In many countries, current alcohol tax rates are far below what is feasible in terms of revenue potential, according to a World Bank study. Also in Lesotho, a small country of 2 million inhabitants that is completely surrounded by South Africa, alcohol tax revenue falls short of the costs to society caused by the products and practices of the alcohol industry.

To remedy this situation and begin to effectively reduce and prevent alcohol harm, the Government of Lesotho requested support from a World Bank to develop evidence-based, public health-oriented alcohol and tobacco taxation levels in 2017.

Since the World Bank study into evidence-based alcohol taxes in Lesotho, a tax increase has been discussed since 2019, when former Finance Minister and current Prime Minister Moeketsi Majoro announced that the government intended to increase the levies during the 2019/2020 financial year. This never came to pass.

But in February of this year, Finance Minister Thabo Sophonea again proposed to finally implement the alcohol tax increase. The idea was to raise alcohol and tobacco levies by 15% and 30% respectively. He said the government hoped to realise an additional M286, 6 million in revenue annually from the levies, according to Lesotho Times reporting.

Nevertheless, Lesotho Parliament has not approved the tax increase yet due to alcohol and tobacco industry interference that tries to delay and derail the approach to alcohol taxation as development priority.

However, in a seismic shift, the Parliamentary Portfolio Committee on the economic and development cluster recently recommended that the Alcohol and Tobacco Levy Bill be adopted with some amendments.

Why alcohol taxation matters

The WHO Global Alcohol Strategy recommends that Member States establish a system for specific domestic taxation that takes into account the alcohol content of the beverage, accompanied by an effective enforcement system. It also encourages countries to review prices regularly in relation to inflation and income levels; ban or restrict sales below cost and other price promotions; and establish minimum prices for alcohol where applicable.

None of these alcohol policy solutions to reduce alcohol affordability and related harm have been implemented in Lesotho, since the adoption of the WHO Global Alcohol Strategy in 2010.

Alcohol taxation is the single most cost-effective alcohol policy solution. It helps reduce overall alcohol use and related harm, as well as heavy and high-risk alcohol use. For instance, young people and adult alcohol users engaging in heavy episodic alcohol use are exposed to serious health and social risks, as reflected in statistics on highway safety, injuries, violent crime, or domestic violence, according to the World Bank.

Secondly, there is good evidence that alcohol use and related harm occurs in a social context, and that alcohol users across the spectrum of different amounts and patterns of alcohol intake influence one another.

This means that reducing alcohol affordability, through ensuring price increases by raising taxes, is effective in reducing the overall level of alcohol consumed in a society, including the consumption of the heaviest alcohol users. Alcohol taxation is proven to reduce heavy and high-risk alcohol use. That’s why it is so effective in preventing and reducing alcohol harm.

The accumulated research findings indicate that population-based policy options – such as the use of alcohol excise taxation to reduce alcohol affordability, reducing alcohol availability and implementing bans on alcohol advertising – are the “best buys”.

Pro-poor, pro-productivity and pro-sustainable development

International evidence shows that the sum of benefits fully offsets the additional cost of alcohol taxes on alcohol consumers.

The World Bank study illustrates that tobacco and alcohol taxes benefit especially lower income households. With increasing alcohol and tobacco taxes and declining alcohol use, better health ensues, less money is needed for smoking-and alcohol related healthcare services and injuries, and labor productivity improves due to reduced sickness and absenteeism.

The World Bank experts find:

This situation as observed in different countries across the world counters the traditional finding that tobacco and alcohol tax increases, by themselves, are regressive – leading to the largest percentage reductions in pre-tax incomes for the lowest-income households.

But the picture changes markedly when the benefits of reduced mortality and morbidity are included. These benefits are strongly progressive, for two reasons.”

Lesotho: Estimated Revenue Impact of Proposed Tobacco and Alcohol Levy, Final Report, World Bank Group Team, January 25, 2017, Executive Summary

Alcohol and tobacco taxation are progressive in two aspects.

