Oman: Alcohol, Tobacco Tax Increase

A royal decree has been issued to tax 100% for alcohol and tobacco and several other health-harmful food and drinks. Sultan Qaboos bin Said took the decision following similar moves by Saudi Arabia, the United Arab Emirates, Bahrain and Qatar.

This excise tax is applied to goods that are deemed harmful to public health and the environment. It is a result of a 2016 tax agreement by the six-nation Gulf Co-operation Council. In addition to promoting healthy living, the tax is used as a way to boost revenue with the aim of using those funds for beneficial public health services.

The selective tax increases are set to come into force on June 15, 2019*.

As per evidence from the health data survey conducted by Oman’s Ministry of Health, one in 10 adults smoke tobacco, while close to 40% are exposed to second-hand smoke at home or at work. The tax increase could result in curbing this harm caused by tobacco as well as add at least OMR 100 million to the government’s funds every year.

Increasing taxes is one of the 3 alcohol policy best buys recommended by WHO to curb alcohol harm, included in the SAFER package by WHO.

https://movendi.ngo/the-issues/the-problem/aiap/alcohol-policy-best-buys/

Alcohol Policy in Oman

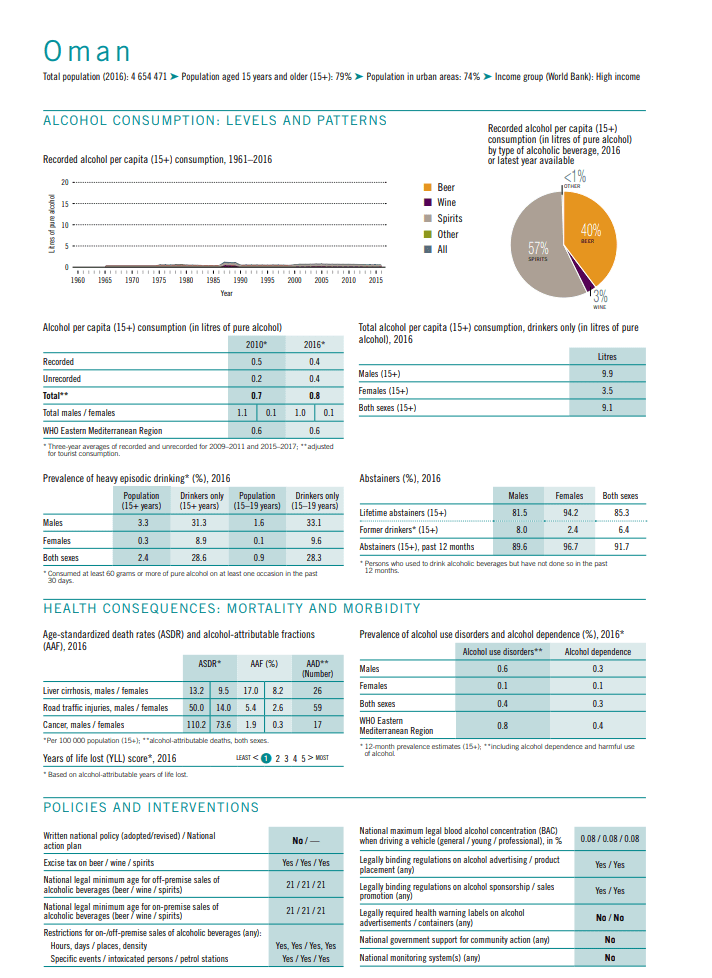

Oman is a country with a large majority of adults who live free from alcohol. The result is positive with low mortality and morbidity due to alcohol. Oman is rated as a country among the lowest number of years of life lost due to alcohol.

However, the country does not have written national policy for alcohol. Incorporation of such a policy could reduce alcohol harm even more and lower the current per capita consumption of alcohol which is still slightly higher than the average of the WHO Eastern Mediterranean region.

*The information has been updated on May 30, 2019

—

For Further Reading, more on SAFER:

https://movendi.ngo/press-release/who-launches-safer-alcohol-control-initiative-to-curb-alcohol-harm/