The last two days, I have had the honor and pleasure to represent IOGT International and CEM at the Stakeholder Forum convened by the World Health Organization Global Coordination Mechanism on NCDs, which was a part of the First WHO Global Meeting of National NCD Program Managers and Directors.

National #NCD Directors from 134 countries meet @WHO to exchange best practices to #beatNCDs https://t.co/QA5SpzXiwa pic.twitter.com/3D9jHMoUct

— UN IATF NCDs (@un_ncd) February 15, 2016

In Bosnia and Herzegovina, we in CEM are actively advocating towards our government for alcohol taxation measures. And in IOGT International, we have put together a report with our colleagues at East African Alcohol Policy Alliance (EAAPA) about the potential of alcohol taxation for financing of sustainable development.

Therefore it was a great opportunity for us to be invited by WHO and to present our experiences and findings to national NCDs Directors.

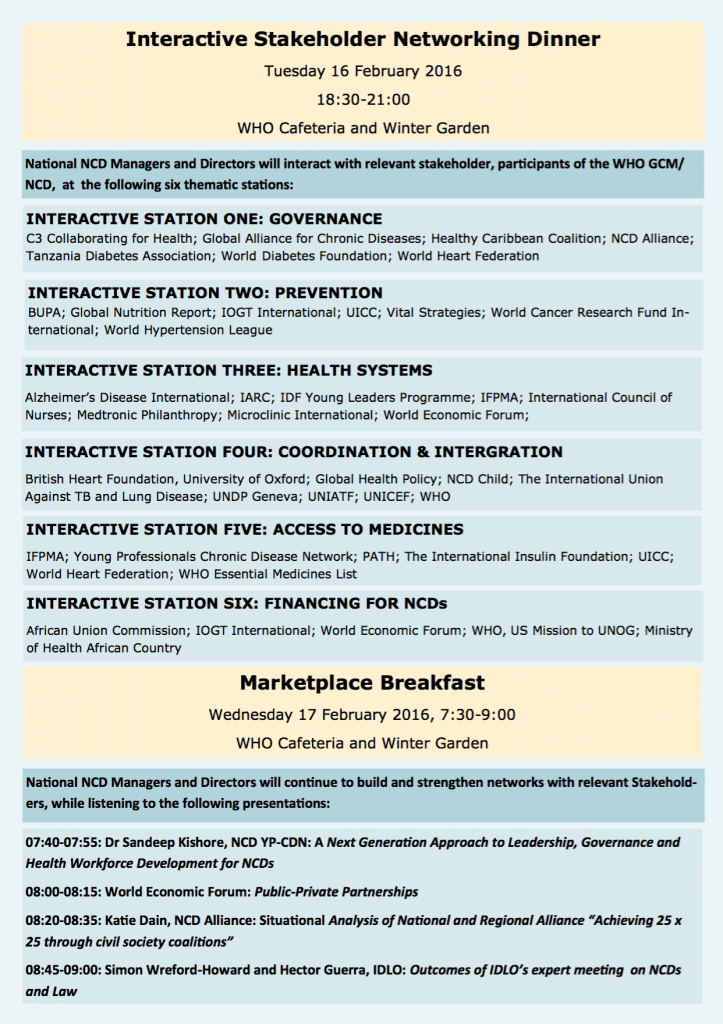

For the Interactive Stakeholder Networking Dinner, I participated in Station 6, together with an impressive line-up of honorable experts from the World Economic Forum, the African Union Commission, WHO and the US Mission to UNOG.

