The Vietnam Economic Pulse Forum was held recently on November 5, 2021. At the forum Professor Jonathan Pincus, UNDP Senior International Economist stressed the importance of domestic resource mobilization to increase long-term finance for productive investment.

Alcohol taxation is one key solution with largely untapped potential for Vietnam to increase domestic resources for health promotion. This can enable the country to reach their ten-year development strategy of achieving upper middle-income status by 2030 and high-income status by 2045.

Recently, other countries such as Lesotho, Zimbabwe, Nigeria, Ghana and Philippines have also begun exploring alcohol tax increases and more international organizations are waking up to the potential of evidence-based alcohol taxes to unlock triple benefits for people and societies.

Alcohol use and harm in Vietnam

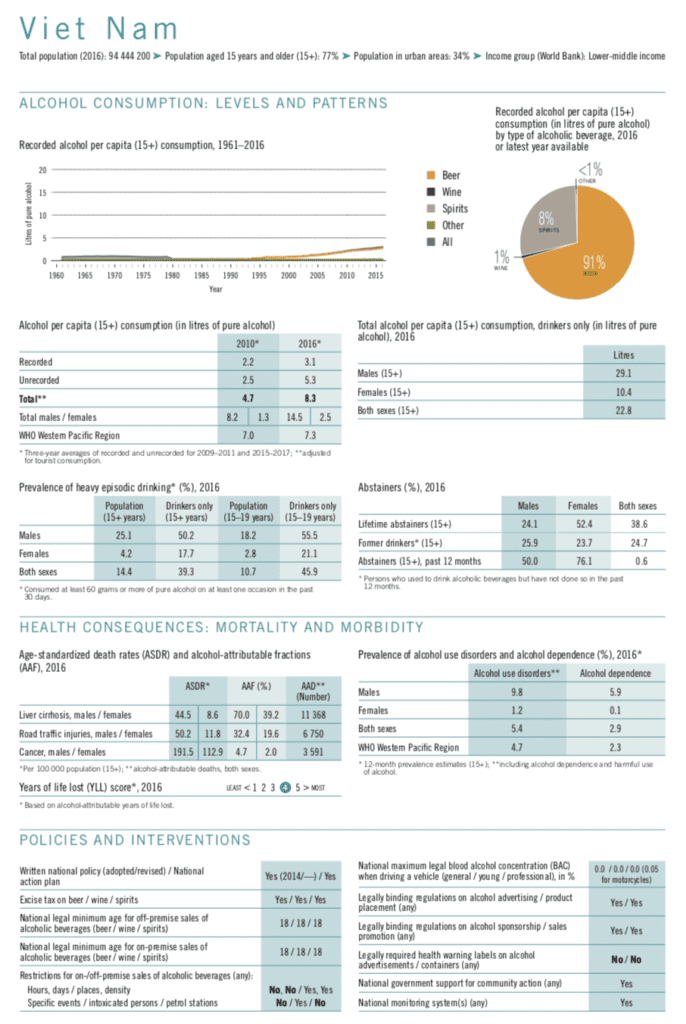

According to the World Health Organization (WHO), Vietnam’s per capita alcohol use has been on the rise since 2010. In 2016 it was at 8.3 liters which is higher than the average of the WHO Western Pacific Region. Almost half of young people (45.9%) who consume alcohol in Vietnam engage in binge alcohol use.

As Movendi International reported in 2019, Vietnam is Asia’s third-largest beer consumer, after China and Japan. In the six years prior to 2019, Vietnam saw beer volumes climb by an average 6.6% compared to an increase of 0.2% for consumption globally.

Alcohol use is one of the major risk factors driving the NCDs burden in Vietnam. A scoping review found that Vietnam’s alcohol use has been on an increasing trend since 2003. The annual consumption level per capita of pure alcohol by adults (age 15 and older for both genders) has increased from 3.8 liters in 2004 to 4.7 liters in 2010, and further to 8.3 liters in 2016. In Vietnam men consume alcohol more than women. The prevalence of heavy episodic alcohol use among Vietnamese adult males has increased from 25.1% in 2010 to 44.2% in 2015.

