According to the report “Zenith Business Intelligence – Alcohol: Beer + Spirits”, advertising spending on alcohol in twelve key markets will grow by 5.3% this year. This means bigger growth in alcohol ads spending than the entire advertising market (4.9%).

During the pandemic, alcohol sales collapsed from US$ 761bn in 2019 to US$ 659bn in 2020, falling by 13.4%. This is a decline that was three times bigger than the drop in overall consumer spending.

The volume of beer and liquor consumed shrank as consumers began to physically distance and stay at home.

Alcohol prices fell as purchases shifted from on-trade (bars, restaurants and so) to off-trade (supermarkets and alcohol retailers), where profit margins are much lower. This shift was part voluntary, and part imposed by governments that decided to address the lethal interaction between alcohol and the pandemic.

As the alcohol industry attempts to recover from the steep 11.6% drop in advertising in 2020 during the height of the coronavirus pandemic, Big Alcohol is investing in an advertising onslaught. In the following years, 2022 and 2023, alcohol advertising spending will then grow roughly in line with the overall market, namely by four to five percent annually, according to Persönlich.com.

The twelve key markets are Australia, Canada, China, France, Germany, India, Italy, Russia, Spain, Switzerland, the UK and the US. Together, they account for 73% of total global alcohol advertising spending.

In this country we see a similar picture,” Maria Brinkmann, Managing Director of Zenith in Switzerland, is quoted in the press release.

In 2021, alcohol producers will increase their advertising investments by eight percent to 42 million francs,” Brinkmann continued, as per Persönlich.com.

In the following years they will increase their budgets by a further 7.1 percent (2022) and 1.5 percent (2023), so that the level of 2019 will be exceeded.”

Maria Brinkmann, Managing Director, Zenith in Switzerland

Pandemic affects alcohol advertising spending

As Zenith reports, alcohol advertising shrank nearly twice as fast as the overall advertising market in 2020. There are three main reasons why Big Alcohol’s advertising spending fell significantly:

- The finances of major alcohol industry giants came under pressure by a decrease in consumption volume,

- The average price per alcoholic drink fell, and

- Profit margins decreased substantially.

With bars, pubs and restaurants closed, many consumers reduced their alcohol use. And most importantly consumers bought alcohol in the off-trade, where alcohol costs much less, compared to the prices in bars, restaurants and pubs (on-trade), or on airports (off-trade). Zenith reports that alcohol producers dramatically reduced their marketing expenses to protect their bottom lines. Their combined advertising spending fell from US$ 7.6bn in 2019 to US$6.7bn in 2020, a reduction of almost $1 billion.

Big Alcohol readies alcohol advertising onslaught

The new Zenith report shows that alcohol industry giants are now readying massive spending on alcohol marketing in 2021. Alcohol advertising spending will still be 8% below the 2019 level by the end of 2021, at US$ 7.0bn. But over the next few years the alcohol industry’s expenses for alcohol advertising will reach the pre- pandemic peak. It is projected that in 2023 Big Alcohol will spend will US$ 7.7bn – slightly bigger than before COVID-19.

The alcohol industry has traditionally relied heavily on television and out-of-home advertising, spending twice as much on television as the average brand and nearly four times as much on out-of-home advertising.

But this tactic has become less effective as audiences have shifted more to digital media, particularly the young audiences most likely to visit a new bar and try out a new alcoholic drink.

Big Alcohol has mitigated this partially by focusing their spending on advertising around sporting events that attract young and well-off audiences, but here too viewing is shifting online.

The Zenith reports therefore predicts that the alcohol industry will reduce their expenditure on television advertising by 2.4% a year until 2023, compared to the 2019 baseline, as audiences continue to shrink. Out-of-home advertising, by contrast, will grow by 1.1% a year.

Television’s declining reach increases the importance of out-of-home’s ubiquity even more – even taking into account the pandemic-induced reduction in foot and road traffic.

Lasting changes to alcohol advertising landscape

Alcohol brands have historically been slow to commit to digital advertising, devoting less than half as much of their budgets to it than the average brand in 2020, according to the Zenith report. But that is changing rapidly – for two reasons:

- The underlying shift in media consumption to digital channels, and

- The sudden shifts in alcohol consumption caused by the pandemic, which are predicted to persist even after COVID-19.

The closure of the on-trade for alcohol sales in many key markets during the pandemic meant that the alcohol industry needed to find new tactics to market alcohol. Online sales and on-demand delivery were and are the answer.

Breweries, distilleries, bars, and restaurants shifted rapidly to direct-to-consumer shipping and takeaway services even for alcohol. This shift is facilitated by the rise of and investment in e-commerce and by an onslaught of alcohol advertising on digital media, particularly social media.

In many markets, for example in US states, Indian states, and Europe, the alcohol industry lobbied governments to deregulate alcohol availability rules to allow alcohol delivery – making alcohol even more ubiquitous.

Rapidly expanding alcohol online advertising

The need to drive awareness and traffic to e-commerce channels meant the alcohol industry had to expand their online presence rapidly in 2020. This meant spending more on digital advertising.

Online alcohol advertising spending rose from 21% of alcohol budgets in 2019 to 24% in 2020, but also developing owned assets such as brand websites and “educational” content, such as videos teaching consumers to mix their own cocktails at home.

Consumers are now much more aware of the available options for buying alcohol online, and alcohol brands now have distribution networks in place to supply them.

The Zenith reports predicts the alcohol industry will further expand their digital advertising to drive alcohol e-commerce, even after pubs and restaurants are fully open, fuelling 9.2% annual growth in digital advertising spending between 2019 and 2023, when digital advertising will account for 30% of alcohol advertising budgets.