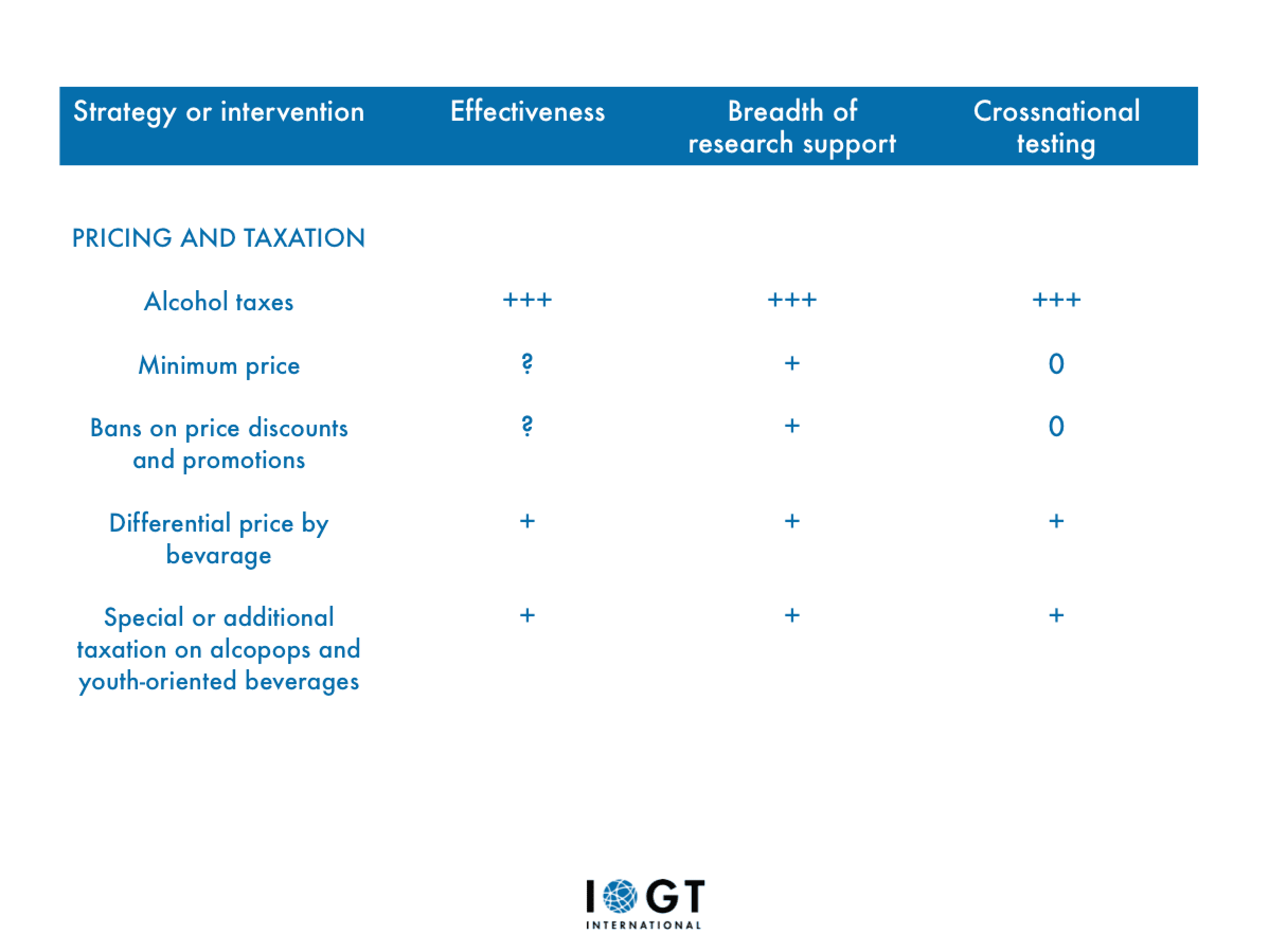

In my 7 minute presentation, I introduced world class evidence from Alcohol No Ordinary Commodity, about the cost-effectiveness and high-impact of alcohol taxation on reducing alcohol consumption and thus preventing and reducing alcohol-related harm.

I also showed quotes from key publications that make it clear: OECD, World Economic Forum, WHO, World Bank and leading academic institutions such as Harvard School for Public Health all agree on the fact that alcohol taxation is a crucial toll for controlling the NCD epidemic.

You can find the quotes in our report.

