusing specifically on the need to help small businesses. For example, in a recent letter to Congress, DISCUS and its allies write:

Due to the extreme economic duress brought on by the COVID-19 pandemic, [small] businesses have been devastated. Small beverage alcohol producers have seen average revenue losses of 40% or more. We are asking you to support the alcohol beverage producers in your state and congressional district by co-sponsoring [this] legislation.”

DISCUS

The rhetorical power of such material works to elide the interests of the large companies who run DISCUS and who will benefit from such legislation. DISCUS has also used COVID-19 as an opportunity to present itself as a good corporate citizen in other ways. DISCUS, as did companies and TAs elsewhere, regularly pointed out that there were over 800 distilleries in the US that were producing hand sanitiser for first responders and health care facilities. The organisation also launched an online portal to connect distillers with industry suppliers and distribution channels.

DISCUS has a long history of operating at the international level. DISCUS has influenced recent debates about alcohol policy, for example, through submissions to the World Health Organization (WHO) in 2018 and 2020. The framing work therein is consistent with other industry efforts to shape policymaking at the national and international level.

First, DISCUS seeks to re-frame alcohol as a policy problem by moving the emphasis away from the societal costs or population-level harms and focusing on alcohol consumption among specific subgroups, by claiming that most people drink unproblematically:

[Most] adults who consume alcohol do so responsibly and in moderation. Consequently, the Commission’s recommendations for governments to explore policies to minimize production, marketing and consumption are misguided and do not accomplish the goals of the Global strategy to reduce the harmful use of alcohol.”

DISCUS

Second, DISCUS makes unsubstantiated claims about the effectiveness of population-level interventions, pointing to limitations or perceived flaws with the existing literature, regardless of the actual content of that literature:

By focusing on the ‘best buys,’ [the WHO] ignores the scientific literature demonstrating the ineffectiveness and variability of these measures in reducing harmful alcohol consumption and failing to appropriately consider the effectiveness of other interventions.”

DISCUS

Similarly, DISCUS points to the industry’s long preferred policy approaches, using targeted approaches to address “harmful drinking” rather than whole population approaches such as increasing price, reducing availability and marketing, and promoting education programs and family-based interventions instead.

Finally, DISCUS positions itself and other industry groups as legitimate participants in the international public health policymaking process. For example, according to DISCUS:

The U.S. private sector is an important contributor to evidence-based policymaking at WHO and in other fora. Private sector engagement is and has been effective in government efforts to address pressing health issues by providing additional resources, evidence-based measures and technical collaboration to implement sound, effective policies.”

DISCUS

Again, such claims are advanced in strong terms, and notwithstanding the actual evidence, which is rather different. Moreover, in responding to the WHO’s working document in 2020, DISCUS complained:

The [WHO] takes an unduly negative view of engagement with economic operators… sound, effective efforts to address harmful use of alcohol require evidence-based measures and technical collaboration across the whole of society, including with economic operators.”

DISCUS

Lobbying

As the leading US group representing the interests of the spirits industry, engagement with federal and state officials, represents a key function of DISCUS. This study provides insights into the nature and scale of DISCUS’s lobbying efforts.

How much money does DISCUS spend on lobbying?

DISCUS’s materials indicate that federal lobbying is a major component of its public affairs strategy but the organisation’s website does not specify how much money it allocates to this activity.

