The government of Turkey has raised alcohol taxes as part of a response to a 19-year high level of inflation of 36.1% recorded in December.

Turkey faces a dramatic drop in its currency’s value, combined with high inflation rates. The Turkish lira lost more than 70% of its value against foreign currencies last year.

Effect of higher alcohol prices on consumption

Anecdotal evidence from customers as well as bar and tavern owners in Istanbul, Turkey’s metropolis, report that purchases and consumption of alcohol are declining.

One tavern owner, Ismail Inanc, told Ruptly news agency, :

Serkan Fikir, a pub manager, said, as per 5 Pillars:

There is a serious decrease in the alcohol consumption of our customers. Since the day we made sales at new prices with the hike, our customers have decreased. People don’t even go out.”

Serkan Fikir, pub manager, Istanbul

Turkey has raised alcohol taxes previously, in recent years. For example in 2019, the consumption taxes on alcoholic beverages were increased by 13.5%. That alcohol tax increase followed a 15.5% price increase in alcohol fees in July 2018.

High rates of harm among alcohol users

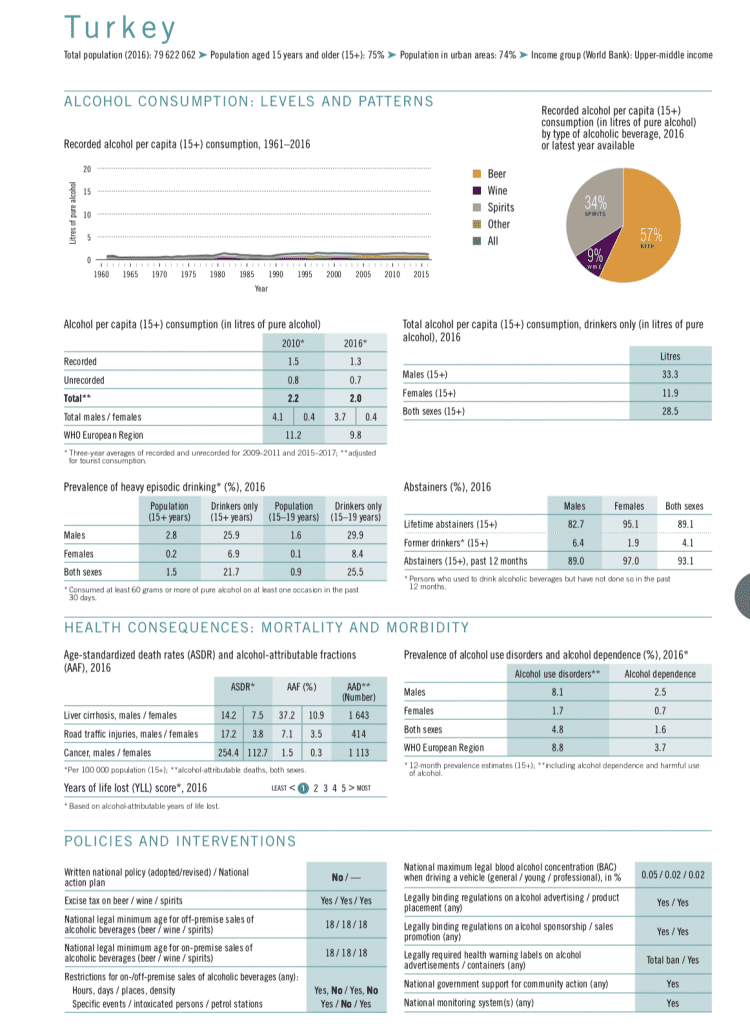

Per capita consumption in Turkey is 2.0 liters per year, well below the average of the WHO European region (9.8 liters). 93% of the adult population did not use alcohol in the past year. But among the alcohol users, per capita consumption is almost 29 liters.

This leads to a very high prevalence of alcohol use disorder and other types of alcohol harms. More than 8% of adult men experience an alcohol use disorder. More than 1000 people die due cancer caused by alcohol, every year in Turkey. And cirrhosis due to alcohol causes more than 1600 deaths every year in Turkey.

Alcohol taxation – a best buy alcohol policy solution

Therefore, raising alcohol taxes has very positive effects on promoting health and alleviating the burden alcohol harm places on the healthcare system.

Alcohol taxation is endorsed by the World Health Organization as a best buy measure in reducing and preventing alcohol harm.

For example, a study of 42 high-, middle- and low-income countries found that raising excise duties on alcohol to at least 40% of the total retail price would increase tax revenue in these countries by 80% to US$ 77 Billion. Expressed as a proportion of total current spending on health, it is low-income countries that have most to gain (additional receipts would amount to 38% of total current spending on health).

Implementation of evidence-based alcohol taxation is also likely to have a net positive effect on employment, as consumers divert their spending on other (healthier) products, services and needs.