The harm caused by the practices and products of the alcohol industry can be reversed through implementation of evidence-based, cost-effective and high-impact public policy measures: the alcohol policy best buys.

Effective public policy interventions do exist. They are so cost-effective and high-impact that country income levels need not be a major barrier to successful prevention of alcohol harm.

What is needed is political will:

- High levels of commitment,

- Good planning,

- Community mobilization and

- Intense focus on a small range of critical actions.

Implementation of the alcohol policy best buys promise thus quick gains across the spectrum of the burden of disease due to alcohol.

High-impact alcohol policy solutions: Definition

An alcohol policy best buy is an intervention that is not only highly cost-effective but also cheap, feasible and culturally acceptable to implement. A highly cost-effective intervention is one that, on average, provides an extra year of healthy life (equivalent to averting one DALY) for less than the average annual income per person. Analysis by the World Health Organization (WHO) has identified a set of affordable, feasible and cost-effective intervention strategies and its study estimates a global price tag for implementing these measures.

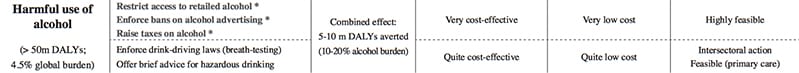

Cost-effective measures for reducing harmful alcohol use include increasing alcoholic beverage taxes, regulating the availability of alcoholic beverages, restricting marketing of alcoholic beverages and drink-driving countermeasures.” (WHO)

Overview

Many interventions for the prevention and control of alcohol harm do exist.

WHO has identified a set of evidence-based alcohol policy “best buy” interventions that are not only highly cost-effective but also feasible and appropriate to implement within the constraints of national budgets. WHO has developed a costing tool to enable countries to add or substitute interventions according to national needs or priorities. A number of criteria play a role in the political decisions which best buy interventions to implement:

- Current and projected burden of disease,

- Cost-effectiveness,

- Fairness and feasibility of implementing interventions, and

- Political considerations.

Cost-effectiveness

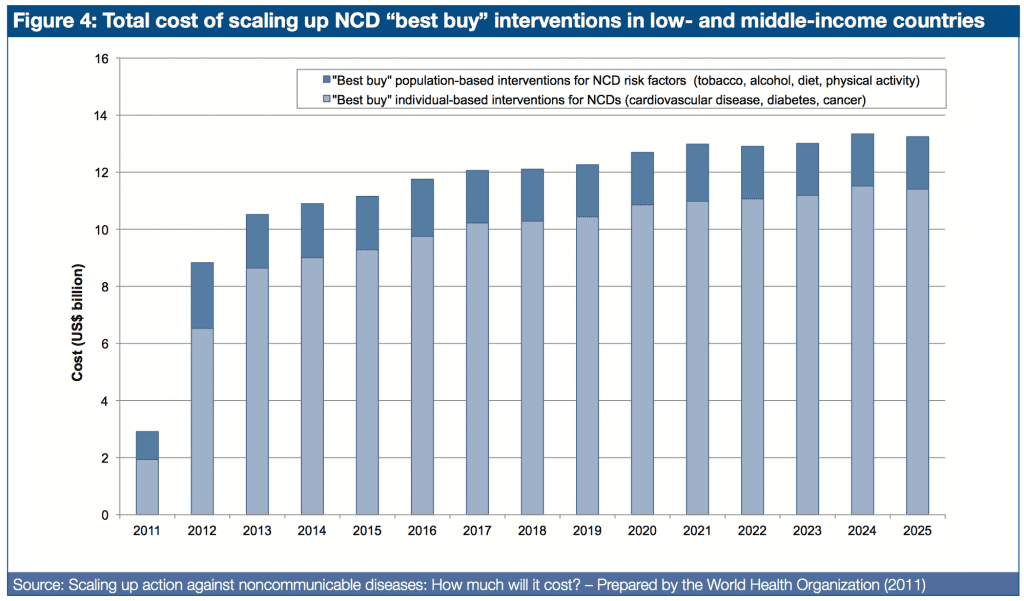

Findings from WHO indicate that the price tag for scaled-up implementation of a core set of NCDs “best buy” interventions is comparatively low. Population-based measures for reducing tobacco and harmful alcohol use, as well as unhealthy diet and physical inactivity, are estimated to cost US$ 2 billion per year for all LMICs – less than US$ 0.40 per person.