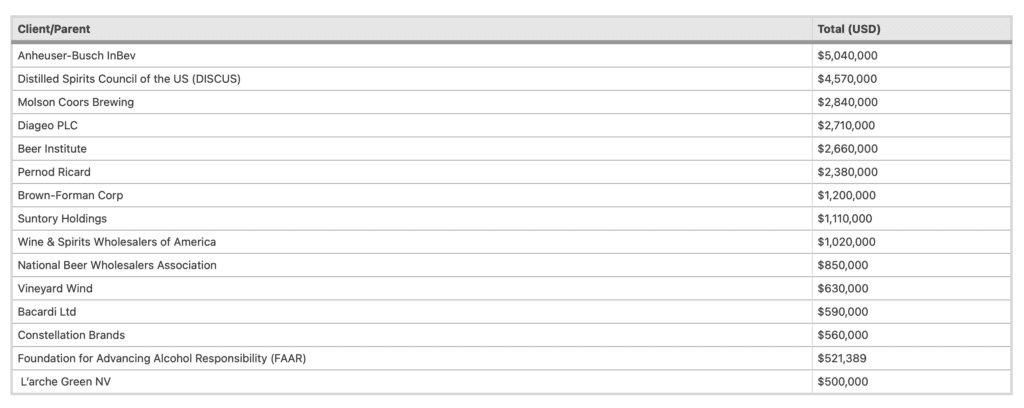

In 2021, DISCUS spent more than $4.5 million on federal lobbying, according to data collected from OpenSecrets.

Table 2 reports total expenditures for major alcohol industry actors in the United States for the most recent year available, above a minimum threshold of $500,000.

DISCUS was only second to AB InBev in total lobbying expenditures for 2021, without including FAAR, and both entities greatly exceeded all others in expenditure, amongst which DISCUS member companies are also prominent.

Between 2008 and 2021, its lobbying expenditures ranged between $4–6 million, with an average annual spend of about $5 million according to OpenSecrets.

In recent years, DISCUS has employed around 7 lobbyists. Previously, however, this figure was much higher, particularly in 2009 and 2010, presumably relating to specific legislation under consideration at the federal level, and perhaps also contributing to US involvement in the 2010 WHO Global Alcohol Strategy process.

DISCUS has also sought to gain influence through campaign finance activities. These include the formation of a Political Action Committee (PAC). PACs are organisations that enable members to pool campaign contributions and use these funds to finance campaigns for specific candidates, ballot initiatives or legislation. Campaign finance laws require PACs to disclose information about donors as well as the specific activities that are being financed. DISCUS created the Distilled Spirits Council of the United States Inc. Political Action Committee (DISPAC). As well as to federal candidates, DISPAC makes contributions to candidates at the local and state level.

According to FEC filings, several of the DISPAC’s regular donors are DISCUS senior managers, including the CEO, senior vice presidents, and vice presidents. Older FEC records reveal that several of the most significant contributions to DISPAC came from employees of DISCUS member companies, including Pernod Ricard USA, Brown Forman, and Patron Spirits Company. Campaign contributions operate at a much lower level of expenditure than lobbying, with DISPAC’s spending averaging at just under $78,000 per election cycle.

What are some of the main targets of DISCUS’s lobbying efforts?

In the US, alcohol policies are not just established by Congress but are also subject to regulatory decisions made by federal executive departments and agencies.

Between 1998 and 2021, DISCUS’s most common targets were the Departments of Agriculture, Commerce, Defence, Health and Human Services, State, Treasury, the Federal Trade Commission, the US Trade Representative, and the White House.

The responsibilities of these departments are largely in line with DISUS’s stated policy priorities (e.g., taxes, trade), though engagement with Health and Human Services is noteworthy.

Between 1998 and 2021, DISCUS lobbied federal officials on several issues according to OpenSecrets. The policy issues that are identified most frequently include taxes, alcohol addiction, trade, agriculture, and advertising.

DISCUS materials offer a more restricted view of the issues it is focused on at the federal level. Much of DISCUS’s press releases and documents identify trade issues, particularly tariffs on distilled spirits as key policy priorities. Over the last few years, DISCUS has been highly focused on the removal of all tariffs on spirits. Another key federal target is that taxes on ready-to-drink (RTD) beverages be taxed at the same rate since spirit-based RTDs have long been taxed at a higher rate than beer and wine.

