Federal Budget Contains Alcohol Tax Increase

The Canadian government, led by the Liberal Party, announced a 2% excise duty increase to the cost of alcohol in the new federal budget.

The tax increase is expected to add several cents to the cost of alcohol – from under a penny for a bottle of wine to five cents for a 24-bottle case of beer and seven cents for a 750ml bottle of spirits.

The rate is also set to increase every year along with the Consumer Price Index.

The tax increase itself is small, but will be worth more to consumers once stores calculate additional sales tax and other duties on top of the base cost of a product. The final cost to consumers will depend on whether their province charges flat rates for the additional duties applied to the cost of alcohol.

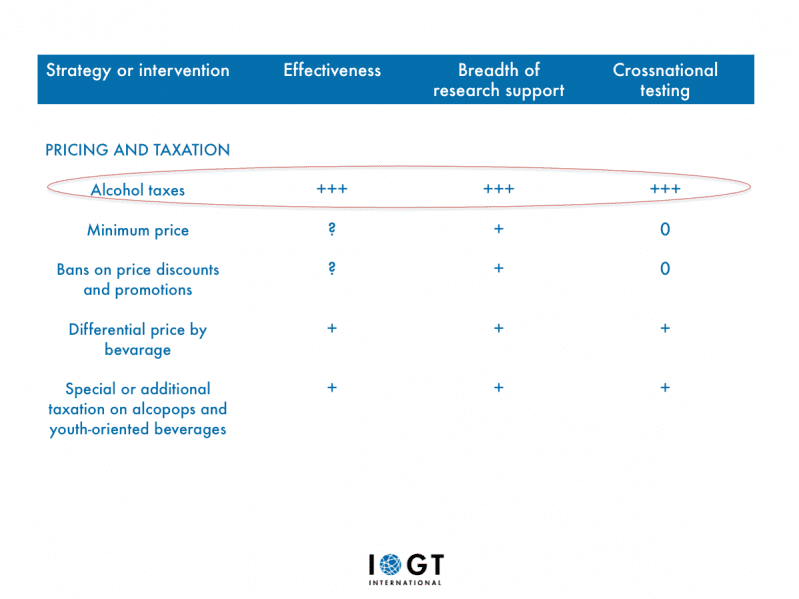

Taxation – positive for public health

A systematic review of the literature to assess the effectiveness of alcohol tax policy interventions for reducing alcohol consumption and related harms showed that the reviewed studies provide consistent evidence that higher alcohol prices and alcohol taxes are associated with reductions in both total alcohol consumption and related, subsequent harms.

Results were robust across different countries, time periods, study designs and analytic approaches, and outcomes.

There is strong evidence that raising alcohol taxes is an effective strategy for reducing alcohol consumption and related harms.