A highly cost-effective intervention is one that, on average, provides an extra year of healthy life (equivalent to averting one DALY) for less than the average annual income per person.

For example, in Eastern Europe, any intervention that produces a healthy year of life for less than US$ 9972 (the average GDP per capita) is deemed to be highly cost-effective; an intervention that does so for less than three times GDP per capita is still considered reasonable value for money or quite cost-effective. These threshold values are based on a recommendation by the WHO Commission on Macroeconomics and Health (2001) and the work of the WHO cost-effectiveness CHOICE project.

Figure 4 shows – per WHO and WEF – population-based measures that address tobacco and alcohol harm, as well as unhealthy diet and physical inactivity, account for a very small fraction of the total price tag (US$ 2 billion per year – less than US$ 0.40 per person).

Current and projected burden of disease

Established evidence for the effectiveness and cost-effectiveness of interventions to reduce alcohol harm and its contribution to the overall burden of disease include examples from countries such as Brazil, China, Mexico, the Russian Federation and Viet Nam, and others. The following alcohol policy best buys measures are especially supported:

- Increasing excise taxes on alcoholic beverages;

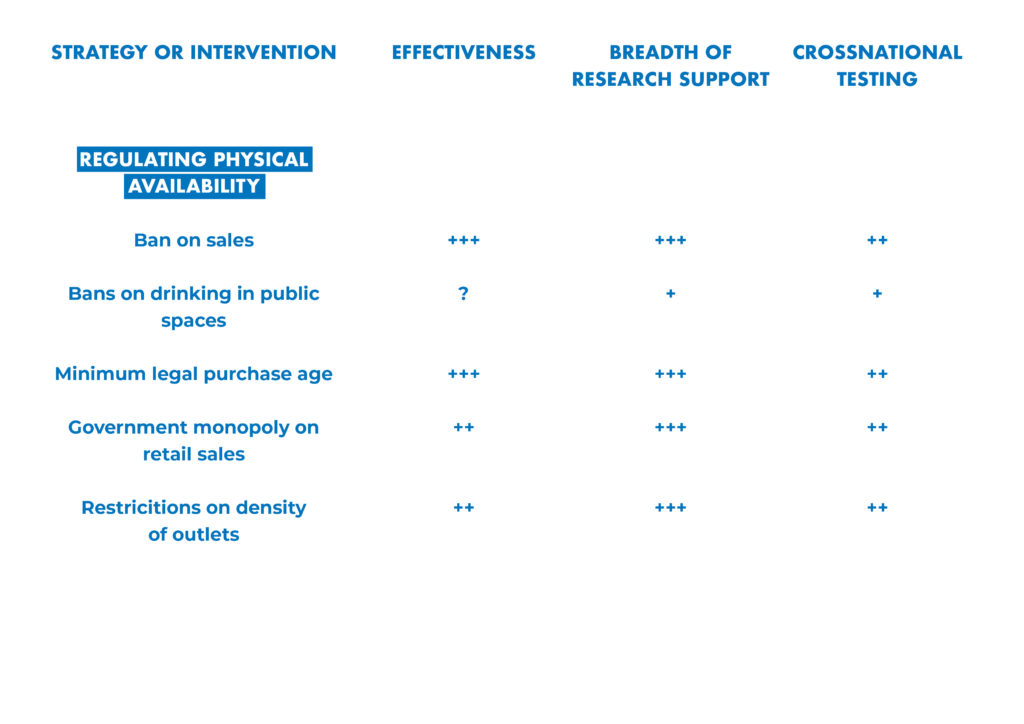

- Regulating availability of alcoholic beverages, including minimum legal purchase age, restrictions on outlet density and on time of sale, and, where appropriate, governmental monopoly of retail sales;

- Restricting exposure to marketing of alcoholic beverages through effective marketing regulations or comprehensive advertising bans;