- Alcohol harm, for instance, disproportionately affects households and communities with lower socio-economic status. That is why these vulnerable people and communities benefit enormously from declining alcohol use and related harm.

- Improvements of health, employment, and social outcomes are relatively more important to lower-income households because they are more vulnerable to the consequences of alcohol harm due to their lack of resources.

Triple win potential of alcohol taxes

Public health-oriented taxes on tobacco and alcohol are non-distortionary taxes. They have a triple benefit:

- Raise fiscal revenue,

- Reduce and prevent harm due to tobacco and alcohol, and

- Promote health and development by easing the health system burden and facilitating investments into healthcare and health promotion.

Besides revenue raising objectives, the rationale for excise taxes on alcohol is to reflect their harmful external costs. The benefits of higher alcohol taxes are obvious for individuals and entire communities. The benefits result from:

- Reduced alcohol use,

- Preventing the initiation of alcohol use among children and youth, as well as

- Reducing the negative health, social, and economic consequences caused by the products and practices of the alcohol industry.

Nevertheless, in many countries, including in Lesotho, current alcohol tax rates are evidently far below what is feasible in terms of revenue potential and what is needed to achieve development targets, according to the World Bank.

A brand-new study published in The Lancet is providing ground-breaking analysis: the most effective alcohol policy solutions have declined between 2015 and 2020, while it improved for tobacco policies. In fact, the alcohol policy best buys are “systematically neglected at the global level.”

- Most policies targeting alcohol harm have not been fully implemented in 2020. Often, they are not even partially implemented.

- Alcohol advertising is among the best buy measures that are the least widely implemented.

- And in many regions alcohol is becoming more affordable, due to a failure to implement public health-oriented alcohol excise taxes.

Alcohol harm and the absence of alcohol policy solutions in Lesotho

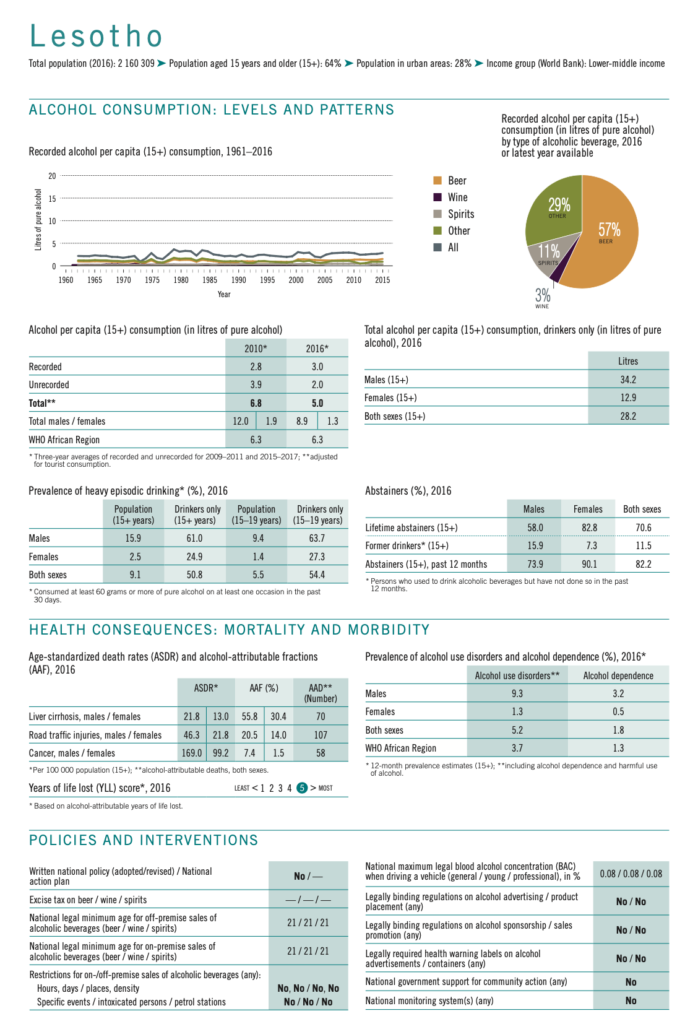

Lesotho, with 20% of daily adult smokers, has the second highest tobacco consumption rate in Africa; similar high rates in alcohol consumption are prevalent in the country.