DISCUS identifies state-level lobbying or “advocacy” as a key activity, perhaps unsurprisingly as state governments hold legal authority over many policy issues that affect the production and sales of spirits. DISCUS identifies “state market modernization” as one of its main areas of focus. In practice, this has meant lobbying for the reduction of taxes on spirits products and eliminating restrictions on alcohol sales. Numerous states, for instance, have bans on spirits sales on Sundays. According to one briefing note, one of DISCUS’s main legislative priorities for 2022 was to promote the repeal of these bans. DISCUS’s lobbying efforts have been successful in removing Sunday sales restrictions in Oregon and North Carolina.

DISCUS has made liberalising alcohol delivery laws a major legislative priority, particularly in the context of the COVID-19 pandemic. When public health restrictions were first introduced in March 2020, some states began allowing restaurants and bars to sell cocktails to-go. The State of New York’s decision to temporarily allow cocktail delivery quickly diffused across the US, with 35 states following New York’s lead. DISCUS continues to invest heavily in lobbying state governments to make these arrangements permanent. On cocktail delivery alone, the researchers collected over 100 relevant press releases and other documents (e.g., witness testimony to legislative committees). Since 2021, a total of 18 states have enacted permanent cocktails to-go legislation, with DISCUS having been involved in lobbying in all but two. During a presentation to staff and DISCUS members in February 2022, CEO Chris Swonger hailed these policy changes as some of the organisation’s most important legislative “victories”].

How has DISCUS used mass political mobilisation to enhance its lobbying efforts?

DISCUS has also used mass political mobilisation to advance political influence. In 2019, DISCUS created the Spirits United campaign. Spirits United is a joint initiative with the American Distilling Institute, and several state-level TAs. It is described as a “grassroots platform” aimed at bringing together spirits advocates, including spirits professionals and consumers.

The Spirits United platform is designed so that consumers can contact their lawmakers about spirits-related legislation. Visitors are asked to supply their personal information, including their home address, which is then used to facilitate correspondence between individual members and elected officials. Spirits United is focused on mobilising the public to influence a range of policy debates. These include federal spirit taxes and tariffs (particularly in the context of free trade agreements), increased availability of alcohol, reducing regulations on spirits tastings, and reducing taxes on spirits. Spirits United is seen as a particularly important resource for state-level efforts. As one campaign document explained:

Last year alone, over 2,000 bills related to beverage alcohol were introduced in the states, including proposals to increase spirits tax rates in 18 states. [DISCUS] will be utilizing Spirits United in support of our efforts to defend against taxes and improve market access for spirits in the states!”

DISCUS

Unlike traditional lobbying, Spirits United appears modelled on a different conception of how to build political support for the spirits industry’s policy goals. DISCUS materials suggest that mobilising consumers and other indirect stakeholders is a key tactic for securing industry goals. According to one presentation:

We are all competing for lawmakers’ attention. These [other] industries are taking advantage of a communication channel that our industry is not. We need individual engagement from everyone in the industry to ensure our messaging, needs, and concerns are at the top of Congress’ mind”

DISCUS

There is some evidence of successful political mobilisation. Between 2019 and 2020, the Spirits United platform led to “more than 65,000 communications to Congress” in support of the Craft Beverage Modernization and Tax Reform Act [98].

How has DISCUS used coalition-building to strengthen its lobbying operations?

DISCUS has also worked with other industry partners to achieve common goals, including creating the Hospitality Recovery Coalition (HRC), a partnership formed between DISCUS, the American Distilled Spirits Alliance (ADSA), the Council of State Restaurant Associations (CSRA), the National Restaurant Association and Training for Intervention Procedures (TIPs). The coalition’s aim is to “advocate for policies supporting on-premise establishments facing financial turmoil due to the COVID-19 crisis”. HRC engages in several policy-influencing efforts, including lobbying state leaders and lawmakers to make cocktails to-go legislation permanent.

