In the beginning of the COVID-19 lockdown in India, the country implemented an alcohol sales ban. When the lockdown measures were relaxed on May 4, India decided to lift the sales ban on alcohol. Accordingly, from May 4 onwards L6 and L8 type liquor stores were allowed to open. This is about 50% of 70,000 liquor stores in the country. The alcohol industry was overjoyed, but as Movendi International reported, the fallout from lifting the sales ban was massive.

Several harmful situations played out since the country lifted the alcohol regulations. This included, large crowds gathering to buy alcohol and ignoring health guidelines and physical distancing requirements. Then Big Alcohol used the crowds as an excuse to push for instituting online alcohol sales and on-demand delivery in the country.

The World Health Organization (WHO) has clearly advised to restrict alcohol sales during COVID-19 and lockdown for several reasons including to reduce the burden on healthcare systems, reduce severe disease progression and ensure adherence physical distancing and hygiene requirements.

Alcohol harm in India

By re-opening liquor stores during COVID-19, India opened the flood gates of alcohol harm they were barely containing even before the pandemic.

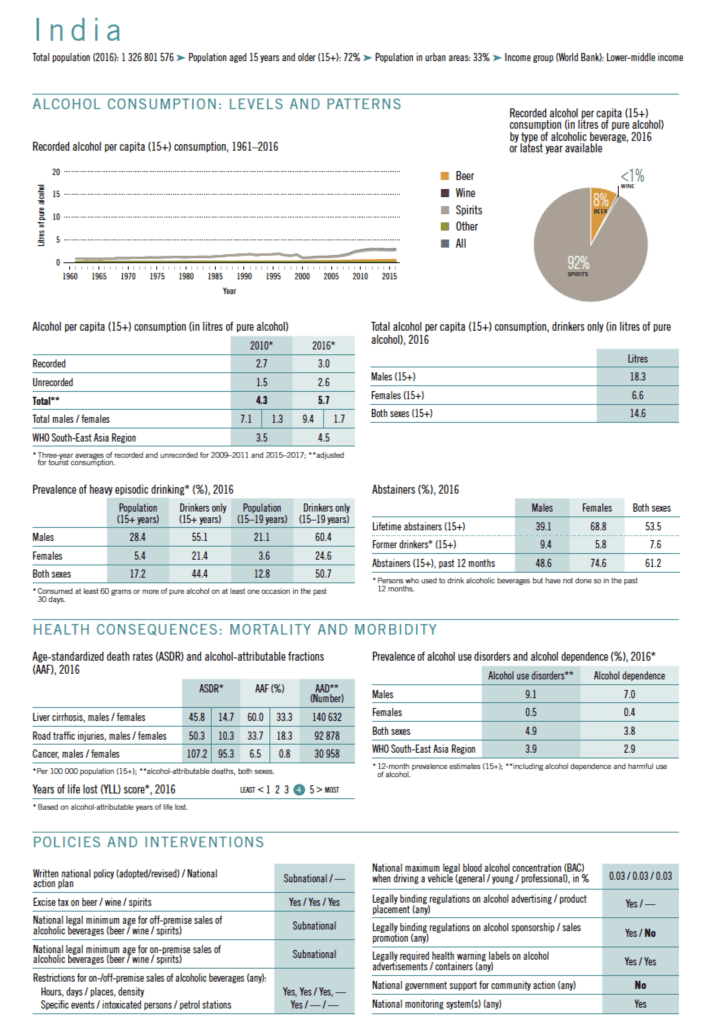

As the WHO reports, total alcohol per capita consumption in India was 5.7% in 2016, showing an increasing trend since 2010. This is also higher than the average consumption of the WHO South-East Asia Region. Binge alcohol use is a significant problem for the country with over half (55.1%) of Indian men engaging in heavy episodic alcohol use. at 60.4% for young males between 15 to 19 years the problem is even worse.

In 2017, alcohol was responsible for more than 580,000 deaths in India, according to the Global Burden of Disease Study. The three leading causes of alcohol attributable deaths in India are tuberculosis, road injuries, and self-harm. All of these conditions have an existing large burden in India and increase risk of COVID-19 infection.