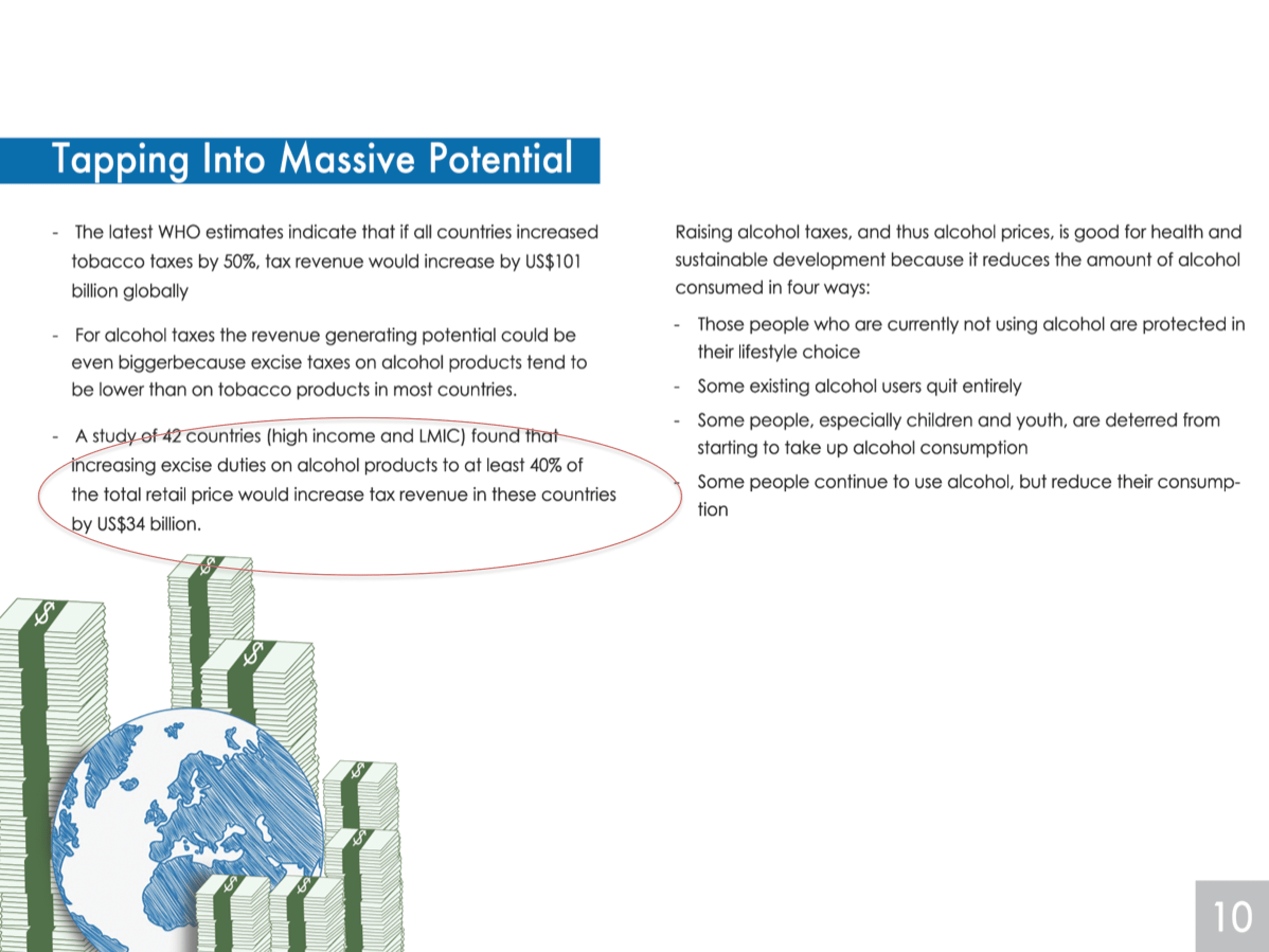

Finally my key messages was: Alcohol taxation is a win-win measure and holds massive (largely untapped) potential.

- It helps to bring down alcohol harm and the NCD burden.

- It helps to increase government revenue and thus funding for health promotion.

In our report, we show a couple of country examples and their alcohol taxation levels. Only very few (e.g. Kenya) are at that level of taxation as depicted above. That’s where the massive potential is hidden. I hope that the national NCD processes will excavate the alcohol taxation measure.

—

Find the presentation and taxation report:

Alcohol Taxation – A win-win measure for financing development

IOGT International and EAAPA

Overview of evidence: Alcohol taxation in the context of financing development

Adis Arnautovic, presentation at WHO Stakeholder Forum convened by the World Health Organization Global Coordination Mechanism on NCDs

In addition to taxes which most industries pay, I strongly suggest a two pronged approach for alcohol to differentiate it from harmless products.

First put alcohol through the strict process which other drugs must pass before any approval is given allowing it to be sold legally which means that IF it passes, there would have to be labels with ALL the side effects listed. The second part is for the producers and sellers to pay for the harm caused by their product.