Among all policies aimed at reducing heavy alcohol use and related harms, increasing taxes is the most effective intervention. In particular, how excise alcohol taxes are passed to prices (i.e. how much prices increase in response to per unit tax increase – tax pass through rate) and the price elasticity of demand for alcoholic beverages will determine the effectiveness of tax policies and thereby impact alcohol consumption behaviors.

Evidence on the tax pass-through rates of alcohol prices to prices are scarce. To fill in this critical research gap, my research colleagues Anh Ngo, Frank J. Chaloupka and myself conducted a study entitled “The Pass-Through of Alcohol Excise Taxes to Prices in OECD Countries” to examine the pass-through rates of various alcoholic beverages such as beer, wine, and liquors in 27 OECD countries from 2003 to 2016.

The Pass-Through of Alcohol Excise Taxes to Prices in OECD Countries

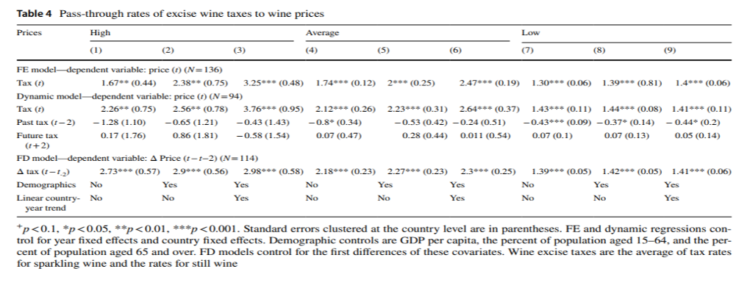

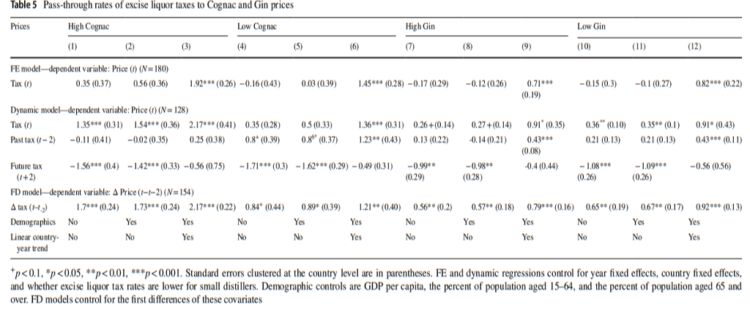

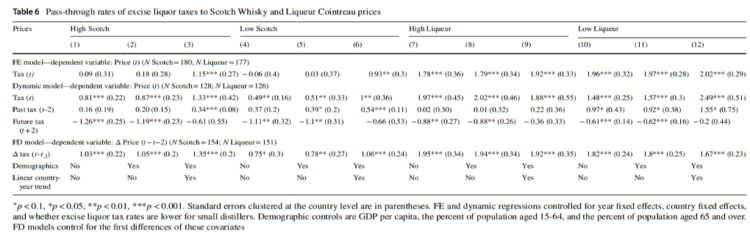

We found that excise taxes are over shifted on wine (Table 4 below), Cognac, Gin, Scotch whisky (Table 5 below), and Liqueur Cointreau (Table 6 below). There is no clear evidence on the tax pass-through rates of beer, Gin, and Scotch whisky. By examining the tax pass-through rates on alcoholic beverages comprehensively, our research provides insights on more informed, efficacious, and effective alcohol taxation policies to reduce alcohol harm and promote healthy behaviors.

- Table 4 @Ce Shang et. al.

- Table 5 @Ce Shang et. al.

- Table 6 @Ce Shang et. al.

Another important contribution that our study offers is to evaluate how taxes are passed differently to various price levels along the price distribution (i.e., higher- vs. lower priced products). The findings suggest that for most alcoholic beverages, the tax pass-through rates are higher for higher-priced products. Overall, manufacturers of beer and wine may adjust down the prices of lower-priced products in response to past tax hikes to keep these products affordable.

These impacts were not found for their higher-priced counterparts. This evidence, together with the evidence on the lower tax pass-through rates for lower-priced products, indicates that the lower end of the price distribution may be the target of the alcohol industry in responding to taxes strategically. Thus, despite tax increases, prices of cheap products may still be low. The availability of relatively cheap products may reinforce the heavy and high-risk alcohol consumption and thus undermine the effects of increasing taxes in reducing alcohol consumption. The spectrum of tax pass-through rates highlights the complexity of the alcoholic beverage market, suggesting that changes in taxation policies are necessary to respond to such complexity.

Our study makes important contributions to a field where the evidence is limited.

Excise taxes are a win-win strategy of not only reducing alcohol-related harms but also generating revenues that can be further directed to advance public health, and more effective ways of implementing alcohol taxes that will benefit the society.

Given our research findings that cheaper alcohol is not as susceptible to price increases via excise taxes, governments may consider additionally implementing minimum pricing policies. Minimum pricing policies would raise floor prices and complement excise taxes on cheaper alcohol.