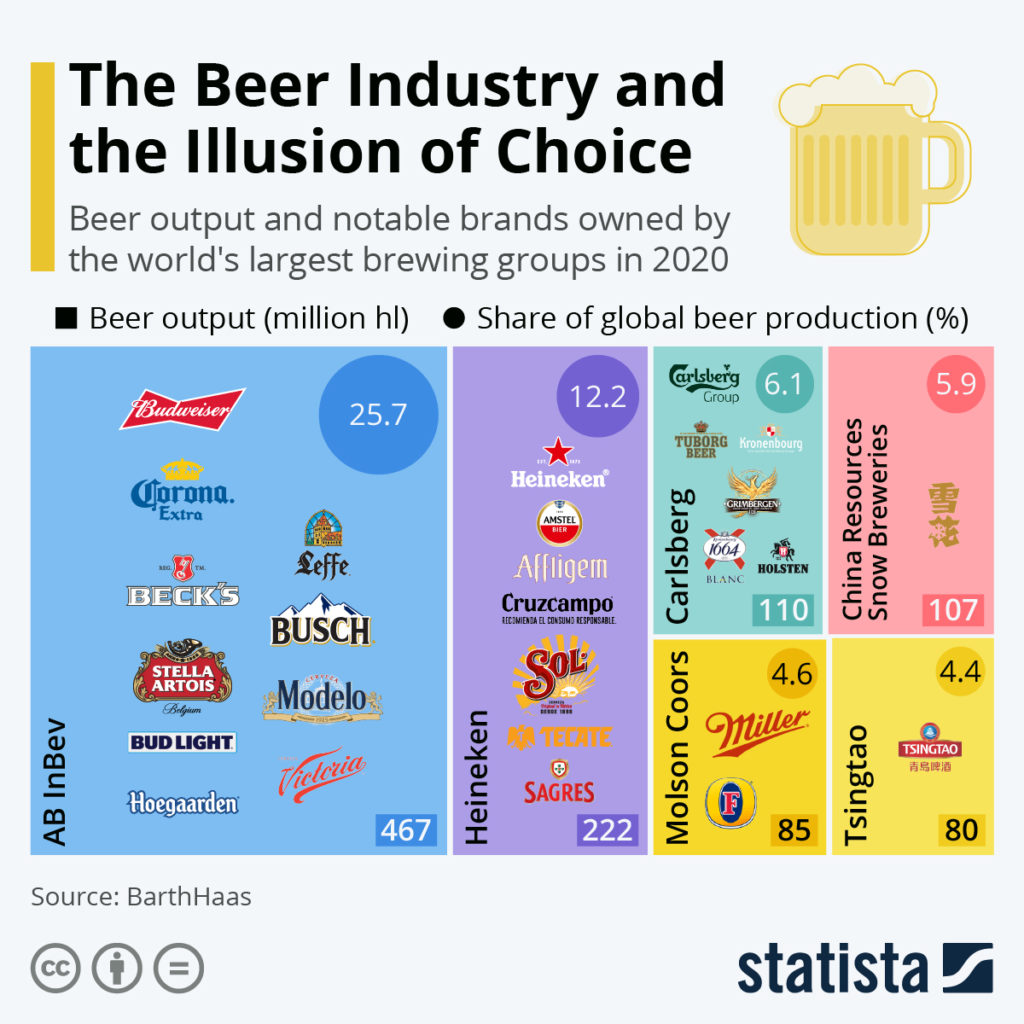

Statista, a leading provider of market and consumer data, illustrates data from BarthHaas showing that over half the beer made in the world is controlled by just six alcohol industry giants.

At the top, controlling over a quarter (25.7%) of the world’s beer market is AB InBev. In second place is Heineken (12.2%). Third comes Carlsberg (6.1%). Then there is Molson Coors (4.6%), China Resources Snow Breweries (5.9%) and Tsingtao (4.4%) in that order.

Statista’s infographic illustrates the extreme market concentration of the beer industry.

Why is market concentration bad?

Movendi International has previously covered the issue of market concentration, for example exposing how even amidst the coronavirus crisis the alcohol market is changing, such as increasing market concentration driven by already gigantic multinational alcohol corporations.

