USA: Congress Extends Big Alcohol’s Tax Break

The United States Congress extends the major tax break for the alcohol industry, losing billions of dollars in government revenue and further filling the coffers of Big Alcohol shareholders and executives with growing profits.

Congress is extending the tax break for beer, wine and distilled spirits which was initially approved in 2017.

- Without the tax breaks the Distilled Spirits Council (DISCUS) would have payed $275 million in higher taxes,

- A beer industry group claims they would have to pay $130 million in higher taxes.

- California fineries alone would have paid $150 million in higher taxes.

All this money is tax revenue being lost to the government which could have been invested in health and development of people and communities across the country that are seriously affected by rampant alcohol harm.

Furthermore, the legislation reduces excise tax payments for all U.S. wineries by expanding the value of the existing producer credit and doing away with the phase-out that has prohibited many wineries from receiving any benefit.

- Excise tax payments for small- to medium-sized wineries are reduced by 55% or more.

The one year extension has been estimated to cost the government a total $1.2 billion.

The tax breaks claim to help small industries within the country, but the tax breaks are worth $12 million annually to both Anheuser Busch InBev and Molson Coors Brewing Co – two of the world’s largest beer producers, which indicates the tax break is actually benefiting Big Alcohol massively.

Contrary to helping smaller local industries this makes multinational alcohol corporations even more powerful and undermines the ability for small local industries to compete. Moreover, the government’s ability to address alcohol harm and related costs is further diminshed due to shrinking tax receipts.

the vast majority of its tax cuts go to large distillery corporations and foreign spirits importers, ballooning the cost of the bill, undercutting the ability of truly small businesses to compete, and threatening public health,” said Adam Looney, a fellow at the Brookings Tax Policy Center, as per Reuters.

Alcohol harm in USA

Alcohol causes significant harm in the USA. According to the National Institute on Alcohol Abuse and Alcoholism, alcohol harm costs the United States $249.0 billion every year.

And the death toll due to alcohol has been rising in the country since 2006. Furthermore, deaths of despair for which alcohol is a major factor have also been rising in the country.

Two new studies have found that life expectancy in the USA is decreasing with rising alcohol-related deaths. One study states, alcohol-related liver disease is partly to blame for the drop in life expectancy across the United States, as Movendi International reported previously.

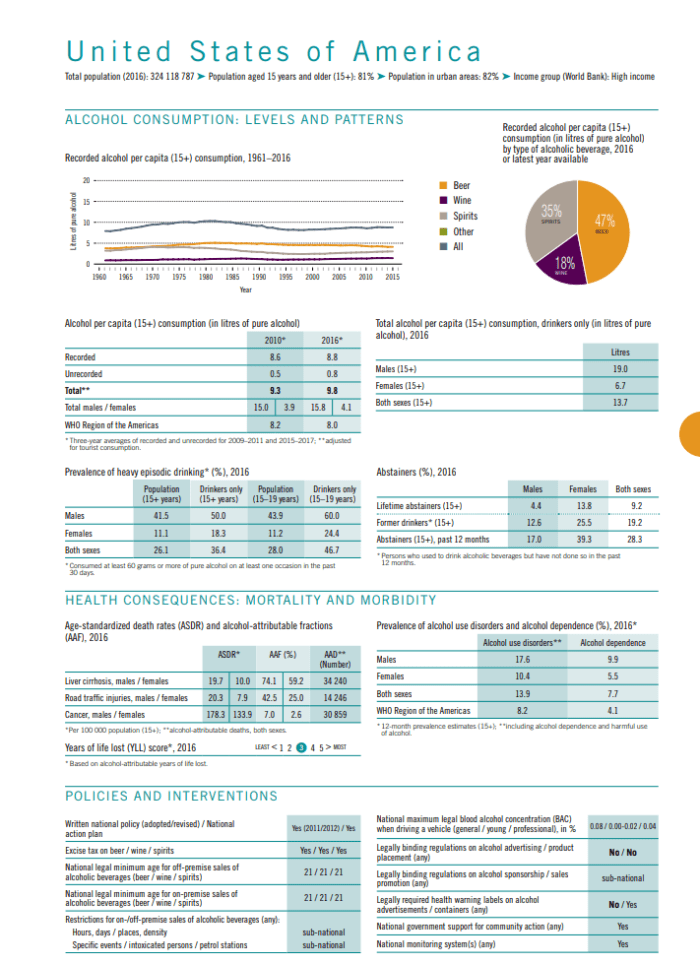

The World Health Organization (WHO) reports that the total per capita alcohol consumption in the United States is 9.8 litres which is above the regional average for the Americas.

Alcohol harm is obvious in the country. Alcohol causes,

- 34,000+ deaths from liver cirrhosis,

- 14,000+ deaths from road traffic injury, and

- 30,500+ deaths from cancer.

Furthermore, 13.9% of the population suffer from alcohol use disorder and 7.7% are dependent on alcohol, both of these are above the WHO regional averages.

A recent study found that the current alcohol taxes in the United States do not cover the cost of alcohol in the country. The study published in the Journal of Studies on Alcohol and Drugs found the total harm caused by alcohol use is a whopping $2.05 per unit of alcohol in the United States, and, of this, the government ends up paying about 80 cents per unit of alcohol.

However, the federal government and federal states only bring in about 21 cents per unit of alcohol on average in alcohol taxes.

Alcohol taxation is one of the three evidence-based, high impact and cost-effective policy measures recommended by the World Health Organization to reduce alcohol consumption and resulting harm. Besides reducing the harm, the tax revenue can be reinvested to cover the health cost alcohol is currently causing the country. Extending tax breaks for Big Alcohol will only lead to further increases of the health, social and economic costs of alcohol in the United States.