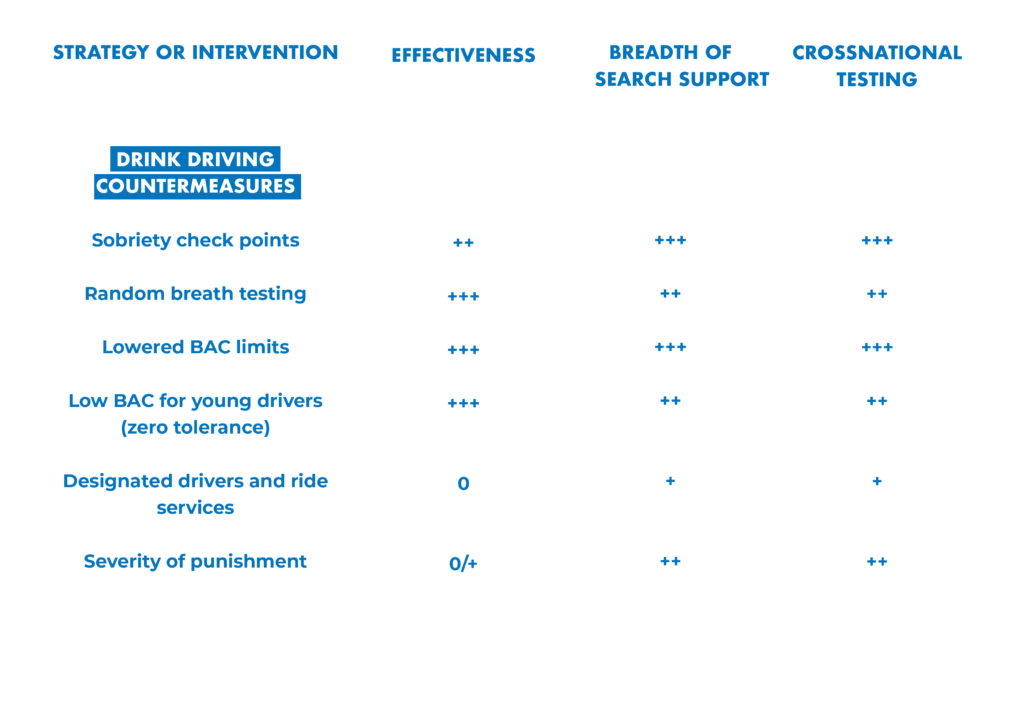

- Driving under the influence countermeasures including random breath testing, sobriety check points and blood alcohol concentration (BAC) limits for drivers at 0.5 g/l, with reduced limits or zero tolerance for young drivers;

- Treatment of alcohol use disorders and brief interventions for hazardous and harmful alcohol consumption.

WHO advice

The current available scientific evidence supports prioritization of multiple cost- effective policy actions – the so-called three alcohol policy best buys:

- Increasing alcohol beverage excise taxes,

- Restricting access to retailed alcohol beverages and

- Comprehensive advertising, promotion and sponsorship bans

Policy Options

The policy options developed around the world to address alcohol harm are numerous in number but also very diverse – ranging from individual therapeutic services to community and population level interventions.

Measures that curb the the affordability, availability and accessibility of alcohol are the most cost-effective.

