Sri Lanka: Finance Ministry to Index Alcohol Tax to Inflation Rate

State Minister for Finance Eran Wickramaratne stated Sri Lanka is planning to index alcohol taxes to inflation.

Criticisms have been aimed at the government for taxing alcohol as the Ministry of Finance or the Finance Minister’s liking and not to a rational formula.

When we tax alcohol, we are now moving to the principle that we will follow an indexation relating to the rate of inflation,” said State Minister for Finance Eran Wickramaratne, as per economynext.

Instead of taxing alcohol according to the wants of the minister or the ministry we will adopt this as a policy.”

The Finance Ministry had previously reduced a successful beer tax increase, a move that received much criticism from the National Authority on Tobacco and Alcohol (NATA) as well as civil society organizations like the Alcohol and Drug Information Centre, ADIC Sri Lanka. High levels of alcohol taxation coupled with inflation-adjustment are recommended by the World Health Organization as a best buy alcohol policy solution.

Tax indexation is a positive measure by the government, says Pubudu Sumanasekara, Executive Director, ADIC.

However this indexation must be transparent and should adjust alcohol taxes to both inflation and purchasing power. The aim of indexing must be to reduce alcohol consumption and decrease alcohol harm to the society. If the indexation follows such a method and end goal it would yield positive result for the country in reducing alcohol harm.”

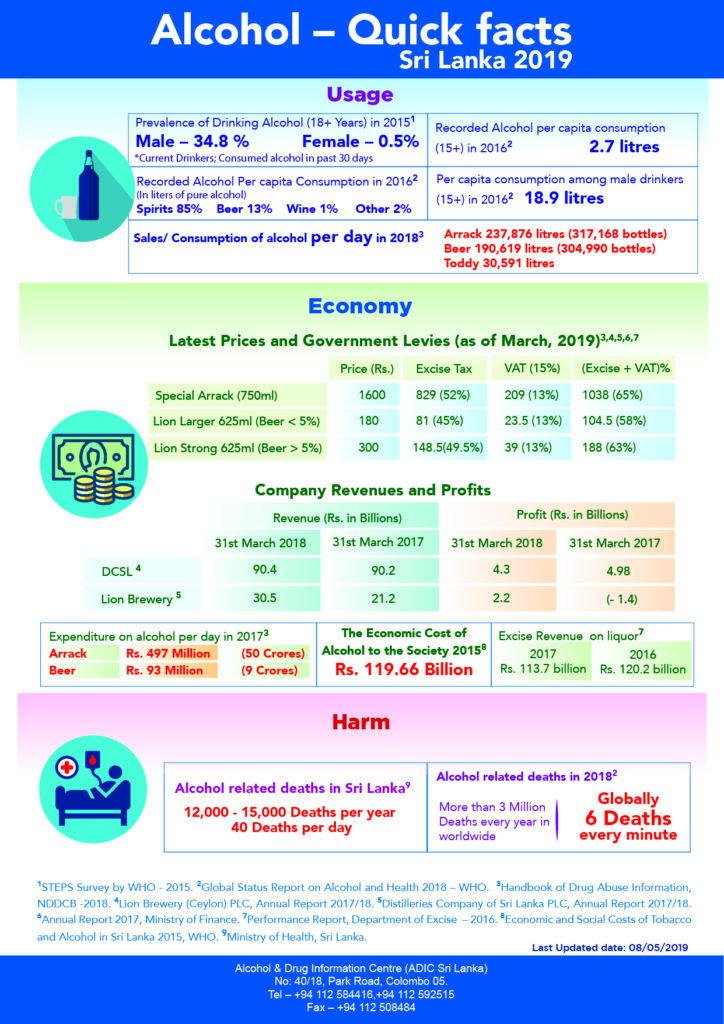

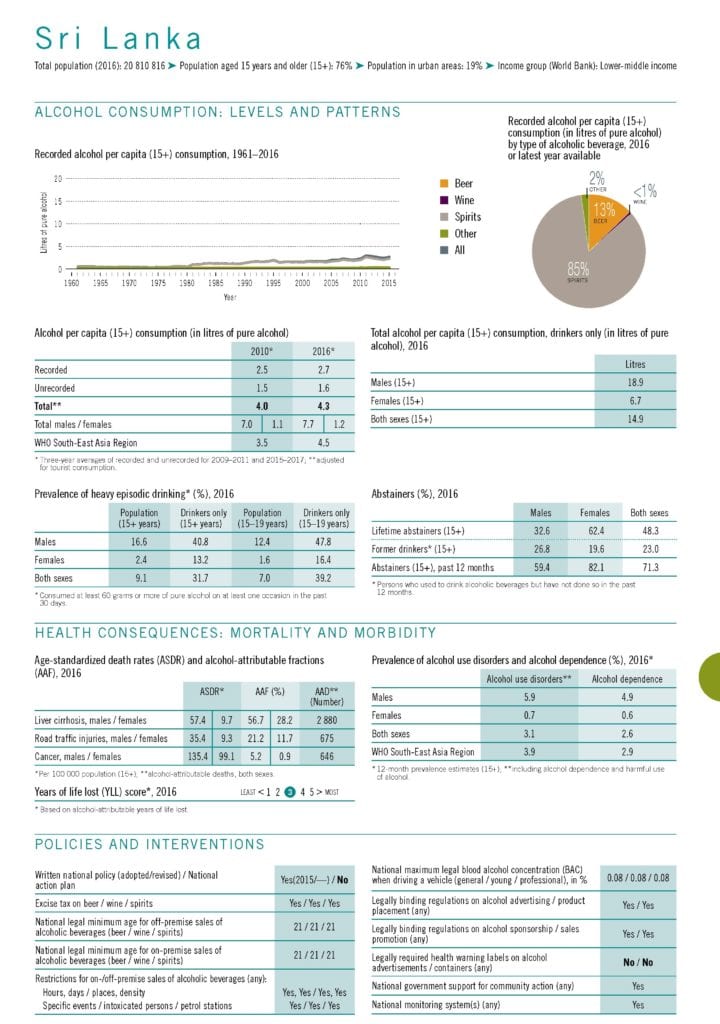

Alcohol harm in Sri Lanka

As reported by the Alcohol and Drug Information Centre (ADIC) – Sri Lanka,

- Alcohol is attributable to between 12,000 and 15,000 deaths per year and 40 deaths per day;

- Economic cost of alcohol to society is Rs. 119.66 billion.

As WHO reports,

- The country has a majority of abstainers and consumers of alcohol are primarily men.

- For alcohol using youth between 15 to 19 years, 39.2% engage in binge alcohol use.

- 5.9% of men suffer from alcohol use disorders and 4.9% men are dependent on alcohol.

Indexing alcohol taxes in a rational, transparent method adjusted to inflation and purchasing power can further strengthen the current alcohol control policy in the country and reduce alcohol harm even further.