From October onwards, taxes will rise for third-segment quasi-beer by ¥9.8 per 350 milliliters, and for fruit-based alcohol, such as wine, by ¥3.5 for the same volume.

Last year October, Japan increased their consumption tax by 2% bringing it to 10%. This affected many alcohol products, but the cheaper third-segment quasi beer has seen increased sales ever since. The new tax increase is aimed at this increased consumption.

Unfortunately, at the same time the Japanese government is planning to reduce taxes for regular beer by ¥7 per 350 milliliters, and for sake by ¥3.5 for the same volume.

The government plans to unify the tax rates for beer, happōshu quasi-beer and third-segment beverages to around ¥54 by 2026.

Increasing taxes are a World Health Organization recommended best buy policy solutions to reduce alcohol affordability, consumption and thus to prevent and reduce alcohol harm. Considering the harmful alcohol norm in Japan, such policy measures are crucial to reduce the growing alcohol burden in the country. The alcohol norm is so pervasive in the country that employees are sometimes unable to say no when an employer offers them alcohol. The pervasive alcohol norm is driving underage alcohol use, too, since age controls are rare.

Alcohol policy and harm in Japan

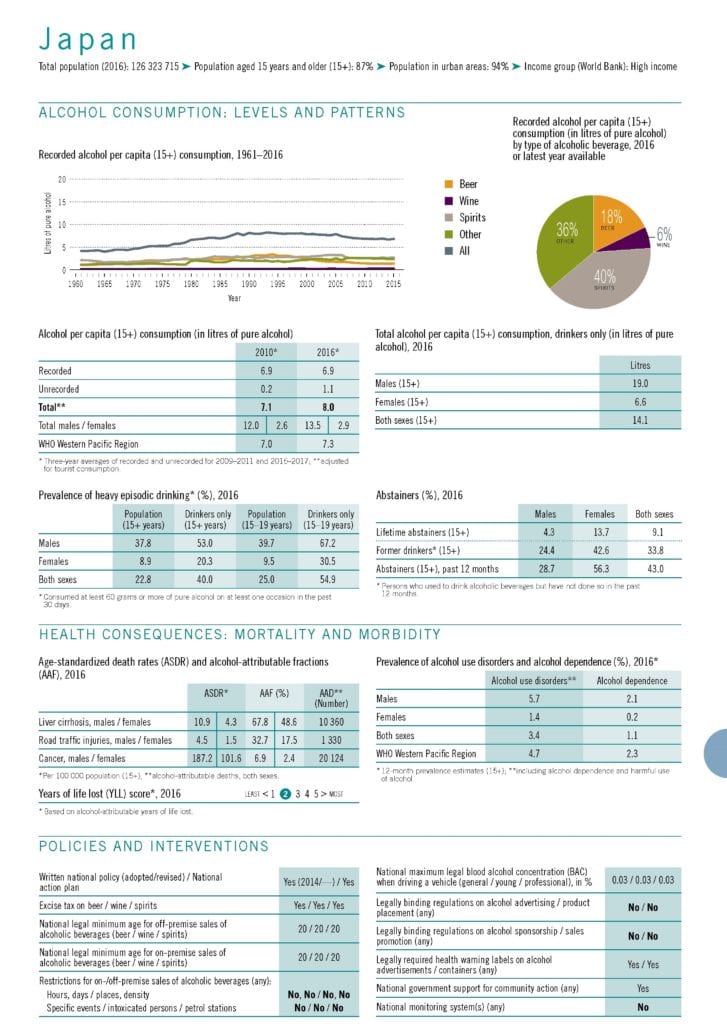

Considering the current alcohol norm it is no surprise that alcohol harm is massive in Japan. The World Health Organization reports a total per capita consumption of 8 litres of pure alcohol which is above the average for the WHO Western Pacific Region. The male alcohol per capita consumption among alcohol users is very high at 19 litres of pure alcohol.

Youth binge alcohol use is also a significant problem with over half (54.9%) alcohol consuming youth between 15 to 19 years of age engaging in heavy episodic alcohol use.

Every year alcohol causes,

- 10,000+ deaths from liver cirrhosis,

- 1000+ deaths from road traffic injury, and

- 20,000+ deaths from cancer.

Considering the high rate of alcohol harm and the prevalent alcohol norm in Japan, it is important that the government impose national level policies to reduce the alcohol burden along with increasing awareness among the public.

While the announced tax increase is positive considering that the third-segment quasi beer is a cheap alcohol, the decrease in taxes for regular beer and sake seems ill-advised. A public health approach to alcohol policy making is needed to ensure policies are integrated with each other and coherent.

The unification of taxes for the different types of beer and third-segment alcoholic beverages as planned by the government for 2026 is a positive move as it will address the problem of cheap alcohol. However, it is necessary that existing alcohol taxes are not reduced to meet this goal, but instead that taxes are indexed, adjusting to purchasing power, inflation and income of the Japanese people.

A modernization of Japan’s national alcohol policy would also be important, since it is now six years ago that the policy was adopted. This should included the development of best buy policy solutions to better regulate alcohol availability and alcohol advertising, promotions and sponsorship – two areas where Japan is currently doing nothing but that are recommended to address by the World Health Organization and its SAFER initiative.