India has a large burden from alcohol use disorder. According to a report by the Ministry of Social Justice and Empowerment (MoSJE) of India, every third alcohol user in India needs help for alcohol use problems and only about 1 in 38 people with alcohol dependence, report getting any treatment or help.

Alcohol taxes to the rescue or is it?

Many state governments cited revenue from alcohol sales as the reason for increasing alcohol taxation during COVID-19, and surprisingly not as a public health policy solution – but as pure revenue generation measure.

One senior excise official stated that the loss from closing liquor stores was 50 crore per day. Alcohol tax revenue goes directly to the government unlike other goods which are under the purview of the Goods and Services Tax (GST). The GST goes to the central government and not directly to the state government. Petroleum is the only other product not under GST. Since demand for petroleum was low during the lockdown the states instead opened up liquor stores to collect alcohol tax to address depleting state government revenues due to COVID-19. Essentially the states strategized to fight a health crisis with revenue from a health harmful product, which is contradictory in itself.

This strategy backfired when people started crowding liquor stores, ignoring protective health measures. States subsequently moved to increase alcohol taxes in order to curb the new problems and cover the loss of revenue during lockdown when liquor stores were closed.

A list of state governments shows the alcohol tax increases during COVID-19:

- Rajasthan: The excise duty on Indian-Made Foreign Liquor (IMFL) bottles having prices below INR 900 were increased to 35% instead of 25%. For IMFL bottles having the price of INR 900 or above, duty increased to 45% instead of 35%.

- Delhi: The Delhi government levied 70% cess on MRP as “special corona fees” on all categories of liquor.

- Karnataka: The state government increased the excise duty by 11%.

- Andhra Pradesh: The state increased tax on liquor by 75% to fund the fight against Covid-19.

- West Bengal: The state government increased the alcohol tax by 30%.

- Punjab: The Punjab Made Liquor (PML) cost INR 5 per quart or INR 3 per pint and more; the IMFL was to cost INR 10 per quart and more (and a proportionate increase in larger packaging) and INR 6 per pint; beer prices were increased by INR 5 for every 650 ml and wine by INR 10 for every 650 ml. The ready-to-drink alcohol prices have also attracted additional excise duty of INR 5 per bottle.

- Tamil Nadu: IMFL increased by 15%, the retail price of an ordinary variety of liquor (180ml) was hiked by INR 10 while the price of medium and premium varieties (180 ml) increased by INR 20.

- Kerala: The COVID cess of 35% and 10% were implemented on IMFL and beer, respectively.

- Assam and Meghalaya: both state governments increased the excise duty on liquor by 25%.

- Uttar Pradesh: The state government increased the price of liquor ranging from INR 5 to INR 400 per bottle depending upon the size and the category of the product.

Increasing alcohol taxation is a WHO recommended alcohol policy solution – when designed and implemented in an evidence-based and public health oriented approach – to prevent and reduce alcohol harm. However, the reasoning behind the alcohol tax hikes cited by Indian state governments of maximizing government revenue reveals the deeper problem of Indian states’ dependency on alcohol industry revenue.

While alcohol taxes may appear to be a significant source of revenue for the states, when the cost of alcohol harm is taken into account losses become far greater than the revenue incurred from alcohol.

Already at current levels of consumption, where 60% of adults live alcohol-free, alcohol is seriously detrimental to the Indian economy. A modelling study found that economically India loses 1.45% of its GDP due to alcohol. This is more than the country’s entire health spending which is 1.28% of its GDP. In numbers, between 2011–2050 India stands to lose US$2.2 trillion – accounting for tax revenues – due to alcohol costs.

Increasing taxes are a good source of revenue for governments and can boost development when done right. A prioritization of the public health aspect of alcohol taxes is necessary to reap the highest benefit from these type of health taxes.

When the situation started normalizing Indian states again lowered the COVID-19 alcohol tax increases. This shows the alcohol taxation method employed by Indian states is flawed and short-sited.

By prioritizing alcohol taxation for public health promotion India stands to make considerable returns on investment, both in health, social, and economic costs saved as well as in revenue generated. These resources can in turn be invested in promoting development and reducing the existing alcohol problem in the country.