Bringing alcohol taxation in UK closer to global best practices

In the UK, the alcohol duty is a type of tax paid by companies that produce alcohol. It is paid by the company who produces or imports the alcoholic drinks. The tax level relates to the strength and size of the product, rather than its sale price. The level of duty is decided each year in the Government Budget.

On August 1, 2023 the alcohol duty change has come into effect in the UK. It makes duty across different types of alcohol more consistent by taxing based on alcoholic strength by volume (ABV).

In the past the UK tax system has been complicated and inconsistent, with different rules for different alcoholic products. The new system is much closer to international standards in alcohol tax policy and contains elements of World Health Organization (WHO) best practices.

For example, the new alcohol tax system has fewer tax bands. From now on, alcoholic drinks in the highest strength tax bands will pay the same rate, regardless of the type of alcohol. That means, some types of alcohol, such as strong cider and wine in off-licenses, will be taxed at a higher rate than before. Others, such as draught beer and cider sold in pubs will be taxed less.

After a decade of cuts and freezes to the alcohol duty, on August 1 the level of alcohol duty will rise with inflation, explains Alcohol Change UK.

The WHO recommends that governments can try to influence the final price of alcohol by increasing excise taxes on alcoholic beverages and regularly reviewing prices in relation to the level of inflation and income.

UK Prime Minister Rishi Sunak said, according to the New York Times:

… most people would agree that paying higher taxes for higher alcohol content is a a common-sense principle.”

Rishi Sunak, Prime Minister, Unitek Kingdom of Great Britain and Northern Ireland

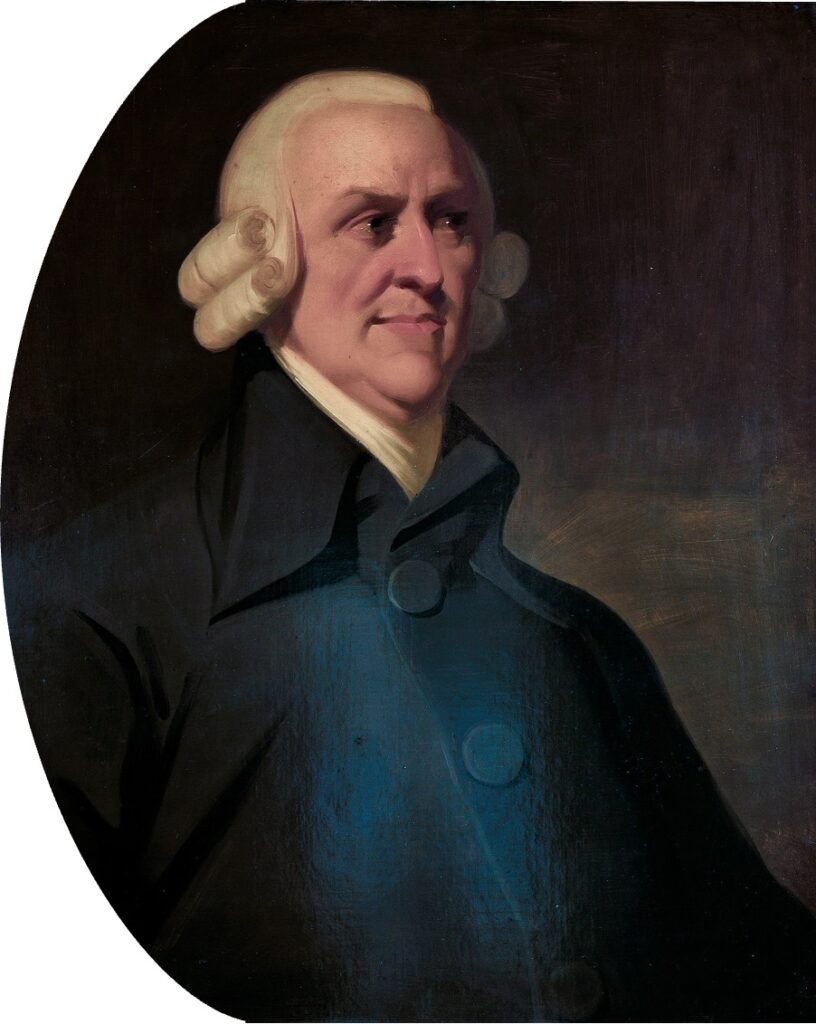

Already in 1776, Adam Smith praised the importance of liquor taxes in his landmark book “The Wealth of Nations”:

Sugar, rum and tobacco are commodities which are nowhere necessary for life, which have become objects of almost universal consumption, and which are therefore extremely proper subjects of taxation.”

Adam Smith. An Inquiry into the Nature and Causes of the Wealth of Nations, McMaster University Archive for the History of Economic Thought, 1776

The World Health Organization (WHO) recommends raising the price of alcohol through alcohol excise taxes as the single most cost-effective alcohol policy ‘best buy’ solution.

An alcohol policy best buy is an intervention that is not only highly cost-effective but also cheap, feasible and culturally acceptable to implement.

World class evidence shows that raising alcohol taxes is an effective strategy for reducing alcohol consumption and related harms.

Alcohol taxation and pricing policies are among the most effective and cost-effective alcohol control measures. An increase in excise taxes on alcoholic beverages is a proven measure to reduce harm due to alcohol and it provides governments revenue to offset the economic costs of alcohol harm.”

The SAFER technical package: five areas of intervention at national and subnational levels. Geneva: World Health Organization; 2019. Licence: CC BY-NC-SA 3.0 IGO.

Evidence from across the world shows that alcohol harm falls when the population levels of alcohol consumption fall. When alcohol is less affordable, less is consumed, and so there are fewer deaths, injuries and illnesses caused by alcohol.