Zenith forecasts Spain, the UK, Germany and France to be the stand-out growth markets, with annual growth rates between 2020 and 2023 of 28%, 21%, 10% and 8% respectively. That’s because these markets saw the steepest drops in alcohol advertising spending when lockdowns were imposed. During 2020, alcohol advertising fell by 52% in Spain, 48% in the UK, 22% in Germany and 23% in France. Their rapid recovery will return them in 2023 to roughly where they were in 2019.

Alcohol advertising to drive alcohol sales

As alcohol advertising spending accelerates, alcohol sales will rise, too. According to the Zenith report, alcohol sales are expected to grow 13.5% year-on-year in 2021, nearly double the growth in consumer spending overall.

Alcohol sales in 2021 are forecast at US$ 748bn. That is still 1.7% below the sales level of 2019 but indicates the power of increased advertising spending to accelerate alcohol sales.

The Zenith report predicts annual growth in 2022 and 2023 of around 7%. This means that the volume of alcohol retail will exceed pre-pandemic levels.

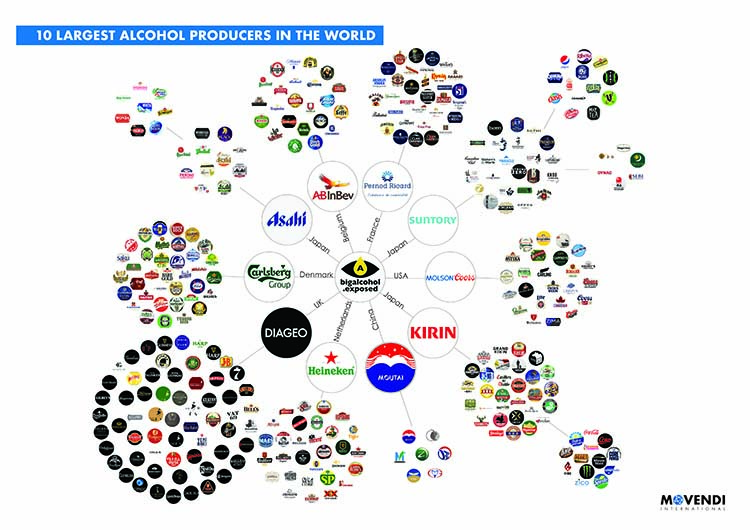

Big Alcohol, market concentration and advertising onslaught

The ownership of alcohol brands is highly concentrated among multinational alcohol giants that have built up their market position through mergers and acquisitions.

Just 15 companies account for half the entire value of global alcohol sales, and one – Anheuser-Busch InBev – accounts for 15%.

Anheuser-Busch InBev was formed through a series of mergers and acquisitions, the latest of which was the 2016 purchase of SABMiller, which had been the fourth-largest alcohol producer at the time, with US$ 50bn in annual sales, according to Zenith. SABMiller had to unload various assets to satisfy competition authorities before the mega-merger was permitted to proceed, but the deal boosted Anheuser- Busch InBev’s sales by at least US$ 30bn, increased its market share from 12% to 15%, and helped it increase the retail value of its alcohol sales by more than any other company between 2014 and 2019.

Most of the other companies with the largest dollar increase in sales were also international conglomerates. But one company stands out among the top eight: Kweichow Moutai, a Chinese alcohol giant specialising in baijiu, a Chinese liquor normally made from sorghum.

Zenith reports that Kweichow Moutai trebled retail sales between 2014 and 2019 by consolidating its grip on the Chinese market, and is now the tenth-largest alcohol producer in the world, up from 24th in 2014. Baijiu is said to be the most consumed liquor in the world due to its dominance in China, but it is barely known elsewhere.

Industry analysts claim that introducing baijiu brands to new markets could be a fertile source of growth for Big Alcohol corporations over the next few years – indicating once again the importance of alcohol advertising for the profits of the alcohol industry.

Even amidst the coronavirus crisis the alcohol market is experiencing continuous changes, such as increasing market concentration driven by already gigantic multinational alcohol corporations and significant market changes with heavy investments in and lobbying for alcohol e-commerce and on-demand alcohol delivery.

A 2020 study by Jernigan and colleagues analysed the global alcohol marketing landscape. The study found that alcohol marketing is widespread globally and a structural element of the alcohol industry. The oligopoly structure of Big Alcohol helps to generate high profits per dollar invested relative to other industries. Advertising expenditures are high and advertising is widespread. Stakeholder marketing and CSR campaigns assist in maintaining a policy environment conducive to extensive alcohol marketing activity.

A 2018 study by Jernigan and colleagues examined the effects of alcohol industry market concentration on alcohol advertising.

The growth of global alcohol corporations and concentration of the global alcohol market in the hands of a small number of companies is a public health concern because it is associated with increased population-level exposure to alcohol marketing. Alcohol oligopolies in many countries permit oligopoly profit taking, which in turn facilitates higher marketing spending and acts as a barrier to entry, thereby preserving the oligopolies.

Increased marketing activity, in the form of both product development and promotion, is used to segment and target groups that have historically not consumed much alcohol. In many low- and middle-income countries this includes women.

- A case study of alcohol marketing in Estonia found intentional industry efforts to increase alcohol use among women.

- Increased marketing of alcopops, flavored vodkas, and other products thought to be attractive to women has coincided in the United States with the narrowing of the gap between men’s and women’s alcohol use.

- In India, Diageo, a London-based global alcohol giant, has explicitly targeted marketing toward women.

These examples point to the possible impact of increased resources for marketing on alcohol use in populations other than youth – and the harm these tactics cause.