According the World Health Organization country profile, Lesotho is among the countries with the highest burden of years of life lost due to alcohol in the world. While more than 80% of the adult population lives free from alcohol use, those who consume alcohol do so in heavy amounts and high-risk patterns.

The absence of modern alcohol policy solutions leads a heavy alcohol burden.

- Among male alcohol users, the per capita consumption is more than 34 liters of pure alcohol per year.

- More than 9% of all men in Lesotho have an alcohol use disorder – more than double the regional average in Africa.

- More than 50% of young alcohol users engage in binge alcohol use. And more than 60% of adult male alcohol users engage in binge alcohol consumption.

But the country has no alcohol policy protections in place for its people.

- There is no national alcohol policy.

- There are no common sense alcohol availability limits.

- And there are no protections against alcohol marketing.

That means people and communities are unprotected from the products and practices of the alcohol industry and it is causing tremendous harm.

Botswana success with alcohol taxation

A country close by in the region shows the potential of alcohol taxation.

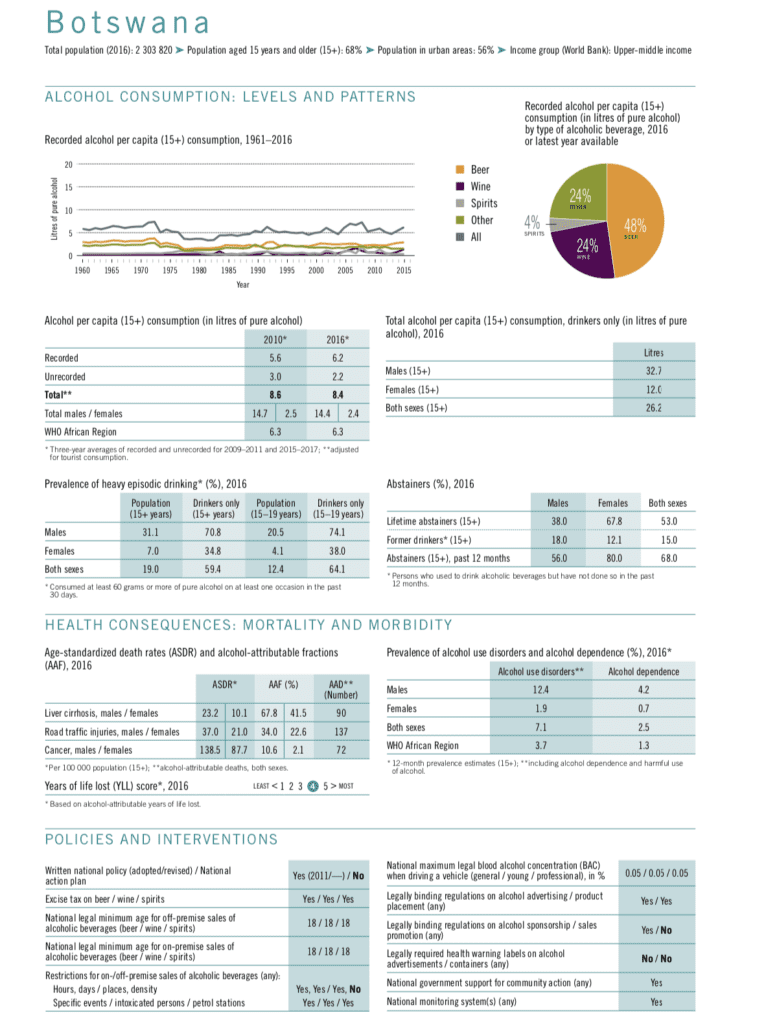

Since its independence in 1966, Botswana has been burdened by an alcohol consumption pattern of heavy consumption among alcohol users, while most people abstained from alcohol. But alcohol users engage in heavy and high-risk alcohol use.

