As Movendi International has reported, Vietnam’s government has debated for some time whether to increase the special consumption tax that applies to harmful products such as alcohol, cigarettes and sugar-sweetened beverages.

Raising pro-health taxes would have a double-win effect:

- increase state revenue and make alcoholic products more expensive, thereby

- reducing alcohol use in the population and the related alcohol harms.

Vietnam’s government needs to recalibrate its revenue collection practices.

Free-trade deals have cut tariffs, and the government is under more pressure to invest domestically. As a result, domestic resource mobilization has become more important than ever and revenue from alcohol taxes yields additional beenfits: less alcohol use, means less alcohol harm, and thus lower costs to society in the form of healthcare burden, economic loss, and other costs.

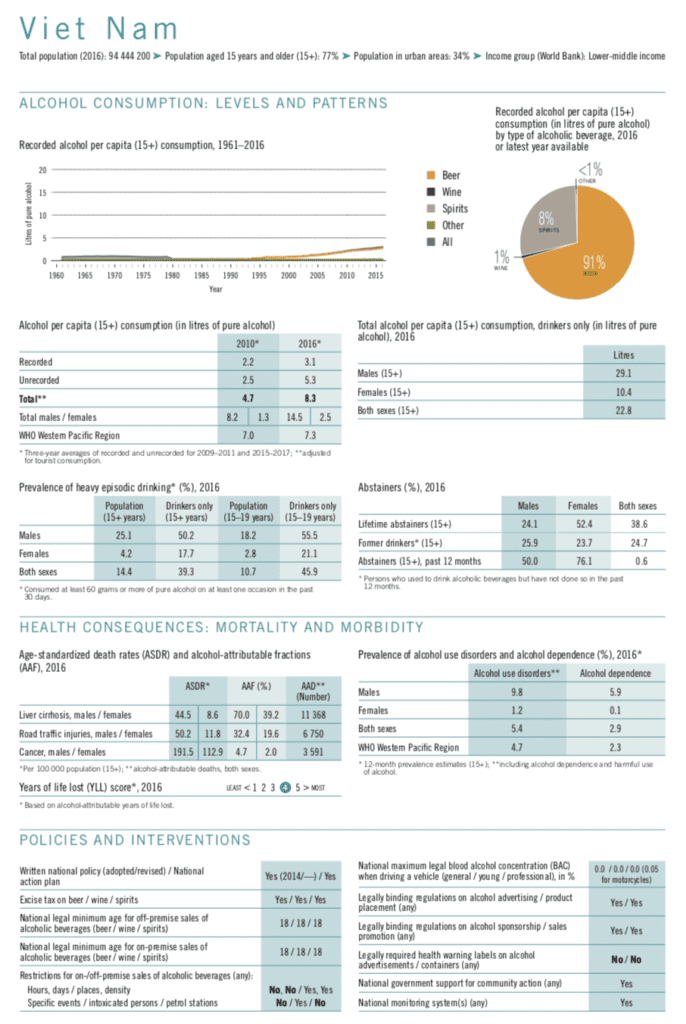

In 2019, the average beer consumption per person in Vietnam was 47.6 liters, the third-highest in Asia after China and Japan, as per Movendi International previous reporting.

A study published in 2019 in the Lancet medical journal showed per capita alcohol use in Vietnam increased 90% between 2010 and 2017, the fifth highest in the world.

Population-level alcohol use is expected to continue growing this decade.

Beer is booming, but at high cost to people and society

The beer sector in Vietnam was estimated to be worth $26 billion in 2021, the highest in Southeast Asia, according to Deutsche Welle reporting.

The country is facing rapidly rising alcohol use over recent years.

- In the six years prior to 2019, Vietnam saw beer volumes climb by an average 6.6% compared to an increase of 0.2% for consumption globally.

- Alcohol consumption in Vietnamese adolescents is at an alarming level and increasing. According to the national survey of adolescents and youths in 2008, approximately 80% of young men and 36.5% of young women aged 14 to 25 years used alcohol.

This growth in the alcohol market comes at a high cost to people and society: a study in 2016 estimated that 12% of all deaths in Vietnam are linked with alcohol use.

A fifth of deaths due to road crashes were caused by alcohol use.

Alcohol harm is a serious problem for Vietnam. Alcohol is one of the major risk factors for the growing Non-Communicable Disease (NCD) burden in the country. Statistics indicate an upward trend in the average per capita alcohol consumption among people aged 15 and above, among both males and females.

More than 11,000 people die due to cancer caused by alcohol in Vietnam, according to the WHO Global Alcohol Status report. Alcohol use disorder and addiction is highly prevalent among males. And binge alcohol use among both adolescent and adult males is also a major social, health, and economic problem.

The costs from alcohol harm amount to 3.3% of the nation’s gross domestic product (GDP).

- There is a heavy burden of social harm caused by alcohol in Vietnam as well.

- Of married women or those living with their partners, 32.5% experienced some form of harm from their partner’s or husband’s heavy alcohol use.

- Further, 21% of parents/caregivers said that children in the family suffer harm from the alcohol use of others.

Improved alcohol law to better protect people from rising alcohol harm

A new and improved alcohol law came into effect in 2020, which included new restrictions on advertising and on the sale of alcoholic substances to minors, as well banning driving with any concentration of alcohol in the blood.

