UK: Raising Alcohol Taxes to Fund Health Services

A new research from the Institute of Alcohol Studies has found raising alcohol taxes in the United Kingdom (UK) can fund health services benefiting the less well off.

The research provides proof against the alcohol industry myth that alcohol taxes are regressive. The research was based on analysis of official government surveys of living costs. The amount of alcohol duty that different households paid as a share of their income and total spending was calculated. These figures were compared between better and worse-off families. In almost all cases it was found there is little difference in the proportion of income or expenditure spent on alcohol duty by more and less affluent households.

In fact, it was found if the increased tax revenue was invested in NHS, the less well-off would benefit the most. These households making up 60% of the population, would lose £18 a year from increased alcohol taxes but gain £34 in NHS spending,

The cuts to alcohol duty [the chancellor] has inherited will cost the public purse £1.2bn this year – money that would do much more to help the economically disadvantaged by being invested in public services.

Gradually raising alcohol duty above inflation over the next 12 years could save 5,000 lives, with a disproportionate share coming from the most deprived households,” said Aveek Bhattacharya, a senior policy analyst at IAS, as per The Guardian.

Who Pays the Tab? The Distributional Effects of UK Alcohol Taxes

Research has also shown that people in lower socio-economic communities suffer the most from alcohol use and related harms, despite consuming less alcohol on average. Therefore, the increased taxes would reduce consumption in these groups and save more lives.

Calls to increase alcohol taxes in the upcoming budget

These findings come as the government weighs whether to increase alcohol taxes or not in the upcoming Budget.

Alcohol taxation in the UK has failed to keep up with inflation in six of the last seven Budgets. As a result, the beer duty is 18% lower in real terms today than in 2012, while the spirits and cider duty have been cut by 10%.

As Movendi International previously reported, alcohol tax cuts in the UK led to nearly 2000 more deaths and 100,000 additional crimes in England.

Alcohol harm in the UK

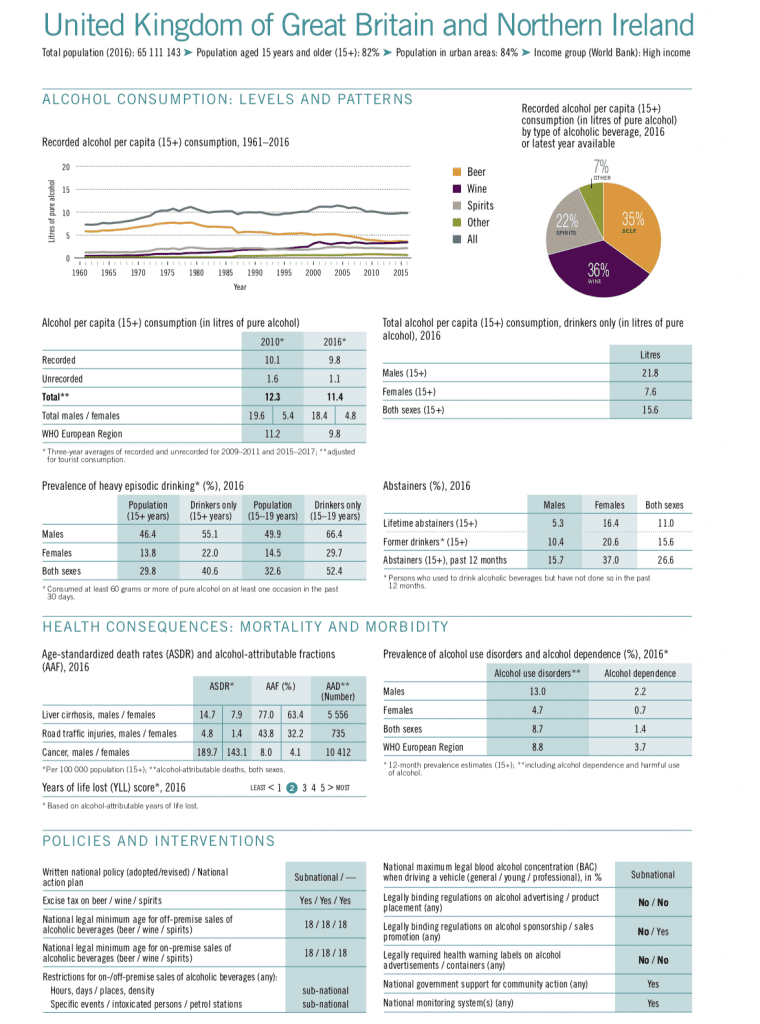

As the World Health Organization reports, total alcohol consumption in the UK is 11.4 litres which is above the average of the WHO European region. Binge alcohol use is a serious problem in the country with over half (52.4%) of youth who use alcohol engaging in this harmful behavior.

The findings of the new IAS study have sparked calls for the Treasury to increase alcohol taxes in next month’s budget to better prevent and reduce alcohol harm and especially binge alcohol use.

The Alcohol Health Alliance UK, a coalition of more than 50 organisations working to reduce the harm caused by alcohol, is calling for a 2% rise above inflation on alcohol duty.

This research debunks the myth that alcohol duty increases disproportionately burden the poor.

In fact, it shows that the most vulnerable have the most to gain if the revenue generated is invested in our overstretched NHS and alcohol services,” said Professor Sir Ian Gilmore, Chair of The Alcohol Health Alliance UK, as per, The Guardian.

—

Sources:

The Guardian: “Higher alcohol taxes to fund NHS would benefit poor – study“

IAS: “Alcohol duty doesn’t penalise the poor, new research shows“

The Times: “Alcohol duty is a life-saving measure, not a tax on the poor“