Male alcohol users consume more than 30 liters of pure alcohol per year, and 70% of them engage in heavy episodic alcohol consumption. And more than 74% of young male alcohol users engage in binge alcohol consumption. More than 12% of men in Botswana were living with an alcohol use disorder in 2016, according to the WHO Global Alcohol Status Report 2018.

With HIV/AIDS prevalence rates as high as 18%, the National AIDS Coordinating Agency (NACA) developed a position paper in 2002 linking alcohol with HIV infection. The following year, national frameworks identified alcohol intoxication as a risk factor for exposure to HIV, and alcohol continues to be an obstacle to effective HIV prevention efforts.

In 2008, Botswana introduced alcohol taxation regulations. In the Control of Goods (Intoxicating Liquor Levy) Regulations the government planned a 70% alcohol levy on all domestically produced intoxicating liquors, with the aim of reducing alcohol consumption and harm specifically among young people. The revenue collected from the new levy would be invested in efforts to prevent and reduce alcohol harm.

But alcohol industry lobbying came in the way.

Ultimately, the Government introduced in 2008 a levy on alcohol products of 30% as part of a set of proactive measures to reduce alcohol use and help tackle the HIV/ AIDS epidemic in the country.

In 2010, the alcohol tax was increased to 40% under the Levy on Alcohol Beverages Fund (Amendment) Order. In December 2013, it went up to 50% after a 5% increase, and in 2015 the Government imposed a further 10% on the levy, bringing it to 55%.

By 2013, the application of this policy measure allowed the Government to collect a cumulative total of P1.16 billion in revenues, and by 2014, the collected cumulative total increased to P1.441 billion.

The new element brought about by the 2015 statutory instrument is that the levy targets production costs (e.g., and not just the alcohol component), including such elements such as labelling and canning. The levy also came with a reduction of operating hours for liquor outlets and a concerted effort to reduce informal alcohol production.

As a consequence of the alcohol tax increases and other alcohol policy improvements, traffic crash rates fell by 12% seven months after the first alcohol excise tax and by another 12% five months after the 2010 levy increase.

Modelling the potential benefits of alcohol taxation in Lesotho

The World Bank team worked in close coordination with Ministry of Finance (MoF) and Lesotho Revenue Authority (LRA) teams to collect data and conduct a simulation exercise. The purpose was to estimate the likely fiscal revenue impact of introducing a levy on top of the SACU-mandated excise taxes on cigarettes and alcohol products.

The objective of this proposed policy change was to contribute to mobilization of additional domestic resources to expand the fiscal space to fund priority investments and programs over 2017-2018 and to improve the health condition of the population.

The expert teams conducted simulations based on the collected data to determine the reduction in consumption of alcohol and tobacco (the public health impact) and the additional tax revenue that could be collected by introducing a levy on tobacco and alcohol products (the fiscal impact) under three policy option scenarios over 2017-2018.

Policy option scenario 1

On the basis of an initial suggestion by the MoF team, the impact of the introduction of a 4% levy on tobacco and alcohol products, on top of the SACU-mandated excise tax, was estimated for the period 2017-2018. The estimated additional fiscal revenue generated under this scenario would amount close to 30 million Rand (US$ 2.1 million) or about an additional 0.08% of GDP (2017-2018 projections).

Policy option scenario 2

Taking into account the successful experience of Botswana with the application of a levy on tobacco and alcohol products on top of the SACU excise tax, the fiscal revenue impact of a 15% levy (half of Botswana levy rate) was simulated. The expected additional fiscal revenue to be generate under this scenario amounts to about 105 million Rand (US$7.4 million) or about 0.3% of GDP (2017-2018 projections).