Alcohol consumption in Vietnamese adolescents is at an alarming level and increasing. According to the national survey of adolescents and youths in 2008, approximately 80% of young men and 36.5% of young women aged 14 to 25 years used alcohol.

Another study found that heavy alcohol use (more than 14 standard units per week for men and more than seven standard units per week for women) occurred among 35% of those who used alcohol in Vietnam. The study also found that Vietnamese people spend US$ 3.5 per month on alcohol, accounting for 4.6% of household food expenditure, 2.7% of total household expenditure, and 1.8% of household income. For poor households this expenditure on alcohol is substantial.

The health harm from alcohol consumption is high in Vietnam. The WHO reports in 2016 in Vietnam there were:

- 11,368 deaths ue to alcoholic liver cirrhosis;

- 6750 deaths due to alcohol caused road-traffic injuries; and

- 3591 deaths due to alcohol caused cancer.

The harm for men is especially apparent with 9.8% suffering from some alcohol use disorder including 5.9% who are dependent users. Vietnam is placed on the high end for years of life lost due to alcohol.

According to research on the global burden of disease in 2016, 12% of deaths in Vietnam are associated with alcohol use.

There is a heavy burden of social harm caused by alcohol in Vietnam as well.

- Of married women or those living with their partners, 32.5% experienced some form of harm from their partner’s or husband’s heavy alcohol use.

- Further, 21% of parents/caregivers said that children in the family suffer harm from the alcohol use of others.

Alcohol taxation in Vietnam

The WHO forecasts that Vietnam’s alcohol consumption level will further increase to reach 9.9 liters by 2020 and 11.4 liters by 2025, in the absence of effective interventions to reduce alcohol use and prevent harm.

One such effective alcohol policy solution is taxation. Alcohol taxes are proven to reduce the heavy alcohol harm in Vietnam and generate funds for development. There is clear scientific support for improving alcohol taxation in Vietnam.

One study found that Vietnamese households are sensitive to beer and wine prices. Beer and wine consumption decline whenever their respective prices increase and their consumption increases whenever average expenditure rises.

The study provides proof for calls to increase alcohol taxes in Vietnam.

Another study showed similar results: demand for beer, other alcoholic beverages, and non-alcoholic packed drinks is elastic to own-price but also elastic to income. Meaning consumption is dependent upon the price and income of people. Therefore, an increase in excise tax would be an effective solution to reduce demand for alcoholic beverages.

Currently, Vietnam has imposed a special consumption tax on a number of products, including alcohol. This is a type of excise tax. It is levied at a higher ad valorem rate on beverages above 20% (mainly spirits) and it is also the rate charged on beer. Wine (under 20%) is taxed at a lower ad valorem rate. From 2012 until January 2016 the high rate was 50% and the lower rate was 25%. The tax is levied on the factory gate price.

Excise taxes are one of the WHO recommended, evidence-based, and cost effective alcohol policy measure in the SAFER package.

Vietnam’s tax policy is weak in comparison to nearby countries. Only about 7% to 8% of alcohol product prices are paid as tax while in nearby Thailand with alcohol excise taxation, 24% of the price is paid as tax. This means there is a high potential in Vietnam for increasing domestic revenue through increasing alcohol excise taxes.

Alcohol Harm Prevention Law heavily influenced and watered down by Big Alcohol lobby

In 2019, the National Assembly of Vietnam passed the new Alcohol Harm Prevention Law. It came into effect in the beginning of 2020, But controversially, it did not include alcohol taxation or a pricing policy measure. The National Assembly decided that the proposal to raise the alcohol price would be discussed within the premise of a separate law on taxation.