Rise in alcohol duty helps tackle public health crisis of rising alcohol harm

Alcohol harm is a public health crisis in the UK. It needs urgent action.

Alcohol is the leading cause of death, illness and disability among people aged 15-49 in England. Beyond the health costs, alcohol harms relationships, families, workplaces and communities.

Duty increases on alcohol help reduce harm in three ways, according to Alcohol Change UK:

- Revenue from tax on alcohol can be used for the NHS, support services and harm prevention work, to respond more adequately to the UK’s alcohol burden.

- Increasing the cost of alcohol is a proven solution to reduce population-level alcohol use and in doing so reduce harm. This reduces costs due to alcohol and saves the government money. Public health oriented alcohol taxes yield a significant return on investment.

- Finally, in response to alcohol duty rises, producers sometimes reformulate their alcohol products and lower the strength, meaning the amount alcohol units in the UK market decline. This is also positive for public health.

The Institute of Alcohol Studies said, as per New York Times, that it supported the shift to a more proportionate tax system related to the strength of alcoholic drinks, but it argued that the duty rates were still set too low.

Alcohol Change UK agrees and said it was disappointed that the higher duty rate for strong beers now starts at 8.5% instead of 7.5%.

We want the higher rate for beer to be lowered to 6.5%, as 6% is widely considered to be a strong beer or cider. The new rate is likely to increase the number of higher strength beers on sale, which causes more harm.”

Alcohol Change UK

Ending a historic hand-out to Big Alcohol

In recent decades, alcohol has been getting cheaper and stronger in the UK. Duties on alcohol had been frozen since 2020, partly to help UK pubs and mainly as gift to the alcohol industry lobby.

But cheap alcohol causes massive harm.

Alcohol Change UK writes that compared to other products, alcohol has become cheaper to buy, especially in shops. In 2021, alcohol was 72% more affordable than in 1987.

All this means that the UK government subsidized the alcohol industry with tax cuts and duty freezes over the last ten years.

Most years between 2012-2023 saw freezes and cuts to the alcohol duty. In just the first five years of these cuts, the Treasury estimates that the Government lost £4 billion.

These are precious resources that are badly needed in the UK, for example for investing in nurses, doctors, and support services for those impacted by alcohol harm.

Alcohol Change UK calls for the highly profitable alcohol industry to pay their fair share regarding the heavy costs their products and practices are causing to people and communities in the UK.

That is why alcohol must be taxed in proportion to the harm it causes.”

Alcohol Change UK

The Office for Budget Responsibility predicts that the alcohol duty will contribute £13.1bn in tax revenue in 2023/24.

But alcohol harm is estimated to cost between £27bn and £52bn a year – more than double, and possibly up to four times as much.

Duty paid on alcohol can tackle health inequalities

Alcohol harm disproportionately affects people on lower incomes and in greater deprivation, even though evidence shows these groups consume less alcohol than higher income groups.

The impact of alcohol on communities and health is also unequal across the UK. People living in the poorest areas of the country are more likely to experience illnesses due to alcohol, and a greater proportion of the population in deprived areas die due to alcohol.

Movendi International has been documenting the rise of alcohol harm in the UK for years:

- Alcohol causes more working years of life lost than the ten most common cancers combined.

- The COVID-19 pandemic has exacerbated alcohol harm leading to alcohol deaths reaching an all-time high.

- Deprived communities are disproportionately affected by alcohol harm, despite consuming less.

Effects of improving the alcohol taxation system

Taxing alcohol by volume (ABV) targets strong alcoholic drinks, which are particularly harmful. Increasing the price of alcohol could be viewed as ‘regressive’ policy (if alcoholic products are more expensive this affects those with less money more). However, on average, people with less money tend to consume less alcohol than those with more disposable income. At the same time, the health costs and mortality from alcohol are higher among lower income communities and people.

A recent study showed thousands of deaths could be averted through lowering alcohol strength in beer, wine and spirits – something the new alcohol duty system is likely to facilitate.

At March’s Budget, Chancellor Jeremy Hunt announced that the freeze to alcohol duty would end on August 1 and increase by inflation, at 10.1%. The increase will see duty rise by 44p on a bottle of wine, which when combined with VAT will mean an increase to 53p.

Movendi International reported the planned alcohol duty improvements in March 2023. Back then, community groups and civil society welcomed the announcement of the end of a blanket alcohol duty freeze on August 1, 2023, and for alcohol duties to rise in line with inflation in the usual way.

With the alcohol duty improvements being in effect now alcohol prices will rise.

For example, the tax on sparkling wine, which had been higher than that levied on still wine, will decrease, leaving it around 19 pence a bottle cheaper if retailers pass on the reduction. Still wine could increase 44 pence a bottle, and spirits and fortified wines will be subject to even bigger price increases.

Although higher taxes will now be levied on stronger alcoholic drinks, the government says that about 38,000 pubs around the country will benefit from reduced taxes on alcoholic drinks. The alcohol duty that pubs pay will be up to 11 pence, or 14 cents, cheaper than in supermarkets.

And the tax increases will see the duty on a bottle of wine rise by ca. 20%.

As per the New York Times, Prime Minister Sunak described the alcohol duty improvement as “the most radical simplification of alcohol duties for over 140 years.”

Sources

UK Government: “Tax cut for 38,000 British pubs“

Alcohol Change UK: “Nine things you need to know about the new alcohol duty system“

New York Times: “U.K.’s New Alcohol Taxes Are Aimed at Keeping Pubs Open and Votes Flowing“

The Scotsman: “UK alcohol duty: Will it save lives or will it decimate Scotland’s drinks industry?“

LancsLive: “Alcohol prices rising from August 1 with bottle of wine up 44p and gin up 90p“