Policy option scenario 3

Again, taking into account the successful experience of Botswana with the application of a levy on tobacco and alcohol products on top of the SACU excise tax, the fiscal revenue impact of a 30% levy (similar rate as in Botswana) was simulated. The expected additional fiscal revenue to be generated amounts to close to 200 million Rand (US$14.2 million) or close to 0.6% of GDP (2017- 2018 projections).

The best way forward

Given Botswana’s experience, the World Bank team considered the policy options under scenarios two and three to be feasible, and recommended one of those to be adopted by the MoF and LRA to mobilize additional domestic resources to expand the fiscal space and to benefit the entire population by helping to reduce the risk of tobacco and alcohol-related illnesses and injuries.

Based on the results of these simulations and considering the priority of mobilizing additional fiscal revenue in the short-term to expand the fiscal space to fund priority investments and programs in Lesotho, it is recommended that the Government of Lesotho considers introducing a 30% levy on top of the excise tax for tobacco and alcohol products as discussed under Scenario 3.

On March 2 last year, the minister of finance tabled the Tobacco and Alcoholic Products Levy Bill, 2020 in parliament. The Bill was referred to the parliamentary committee for consideration in terms of Standing Order No. 51 (5). The committee thereby invited the MoF to a briefing session in accordance with the Standing Order No. 54 (2).

In the briefing the MoF emphasized that the objective of the Bill is to introduce a levy on tobacco and alcoholic products to reducing the consumption of these harmful products. Harm pr caused by the products and practices of the alcohol and tobacco industries fuels several socio-economic hazards that adversely affect the health and development of the nation.

“It will also normalise the price differentials that exist between Lesotho’s towns and those of neighbouring South Africa, thereby putting Lesotho’s economy on an equal competitive footing,” said representatives of the Ministry of Finance, as per The Reporter.

The Bill empowers a vendor who sells these products to charge the levy at the rate of 30% for tobacco products and 15% for alcoholic products, collect and remit the levy to the LRA.”

Ministry of Finance at Parliamentary Briefing

Big Alcohol blocks progress on alcohol taxation

In their lobbying effort to further delay and derail the evidence-based alcohol tax increase, the alcohol industry in Lesotho is teaming up with Big Tobacco.

The Lesotho Liquor and Restaurant Owners’ Association (LLROA), British American Tobacco (BAT), Maluti Mountain Brewery (MMB), the Private Sector Foundation Lesotho (PSFL), and the Lesotho Chamber of Commerce and Industry (LCCI) are opposing and undermining the alcohol and tobacco tax increase.

Maluti Mountain Brewery is owned by the world’s biggest beer producer, AB InBev.

The Lesotho Liquor and Restaurant Owners’ Association has received serious public criticism because many liquor stores in the capital Maseru have continued to operate illegally and in breach of COVID-19 health regulations.

For further reading

Alcohol taxation as development priority in other countries

Alcohol taxation success in the Philippines

The “Sin Tax” reform in the Philippines shows striking results, according to a World Bank analysis.

Fundamental restructuring of the tobacco and alcohol excise tax structure in 2013 – simplification by reducing the number of tiers, indexation of tax rates to inflation and substantial tax increases – shows that is good for both fiscal and public health.

- About US$ 3.9 billion or 1.3% of GDP in additional revenues was generated from the “Sin Tax Law” in its first three years of implementation.

- The additional fiscal space increased the Department of Health budget threefold and increased the number of families whose health insurance premiums were paid by the National Government from 5.2 million primary members in 2012 to 15.3 million in 2015.

- Additional fiscal space was also generated from interest savings as the Philippines got an investment grade rating shortly after the passage of the “Sin Tax Law”.

Sources

The Reporter: “Alcohol, tobacco dealers up in arms“

Lesotho Times: “Govt To Implement “Crippling” Alcohol And Tobacco Taxes“

All Africa: “Lesotho: Alcohol Levy Could Be Disastrous for Lesotho – Wagamang“

The Reporter: “Liquor outlets flout regulations“