Changes in alcohol consumption and beverage preference among adolescents after the introduction of the alcopops tax in Germany

Background and context

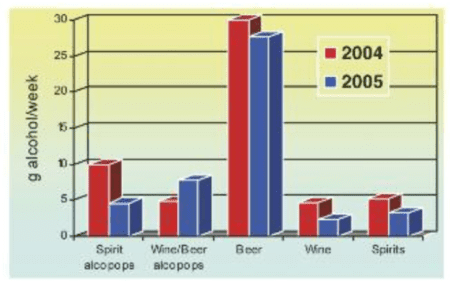

Germany: 12-17 year olds weekly alcohol consumption, in: Deutsche Hauptstelle für Suchtfragen e.V. (DHS) (2008) Binge Drinking and Europe. Hamm: DHS

The case of Germany shows that special taxes for spirit based sweet pre-mixed drinks (alcopops) lead to reductions in sales and consumption of the specific products.

Alcopops are sweet, ready-mixed soft drinks containing between 5% and 7% alcohol by volume.

After the introduction of alcopops in the late 1990s, concerns regarding their seductive power in underage alcohol users were raised due to the sweet taste masking the alcohol content. This product seduced adolescents, especially girls, to initiate earlier onset of alcohol consumption and to increase volume of alcohol intake and frequency of binge alcohol use.

Germany introduced a specific tax on alcopops in 2004, increasing the price of sweet pre-mixed alcoholic drinks that were highly popular with youth and under-age. The policy was introduced with the intent to protect young people from alcohol harm.

Writing in the journal Addiction, the scientists found evidence that the tax clearly worked in reducing the popularity of alcopops among 12 to 17 year-olds – which had previously been found in well-established studies.

Abstract

Aims

The aim of this study is to assess the contribution of the alcopops tax to changes in alcohol consumption and beverage preference among adolescents in Germany. The researchers hypothesize that the decrease of alcohol intake by alcopops is substituted by an increase of alcohol intake by other alcoholic beverages.

Design

Data came from the German 2003 and 2007 cross‐sectional study of the European School Survey Project on Alcohol and other Drugs (ESPAD).

Participants

A propensity score‐matched subsample of 9th and 10th graders was used for the analyses.

Measurement

Alcohol consumption within the last 7 days was assessed by a beverage‐specific quantity–frequency index. An individual’s beverage preference was assigned for the beverage that had the highest share in total alcohol consumption. Multiple regression analyses were used to assess changes in alcohol consumption; changes in beverage preference were tested using multinomial logistic regression.

Findings

While alcopop consumption declined after the alcopops tax was implemented, consumption of spirits increased. Changes in beverage preference revealed a decrease in alcopop preference and an increase in the preference for beer and spirits.

Conclusions

Results indicate a partial substitution of alcopops by spirits and a switch in preference to beverages associated with riskier alcohol consumption patterns.

There is evidence that riskier alcohol consumption patterns such as higher frequency of binge alcohol consumption and earlier initiation of alcohol use are not caused by alcopop consumption but by alcohol consumption in general. The study’s findings suggest that health benefits of the alcopops tax related to the reduction of total alcohol consumption were mitigated by beverage substitution. Moreover, the tax appears to have entailed negative side effects because a switch to alcoholic beverages that are associated with riskier consumption patterns occurred.

Thus, effective alcohol policies to prevent alcohol-related problems among adolescents should focus upon the reduction of total alcohol consumption instead of regulating singular beverages.