Market concentration gives the control of a product to a few, powerful, often transnational companies.

What this does is concentrate all profits among a few alcohol industry giants. Thus, market concentration fuels the concentration of financial resources and with it advertising spending power, political lobbying power and most importantly the ability to sell alcohol cheaper than the competition.

Thereby, these few powerful companies can dominate the market, rendering small alcohol producers unable to compete and eventually unable to survive. Further these transnational corporations become a threat to democracy itself by buying and influencing national policy making in their favor.

Big Beer and Big Alcohol market concentration is becoming an increasing threat to competition as demonstrated by recent investigations into the matter in the United Kingdom (UK) and the United States (U.S.).

- Last year a £780m merger between Marston’s and Carlsberg’s UK brewing operations created the Carlsberg Marston’s Brewing Company. The UK competition regulator, the Competition and Markets Authority (CMA), launched an investigation into the merger.

- This year U.S. President Biden issued a broad executive order titled “Promoting Competition in the American Economy.” Big Alcohol was specifically targeted by the order. Investigations by the Treasury Department and the Alcohol and Tobacco Tax and Trade Bureau (TTB) are currently underway.

Big Alcohol domination

A recent study by David Jernigan and Craig S Ross revealed the public health problems associated with the size, structure, and practices of the transnational alcohol industry.

The oligopoly structure of the producing industry helps to generate high profits per dollar invested relative to other industries. Advertising expenditures are high and advertising is widespread. Stakeholder marketing and CSR campaigns assist in maintaining a policy environment conducive to extensive alcohol marketing activity.”

Jernigan D, Ross CS. The Alcohol Marketing Landscape: Alcohol Industry Size, Structure, Strategies, and Public Health Responses. J Stud Alcohol Drugs Suppl. 2020 Mar;Sup 19(Suppl 19):13-25. doi: 10.15288/jsads.2020.s19.13. PMID: 32079559; PMCID: PMC7064002.

Alcohol marketing is a structural element of the alcoholic beverage industry that shapes alcohol availability and norms, drives consumption and profits, but also impacts the policy environment to advance the interests of Big Alcohol.

Worldwide, alcohol sales totaled more than $1.5 trillion in 2017. Control of alcoholic beverage production and marketing is concentrated globally in the hands of a small number of firms.

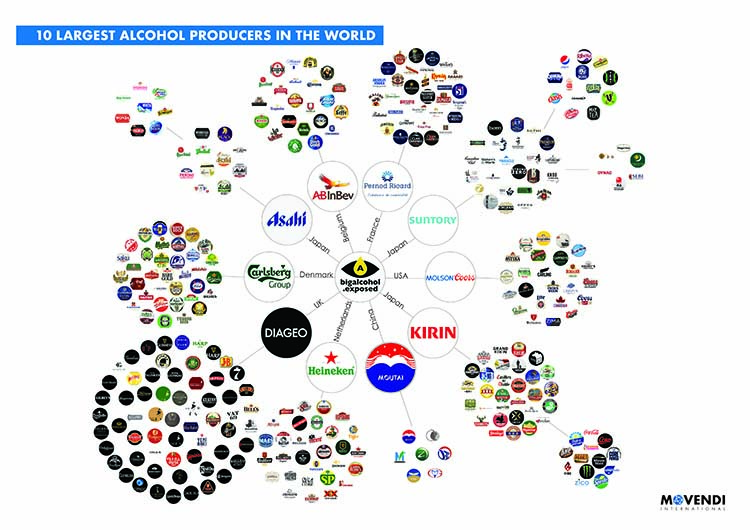

A Movendi International illustration shows the oligopoly structure of the alcohol industry. The Big Alcohol oligopoly helps to generate high profits per dollar invested relative to other industries, which in turn fund marketing expenditures that function as barriers to entry by other firms.

Jernigan and Ross find that advertising expenditures were high and advertising was widespread. Stakeholder marketing and corporate social responsibility campaigns serve to maintain a permissive policy environment conducive to Big Alcohol’s profit interests, such as extensive alcohol marketing activity. For example, the most common alcohol policy response has been alcohol industry self-regulation; statutory public health responses have made little progress in recent years and have lagged behind industry innovation in digital and social marketing.