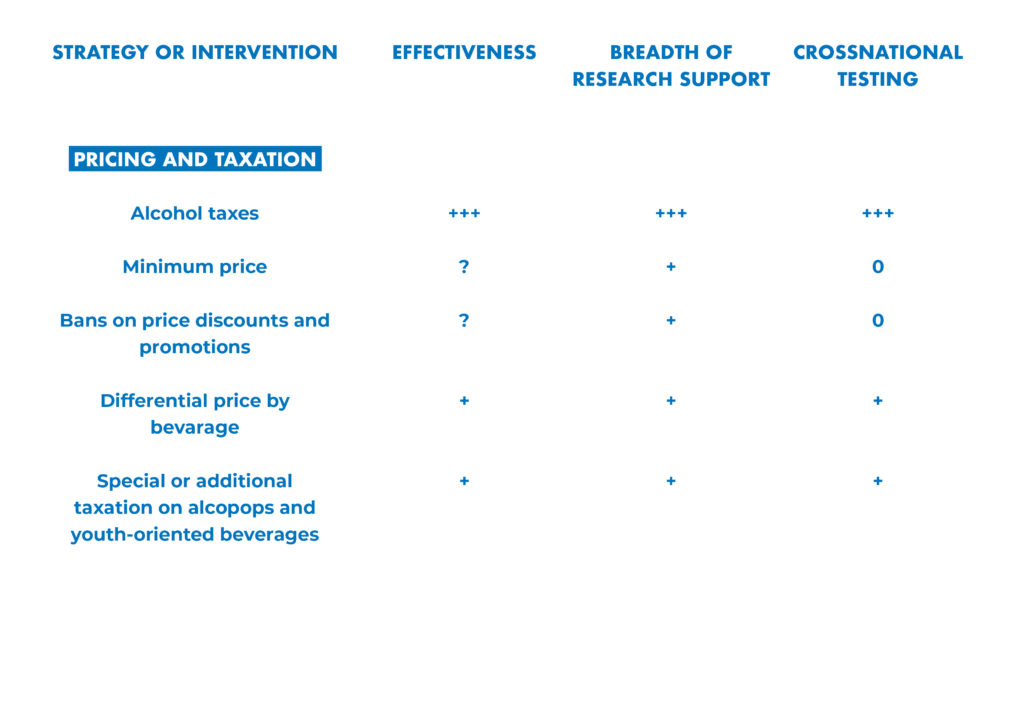

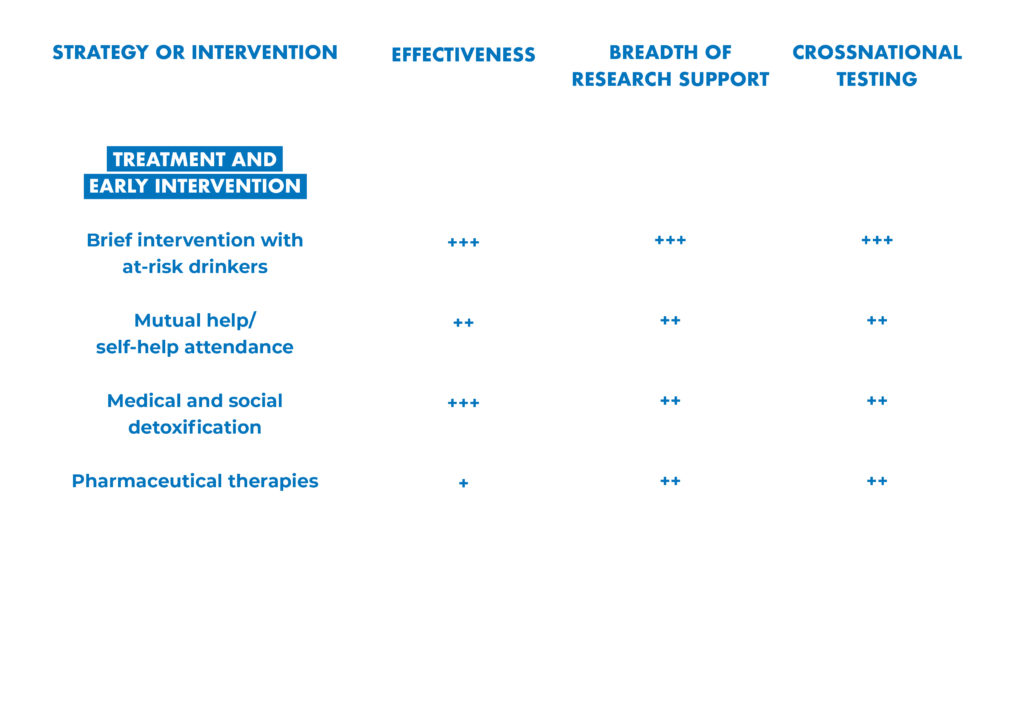

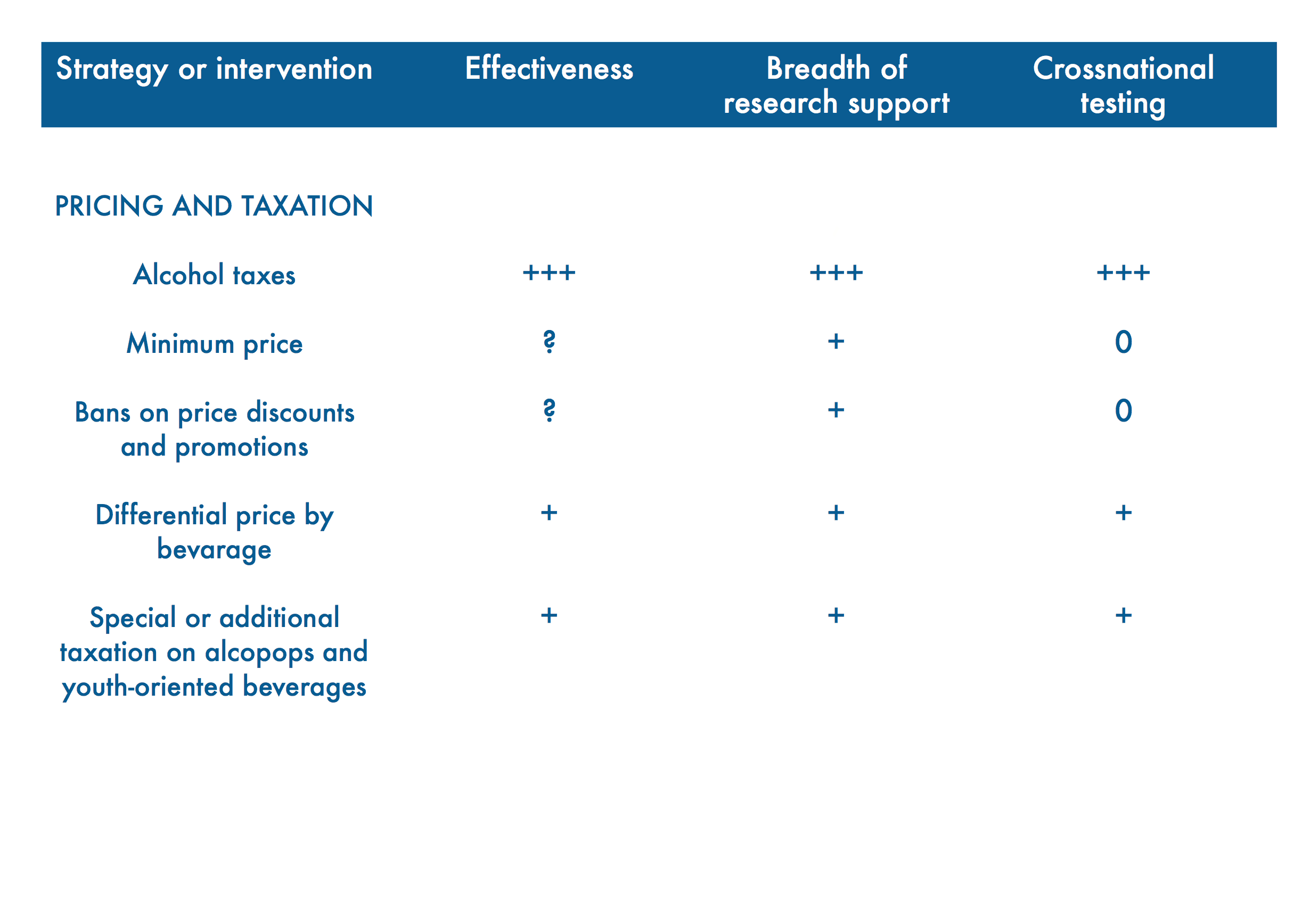

Leading researchers from around the world have assessed the effectiveness, breadth of research support and cross-national testing for 42 alcohol policy interventions.

Their analysis is presented in “Alcohol No Ordinary Commodity. Research and Public Policy,” 2nd edition.

Best Buy: Alcohol Taxation

The World Health Organization and World Economic Forum write:

Specific intervention strategies can effectively tackle leading causes of NCDs and their underlying risk factors, as a growing body of evidence has demonstrated.

These interventions include population level measures that encourage reduced consumption of tobacco, alcohol and salt; increased excise taxes; and enhanced regulation.”

Cost-effectiveness and high impact

A systematic review of the literature to assess the effectiveness of alcohol tax policy interventions for reducing alcohol consumption and related harms was conducted, by a group of independent scientists.

The reviewed studies provide consistent evidence that higher alcohol prices and alcohol taxes are associated with reductions in both total alcohol consumption and related, subsequent harms.

Results were robust across different countries, time periods, study designs and analytic approaches, and outcomes.

There is strong evidence that raising alcohol taxes is an effective strategy for reducing alcohol consumption and related harms.

Note: In countries with low prevalence of alcohol use or with high proportion of consumed alcohol produced informally or illegally and, therefore, not covered by taxation, the cost-effectiveness of raising taxes on alcohol is less favourable.

Alcohol Taxation Benefits

A triple win measure for global health and sustainable development

The infographic visualizes the vast and growing evidence that alcohol taxation holds massive potential for global health, for helping achieve the sustainable development goals and also for significantly contributing to financing health and development.

