In 2017, the Kenya Film Classification Board (KFCB) wrote to the members of the Alcoholic Beverages Association of Kenya (ABAK) complaining that they were airing alcohol advertisements during the watershed period contrary to the Kenya Information and Communication Act.

Upon receiving the complaint instead of adhering to the watershed ABAK went to court questioning the authority of KFCB and arguing that the Kenya Film Classifications Advertising Regulations did not confer on KFCB express statutory powers to license, examine, approve and classify alcohol adverts.

This case was first dismissed in 2017. Upon ABAK appealing the decision the Court of Appeal has upheld the decision giving the KFCB the mandate to regulate TV advertisements promoting alcohol products. The three presiding judges in their ruling said that KFCB’s mandate extended to TV advertisements submitted for exhibition by ABAK members.

There is nothing to suggest that the interpretation given is not proportionate to achieving the purpose for which the legislation was passed,” said Justices Daniel Musinga, Fatuma Sichale and Helen Omondi, as per Business Daily.

Justices Daniel Musinga, Fatuma Sichale and Helen Omondi

Kenya makes improvements to alcohol policy despite Big Alcohol lobbying

In 2018, the Kenyan Treasury changed excise duty laws to adjust alcohol excise taxes to inflation annually. East African Breweries Limited (EABL) launched an intense lobbying attack against this policy improvement which is recommended by the World Health Organization as the most cost-effective policy solution.

Furthermore, in April 2022, the Kenyan government proposed a 15% tax on alcohol advertising in the 2022/23 budget and the Kenyan government also proposed a 10% increase in excise taxes, separate from the annual adjustment to inflation. EABL lobbied heavily against this 10% rise in excise taxes.

Despite Big Alcohol interference, Kenya continues to improve its alcohol policies. The new Kenyan government is upholding the alcohol excise tax adjustment to inflation. From October 1, 2022 the excise tax on alcohol will therefore increase along with taxes on several other excisable goods and services.

The newly elected President of Kenya, Mr. William Ruto is setting the tone for Members of Parliament to be role models by remaining alcohol-free at work. Mr Ruto and his deputy live alcohol-free and believe cutting down or quitting alcohol is better for leadership and productivity.

Not just in Kenya, Big Alcohol has been exploiting the African region to maximize their profits. The growing middle class and young population in this region and the lack of evidence-based, high-impact policy measures make the region a lucrative opportunity for Big Alcohol. But this comes at the cost of the health and well-being of the people of Kenya. A comprehensive national alcohol policy has the potential to protect public health oriented alcohol policy making in Kenya.

Alcohol harm in Kenya

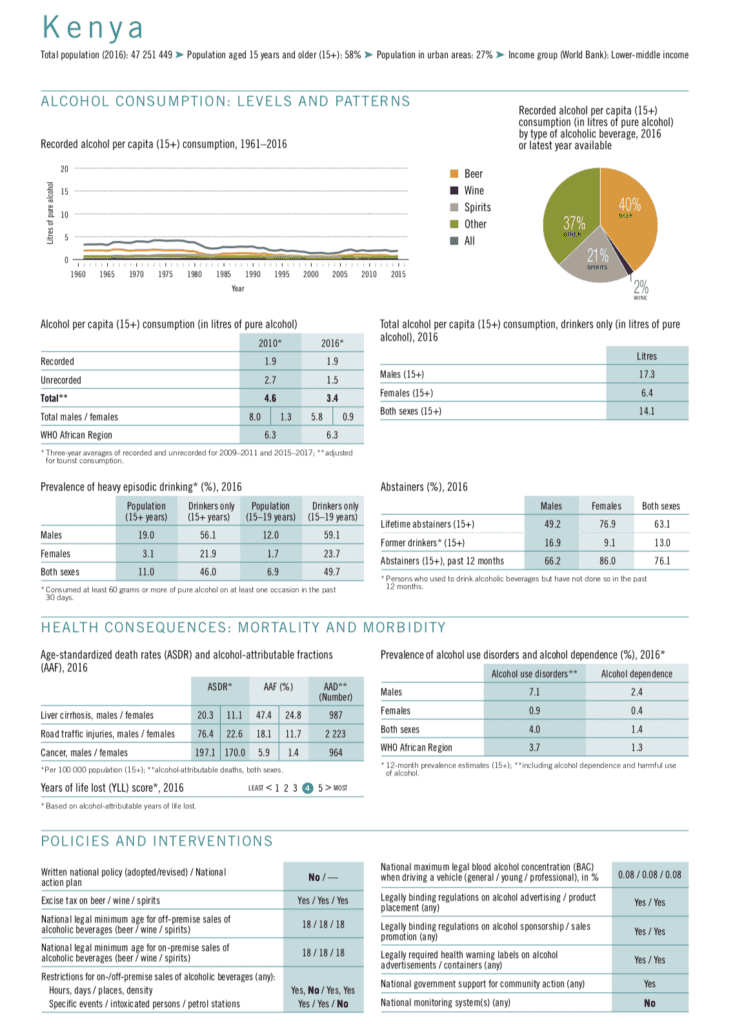

The harm caused by the products and practices of Western alcohol companies is high in Kenya. The country is ranked at the high end for years of life lost due to alcohol.

Almost half (49.7%) of 15 to 19 year old youth who use alcohol engage in binge consumption and 7.1% of Kenyan men suffer some alcohol use disorder.

Despite the high level of harm caused by alcohol products and alcohol industry lobbying, Kenya is yet to adopt a comprehensive national alcohol policy. The improvements Kenya has been making in alcohol policies can be further enhanced by adopting a national alcohol policy.