Nevertheless, the new alcohol law ensures much better limits on the marketing practices of the alcohol industry. It also institutes evidence-based rules to reduce the physical availability of retailed alcohol products. The new and modern alcohol law includes a number of WHO-recommended alcohol policy solutions:

- A ban on alcohol advertising between 6:00 to 9:00 p.m., daily. Advertisements must carry warnings on alcohol-related harms;

- A ban on marketing strategies that involve corporate giveaways, images, logos, music, film talents, and other product brands targeting people under 18;

- A ban of on-site alcohol vendors within 100 meters from health care facilities and schools;

- An age limit for alcohol purchase of 18 years to protect Vietnam’s youth;

- Better driving under the influence of alcohol (DUI) counter-measures; there is zero tolerance for DUI for both car and motorcycle riders; and

- Other alcohol policy measures:

- Prohibition of inciting, encouraging and forcing other people to consume alcohol;

- Prohibition of alcohol use before and during working hours by public officials, students, members of the armed forces; and the

- Ban on employing people under 18 years of age in the production and trading of alcohol.

However, as Movendi International previously reported this law was heavily influenced and watered down by Big Alcohol lobbying. There was also heavy lobbying before implementation to nullify and weaken key components of the law throughout the process which lasted from 2017 till the law was passed in 2019.

Since the implementation of the laws Big Beer has complained that the laws are “too tough” and have cut prices to increase consumption again. From a public health perspective the new alcohol law is a good start to take further steps in the effort to reduce alcohol use and harms in Vietnam.

Triple win potential of alcohol taxes

There is strong and growing evidence that pro-health taxes on health harmful products, such as tobacco, alcohol, and sugar-sweetened beverages, are highly impactful and yield significannt return on investment.

A landmark study confirmed this in 2020:

Excise tax increases on tobacco, alcohol and SSB can produce substantial health gains by reducing premature mortality while raising government revenues, which could be used to increase public health funding.”

Summan A, Stacey N, Birckmayer J, et. al. The potential global gains in health and revenue from increased taxation of tobacco, alcohol and sugar-sweetened beverages: a modelling analysis. BMJ Global Health 2020

Public health-oriented taxes on tobacco and alcohol are non-distortionary taxes. They have a triple benefit:

- Raise fiscal revenue,

- Reduce and prevent harm caused by tobacco and alcohol products, and

- Promote health and development by easing the health system burden and facilitating investments into healthcare and health promotion.

Besides revenue raising objectives, the rationale for excise taxes on alcohol is to reflect their harmful external costs. The benefits of higher alcohol taxes are obvious for individuals and entire communities. The triple benefits result from:

- Reduced alcohol use,

- Preventing the initiation of alcohol use among children and youth, as well as

- Reducing the negative health, social, and economic consequences caused by the products and practices of the alcohol industry.

Movendi International supports the development and implementation of public health oriented alcohol taxation, as a key policy solution to achieve health and development for all.

- An innovative illustration depicts, for instance, the benefits of alcohol taxation across multiple Sustainable Development Goals; and

- Offers insights into the potential of alcohol taxation’s critical role to build sustainable health systems and achieve universal health coverage.

Movendi International’s 2015 report on alcohol taxation concluded: Alcohol taxation is a triple-win measure for increasing fiscal space, boosting health promotion and financing sustainable development.

Sources

Vietnam+: “Domestic resources – key to achieve development goals: UNDP expert“

Journal of Global Health Science: “New law on prevention and control of alcohol related harms in Vietnam“

Taylor & Francis Online: “Alcohol consumption and household expenditure on alcohol in a rural district in Vietnam“

Sage journals: “Patterns of behavioral risk factors for non-communicable diseases in Vietnam: A narrative scoping review“

BMJ Journals: “Do beer and wine respond to price and tax changes in Vietnam? Evidence from the Vietnam Household Living Standards Survey“

L’Universita ta Malta: “The determinants of an econometric demand model for beverages“

Wiley Online Library: “Alcohol taxes’ contribution to prices in high and middle-income countries: Data from the International Alcohol Control Study“