During the pandemic, DISCUS also worked with a broad coalition across the hospitality sector to promote relief for small businesses. This included the Independent Restaurant, American Beverage Licensees, American Cider Association, Beer Institute, Brewers Association, National Restaurant Association, Produce Marketing Association, Wine America, Wine Institute, and Wine & Spirits Wholesalers of America. Creating large coalitions that cut across different parts of the alcohol sector allows DISCUS and other corporate interests to claim that they represent a larger segment of the American economy.

DISCUS has used similar coalition-building tactics in promoting the passage of a range of bills at the federal level, including RESTAURANTS Act of 2021 (S. 255/ H.R. 793), the Fairness for Craft Beverage Producers Act (H.R. 1035) and the Hospitality and Commerce Job Recovery Act of 2021 (H.R. 1346/ S.477). DISCUS has promoted support for this legislation alongside the Beer Institute and Wine Institute, the other key alcohol TAs in the U.S.

Added value of the study

This study uncovers similarities and differences between alcohol and tobacco TAs.

DISCUS was established to communicate the spirit industry’s policy positions to policymakers and to coordinate public relations campaigns.

Before it was disbanded in the Master Settlement Agreement (MSA), the Tobacco Institute, the tobacco industry’s main TA in the US, was created for a similar purpose.

There is also overlap in the tactics employed by TAs in both sectors, particularly lobbying, campaign contributions, public relations campaigns, and alliance building, as well as in leadership.

Key differences are also apparent. DISCUS strives to be a politically visible policy participant, actively engaging with the media. In contrast, since the MSA, tobacco companies have routinely used front groups or “astroturf” organisations to be the public face of their various political campaigns and operations. This strategy is used to remove the tobacco industry’s “fingerprints” from such campaigns. The differences in circumstances allow DISCUS to pursue distinct ways of shaping public understanding of its products and of the alcohol industry, including high-profile CSR activities.

This study also provides insights into how this alcohol TA used major shifts in the economic and political environment to advance its interests.

In 2020, with the onset of the COVID-19 pandemic, concerns about the viability of small businesses were prominent in political discussions. DISCUS seized this opportunity and presented alcohol liberalisation as a policy solution, arguing these policies would provide a “lifeline” for restaurants and small distilleries.

DISCUS’s lobbying efforts were critical in generating an unprecedented surge of alcohol policy making activity at the state level. DISCUS’s response to the hand sanitiser shortage is another key example, and one which was common to large alcohol companies and TAs elsewhere. DISCUS highlighted the distiller’s CSR activities to the press and the public. Efforts of this nature might not seem significant but these can have important, yet subtle, effects on public perceptions of the alcohol industry. These provide an opportunity for the industry to cast themselves as good corporate citizens and legitimate policy participants in advancing public health priorities.

As the lobbying expenditure data show, DISCUS is one among many alcohol industry groups active in Washington DC. Moreover, DISCUS’s public-facing materials rarely make reference to the health and social-related impacts of alcohol but our findings reveal that the Department of Health and Human Services is one of the organisation’s most common lobbying targets.

Although the precise nature of these discussions and the effectiveness of these lobbying efforts is unclear from the data, this suggests that health-related issues, or perhaps the framing of these issues for policymakers, are a major priority for distilled spirits, and likely other sectors of the alcohol industry.

A growing body of work points to the politically sophisticated nature of the alcohol industry and its efforts to shape science and policy. There is further work to do to identify the ways in which industry actors think about and engage with domestic and international political processes. Analysing materials authored by alcohol industry actors offers a key resource for studying the nature of these organisations. Future research should examine other materials that exist in the public domain, including annual reports, tax records, and other mandatory disclosures.

This research study, whilst modest in design, demonstrates what can be accomplished by analysing publically available data. To generate more secure inferences about the nature of the alcohol industry’s efforts to advance its interests, and with what success and at what cost, researchers will need to investigate other TAs in different contexts, and use other data sources.