The law was passed by the National Assembly on June 14, 2019 and took effect from the beginning of 2020. According to the new alcohol law in Vietnam, the following actions are not allowed anymore:

- Inciting, encouragement and forcing others to consume alcohol,

- Sale of alcohol to people under the age of 18,

- Use of alcohol as promotion materials for people under 18 years of age,

- Alcohol consumption by public officials, students, members of the armed forces before and during working hours,

- Advertising of alcohol from 6pm-9pm on radio and TV,

- Operating motorised means of transport under the influence of alcohol.

Among other provisions the law included a ban on driving under the influence of alcohol. From January 1st, a zero-tolerance policy for driving under the influence of alcohol has been active in Vietnam. According to data from the World Health Organization, more than 30% of traffic crashes among men in Vietnam are due alcohol. Since the new laws, beer sales fell by 25% in January 2020.

While the alcohol harm prevention law was a win for public health in Vietnam, it was severely watered down compared to the original draft due to Big Alcohol interference.

Big Alcohol interference

According to the World Health Organization, during debates about the law “the alcohol industry … was lobbying hard to nullify or weaken it.”

At the time, there were multiple reports that some lawmakers had traveled abroad at the invitation of alcohol companies before the bill came up for discussion. And the alcohol industry was successful in their aggressive lobby campaign, as provision after provision got deleted from the draft alcohol law.

In February, Vietnam’s Finance Ministry said it was listening to all opinions about revisions to the Law on Special Consumption Tax.

The alcohol industry lobbied against higher alcohol taxation again.

Since 2003, the Law on Special Consumption Tax has been amended five times.

How Heineken buys political support for its private profit interests

Netherlands-based alcohol giant Heineken is one of the largest players in Vietnam’s market, which is otherwise dominated by Thai and Japanese alcohol companies, as well as Vietnam’s own alcohol company.

Heineken has been doing its own senior-level lobbying. During Vietnamese Prime Minister Pham Minh Chinh’s official visit to the Netherlands in December 2022, he met with the CEO of Heineken, Dolf van den Brink, at the firm’s global headquarters in Amsterdam.

Around this time, the brewer announced plans to invest an additional $500 million in Vietnam, on top of the around $1 billion in Vietnam it has invested to date.

After meeting the company’s CEO, Mr Chinh said his country aimed to improve its tax policy in the spirit of “harmonious benefits, shared risks,” according to a government statement, as per Deutsche Welle.

Last September, Heineken Vietnam unveiled its largest brewery in Vietnam, an event attended by then Deputy Prime Minister Vu Duc Dam. However, it was ordered to pay $39.7 million in back taxes and fines in 2020.

The Netherlands is now the largest EU investor in Vietnam, with registered capital of about $13.7 billion, according to government data.

Already in 2022, the alcohol industry has been revealed to lobbying to delay the proposed alcohol tax increase in Vietnam. The Vietnamese government had approved the Strategy for Tax System Reform till 2030. Accordingly, Vietnam would adopt a road map to increase excise taxes on tobacco and alcohol products.

But despite the multiple benefits for people and society from alcohol and tobacco tax increases, Big Alcohol is claiming that the industry needed more time to recover from the COVID-19 pandemic. The heavily opposed the alcohol tax increase. However, a look at the 2022 revenue and profit increases for one of the largest alcohol companies in Vietnam showed that Big Alcohol made windfall profits that year, too.

People and experts support the alcohol tax increase

The alcohol lobby argues that any increase in a special tax will negatively affect the market, especially during its recovery efforts from the pandemic. If alcohol firms put the extra cost onto consumers, that would also impact the hospitality and tourism sectors, which were decimated by the pandemic and are only now showing signs of recovery.

The Vietnam Beverage Association wants the government to delay any increase in the special consumption tax until at least 2024, and even then it will lobby for only a slight uptick in rates.

Much depends on by how much the tax rate would be hiked. The special consumption tax on alcohol was last increased in 2018, when it rose from 50% to 65%.

Tobacco and alcohol prices in Vietnam remain among the lowest globally. Therefore we will have to wait and watch and see how much of an increase the government plans to implement,” said Pritesh Samuel and Thang Vu of consultancy firm Dezan Shira & Associates, according to Deutsche Welle.

Pritesh Samuel and Thang Vu, consultancy firm Dezan Shira & Associates

Some health experts say only a major increase in the special tax would impact the heavy alcohol burden.

The World Health Organization estimates that a special tax only accounts for about one-third of the retail price of alcoholic products in Vietnam. In many other countries it is usually over half, if not as high as 85% of the retail price.

All this is a headache for a government that reckons that progress and social justice should not be sacrificed for “simple economic growth,” as Prime Minister Chinh said when he welcomed the largest-ever American business delegation to Hanoi.

The World Bank is in support of raising alcohol taxes in Vietnam. Already in 2017, when a public debate was taking place about government plans to increase the value added tax, the low level of alcohol taxation in Vietnam came into focus. And experts, such as from the World Bank weighed in.

Sebastian Eckardt, a senior economist at the World Bank, urged the government to consider implementing a higher special consumption tax on tobacco and alcohol, given the low rates in Vietnam, according to VN Express reporting.

And both the World Health Organization and the World Economic Forum support raising alcohol and other pro-health taxes:

Specific intervention strategies can effectively tackle leading causes of Non-communicable Diseases and their underlying risk factors, as a growing body of evidence has demonstrated.

These interventions include population level measures that encourage reduced consumption of tobacco, alcohol and salt; increased excise taxes; and enhanced regulation.”