The most cost-effective measures to prevent and address alcohol harm remain price interventions especially through taxation. [5, 6, 7]

Sources of evidence used in the infographic

[1] Sornpaisarn B, Shield KD, Österberg E, Rehm J, editors. Resource tool on alcohol taxation and pricing policies. Geneva. World Health Organization; 2017. Licence: CCBY-NC-SA3.0IGO

[2] WHO News Release, May 27, 2014, Geneva http://www.who.int/mediacentre/news/releases/2014/no-tobacco-day/en/

[3] Stenberg et.al. Responding to the challenge of resource mobilization – mechanisms for raising additional domestic resources for health. World Health Report (2010) Background Paper, 13, World Health Organization, 2010 http://www.who.int/healthsystems/topics/financing/healthreport/13Innovativedomfinancing.pdf

[4] Ibid.

[5] The case for investing in public health: a public health summary report for EPHO 8. Copenhagen: WHO Regional Office for Europe; 2014.

[6] McDaid D, Sassi F, Merkur S. Promoting health, preventing disease: the economic case. Copenhagen: European Observatory on Health Systems and Policies; 2015.

[7] Merkur S, Sassi F, McDaid D. Promoting health, preventing disease: is there an economic case? Copenhagen: European Observatory on Health Systems and Policies; 2013.

SDG 1

Mattioli B, Quaranta MG, Vella S. Review on the evidence on public health impact of existing policies. Rome: FRESHER; 2016

McDaid, Sassi, Merkur. Promoting health, preventing disease: the economic case. Copenhagen: European Observatory on Health Systems and Policies; 2015.

SDG 3

Scientific American: Raising alcohol taxes can curtail assaults and suicides

Wagenaar, et al., 2010

Staras, Livingston, Wagenaar: Maryland Alcohol Sales Tax and Sexually Transmitted Infections. American Journal of Preventative Medicine. 2015

Markowitz, Chatterji, Kaestner: Estimating the Impact of Alcohol Policies on Youth Suicides, The Journal of Mental Health Policy and Economics J Ment Health Policy Econ 6, 37-46 (2003)

SDG 5

Chaloupka et.al.: The Effects of Price on Alcohol Consumption and Alcohol-Related Problems, NIAAA, 2002

SDG 8

Alcohol taxation creates more jobs, not less (link)

SDG 11

Jon Foster, Alcohol, domestic abuse and sexual assault, Institute of Alcohol Studies, September 2014

SDG 16

WHO Fact sheet: Child maltreatment and alcohol (PDF)

SDG 17

Rehm et al., 2009a

Laslett et al., 2010

The case for investing in public health: a public health summary report for EPHO 8. Copenhagen: WHO Regional Office for Europe; 2014.

McDaid D, Sassi F, Merkur S. Promoting health, preventing disease: the economic case. Copenhagen: European Observatory on Health Systems and Policies; 2015.

Merkur S, Sassi F, McDaid D. Promoting health, preventing disease: is there an economic case? Copenhagen: European Observatory on Health Systems and Policies; 2013.

Implementing alcohol taxation measures reaps a triple positive effect [1]

1. Domestic resource mobilization

Alcohol taxation generates government revenue for financing development and health promotion.

Domestic resource mobilization: Untapped potential

Compared with tobacco taxation, the potential for domestic resource mobilization through alcohol taxation could be even bigger since taxes on alcohol tend to be lower in most countries. [2]

A study of 42 high-, middle- and low-income countries found that raising excise duties on alcohol to at least 40% of the total retail price would increase tax revenue in these countries by 80% to US$ 77 Billion. [3]

Expressed as a proportion of total current spending on health, it is low-income countries that have most to gain (additional receipts would amount to 38% of total current spending on health). [4]

At the same time, evidence shows that alcohol’s pervasive harm is preventable. [5]

Alcohol Policy Solutions: Evidence sources

- “From Burden to ‘Best Buys‘: Reducing the Economic Impact of Non-Communicable Diseases in Low- and Middle-Income Countries”, World Health Organization and World Economic Forum (2011)

- The content of this report stems from the work published in two separate reports, one led by the World Economic Forum and the Harvard School of Public Health, and the other developed by the World Health Organization:

- “The Global Economic Burden of Non-communicable Diseases“, World Economic Forum and the Harvard School of Public Health (2011)

- “Scaling up action against noncommunicable diseases: How much will it cost?” World Health Organization (2011)

- “Reducing risks and preventing disease: population-wide interventions, Chapter 4″, WHO

- Elder, Randy W. et al. “The Effectiveness of Tax Policy Interventions for Reducing Excessive Alcohol Consumption and Related Harms.” American journal of preventive medicine 38.2 (2010): 217–229. PMC. Web. 17 Oct. 2016.