UK: Rising Government Alcohol Tax Receipt

The tax receipt received by HMRC from alcohol, tobacco and gambling taxation rose by 25%. However, this is a slower pace of tax receipt rise compared to all other forms of taxation between March 31, 2009 and February 1, 2019, which was at 51%.

Both smoking tobacco and alcohol use has seen a decline in the UK over the years. Cigarette smoking has reduced to 15.1% of the population from its peak of 46% in 1974. There is also a steady decrease in alcohol use among millenials. A study by UCL revealed 29% of 16 to 24 year olds were living alcohol free in 2015 compared to 18% a decade before in 2005.

The trend for healthier behavior by people in Britain has led to a slowdown in the amount of alcohol taxes collected by the HMRC, her Majesty’s Revenue and Customs (a non-ministerial department of the UK Government responsible for the collection of taxes), over the past ten years.

The tax receipt from duties on alcohol, cigarettes and gambling activities has not kept up with the overall income from tax collection. The amount received by HMRC from all forms of taxation between March 31 2009 and 1 February 2019 increased by 51%. But tax receipts from alcohol, tobacco and gambling increased “only” by 25% in the same period.

The HMRC is adapting to these changes in consumer patterns, as shown through the tax levied on soft drinks. Furthermore, tax authorities will be bringing in a duty category for heated tobacco products approved through the 2018 budget, to come into force on July 1, 2019.

Alcohol Policy in UK

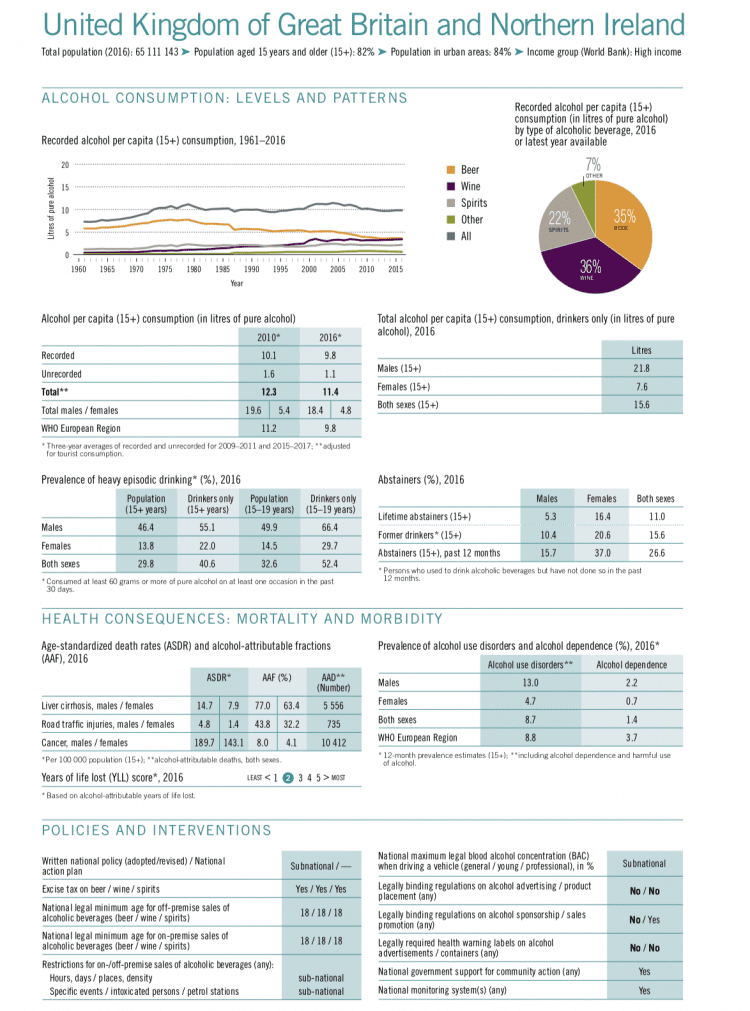

While alcohol use by millennials may be decreasing in the UK, the per capita consumption is still higher than the average for the WHO European region and the majority of the population (73.4%) are still alcohol users. More troubling is that more than half (52.4%) of the young people between 15 to 19 years who use alcohol binge on it. This shows while for millenials the trend of consumption is reducing the ones who use alcohol have troubling patterns of consumption.

Strong alcohol policy control with increased efficacy on implementation should be continued in the UK in curbing the alcohol harm further.

Alcohol taxation, a WHO recommended alcohol control measure, if employed in an evidence-based manner, is found to reap positive effects for a number of Sustainable Development Goals according to a report by IOGT International and EAAPA. The report finds that 10 out of the 17 new Sustainable Development Goals – such as eradication of poverty and hunger, gender equality, good health and well being, quality education, or economic growth – are positively impacted by alcohol taxation measures.