Botswana success with alcohol taxation

Botswana is one of the few countries in the African region that have been championing alcohol policy to address obstacles to development and promote health for all.

For example, the country implemented an ambitious and evidence-based alcohol tax increase to help tackle the HIV/ AIDS epidemic.

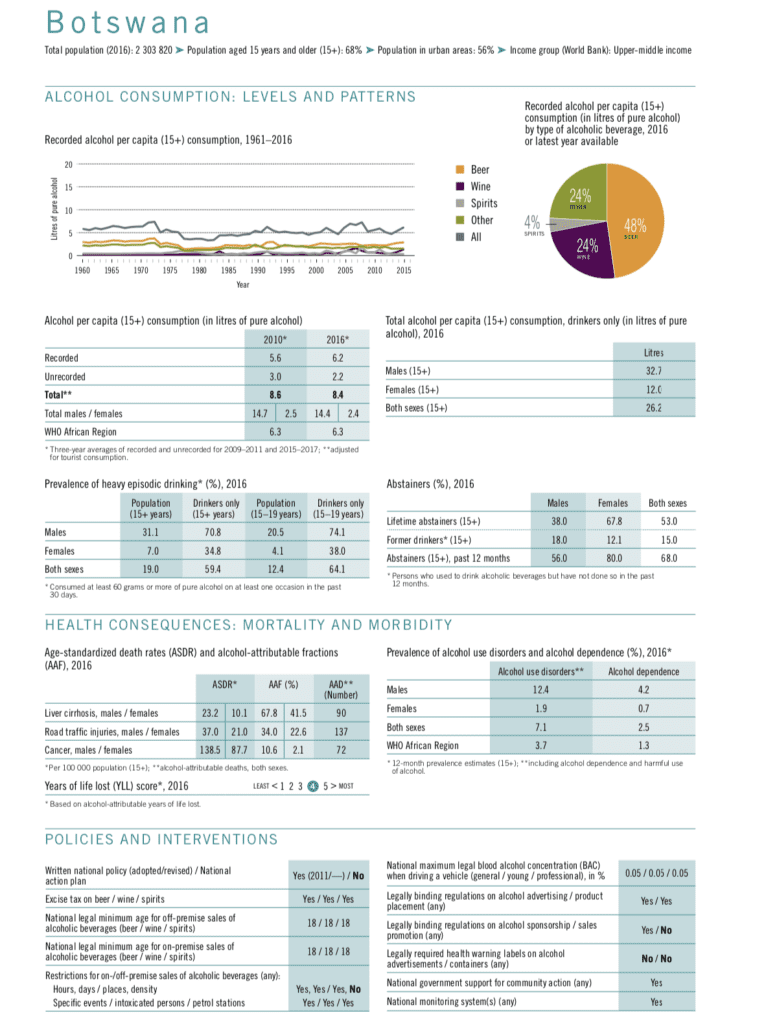

Alcohol harm in Botswana

Since its independence in 1966, Botswana has been burdened by an alcohol consumption pattern of heavy consumption among alcohol users, while most people abstained from alcohol. But alcohol users engage in heavy and high-risk alcohol use.

Male alcohol users consume more than 30 liters of pure alcohol per year, and 70% of them engage in heavy episodic alcohol consumption. And more than 74% of young male alcohol users engage in binge alcohol consumption. More than 12% of men in Botswana were living with an alcohol use disorder in 2016, according to the WHO Global Alcohol Status Report 2018.

With HIV/AIDS prevalence rates as high as 18%, the National AIDS Coordinating Agency (NACA) developed a position paper in 2002 linking alcohol with HIV infection. The following year, national frameworks identified “alcohol intoxication” as a risk factor for exposure to HIV, and alcohol continues to be an obstacle to effective HIV prevention efforts.

The journey to increase alcohol tax to help tackle HIV/ AIDS

In 2008, Botswana introduced alcohol taxation regulations. In the Control of Goods (Intoxicating Liquor Levy) Regulations the government planned a 70% alcohol levy on all domestically produced intoxicating liquors, with the aim of reducing alcohol consumption and harm specifically among young people. The revenue collected from the new levy would be invested in efforts to prevent and reduce alcohol harm.

But alcohol industry lobbying came in the way.

Ultimately, the Government introduced in 2008 a levy on alcohol products of 30% as part of a set of proactive measures to reduce alcohol use and help tackle the HIV/ AIDS epidemic in the country.

In 2010, the alcohol tax was increased to 40% under the Levy on Alcohol Beverages Fund (Amendment) Order.

In December 2013, it went up to 50% after a 5% increase, and in 2015 the Government imposed a further 10% on the levy, bringing it to 55%.

By 2013, the application of this policy measure allowed the Government to collect a cumulative total of P1.16 billion in revenues, and by 2014, the collected cumulative total increased to P1.441 billion ($100 million).

The new element brought about by the 2015 statutory instrument is that the levy targets production costs (e.g., and not just the alcohol component), including such elements as labelling and canning. The levy also came with a reduction of operating hours for liquor outlets and a concerted effort to reduce informal alcohol production.

As a consequence of the alcohol tax increases and other alcohol policy improvements, traffic crash rates fell by 12% seven months after the first alcohol excise tax and by another 12% five months after the 2010 levy increase.