Africa: Big Alcohol Drives Alcohol Use With Bigger Bottles

Using over-sized bottles, beer giant AB InBev is pumping up the volume in Africa in pursuit of ever more profits. A beer war is unfolding on the back of people and communities with major rival Heineken.

Carling Black Label is South Africa’s most popular beer. AB InBev has rolled out one liter bottles across the entire country in a strategic move to hook ever more South Africans on their addictive products. This marks a departure from its typical playbook of increasing margins and profits principally through higher prices and rigorous cost control, tactics honed through its close association with private equity firm 3G Capital – a Brazilian-American multibillion-dollar investment firm, as Reuters reports.

AB InBev has set its sights on Africa, with its young population, emerging markets, and potential for growth as beer sales in other regions stagnate. Analysts estimate the African beer market was worth $10.8 billion of net revenue in 2016, or 7% of the global total, and they see it as the world’s most attractive region for long-term volume and profit growth, according to Reuters.

In 2016, for a record-breaking $107 billion the beer giant purchased its closest competitor SABMiller, the company that had a stronger presence in Africa. SABMiller’s African presence was considered the main prize of the mega merger. By buying its biggest global rival, the new beerhemoth is now well positioned to compete with Heineken for dominance across African countries. Heineken, now the second largest beer maker in the world, controls 7% of South Africa’s beer market.

And the competition is aggressive. When AB InBev took over SABMiller, it cited forecasts that beer sales in Africa would grow by nearly three times the global rate between 2014 and 2025. About a fifth of the industry’s revenue in Africa, and a quarter of the profits, come from South Africa.

On a continent where the average person consumes “only” 10 liters of beer a year establishing its premium brands and selling high volumes of mid-tier beers will be key, as will breaking into countries dominated by other brewers. For comparison, per capita beer consumption is 75 liters in the United States and 66 liters in Brazil.

Cheap prices, aggressive discounts, larger bottles, heavy promotions

The move to increase bottle size is the clearest sign yet of how AB InBev aims to conquer Africa after the mega merger. As part of its new strategy, AB InBev is reinforcing its volume play with more frequent discounting for Carling and another local favorite, Castle, retailers say.

Discounting and promotions are the key tools for the beer giant to protect and expand its mid-tier brands as they will be its workhorses during the time it takes for the premium international lagers Budweiser, Stella Artois and Corona to gain market share.

But because AB InBev already has a range of premium beers for the high end of the South African market, it is also freer than SABMiller to push brands such as Carling and Castle deeper into the mainstream market.

Even though AB InBev controls more than three-quarters of the South African market, it is using promotions aggressively since the mega merger with SABMiller, according to liquor store owners that Reuters interviewed. Promotions were most intense towards the end of 2017.

There were deals almost on a weekly basis … crazy stuff,” said the trader in Vanderbijlpark near Sasolburg, as per Reuters.

AB InBev appeared to be in “full-on war” with its closest rival Heineken in the run-up to Christmas.”

Local alcohol trader

Heineken is also aggressively pushing into the mainstream sector with the Soweto Gold brand, as well an aggressive effort for its more established Tafel brand. Heineken, too, is also rolling out different bottle sizes.

Both AB InBev and Heineken are pursuing an ambitious growth agenda. With that comes quite intensive promotional activity,” said Heineken’s South Africa chief Ruud van den Eijnden, as per Reuters.

Ruud van den Eijnden, South Africa Heineken chief

South Africa’s beer war on the back of the people

The beer giants are using specific packs to do their aggressive promotions. And consumers show the desired response: they perceive the offers with the oversized bottles as a “steal”. It is possible to buy an 18-pack of beer with the accompanying promotion: “Buy 12 and get 6 extra free.”

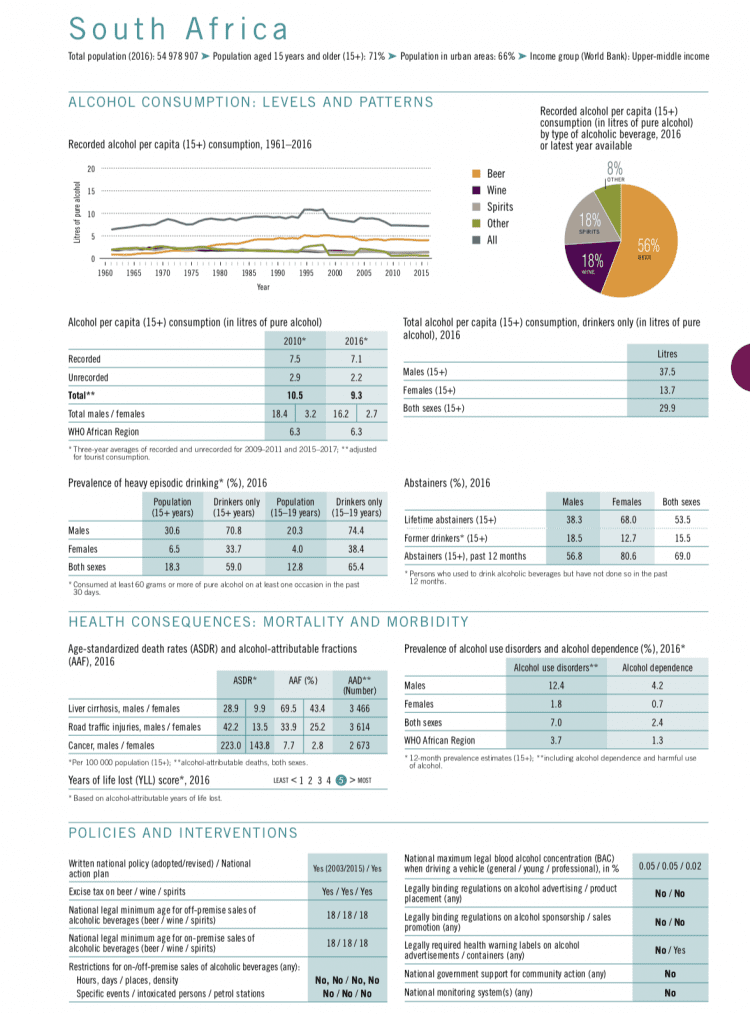

Analysts confirm that the bigger bottles were also a way to drive sales in the near term conquering new alcohol users. In South Africa, 69% of the adult population are alcohol abstainers, according to the WHO Global Alcohol Status Report 2018.

The bigger volume and price promotions converts abstainers to alcohol users and gets price sensitive consumers into the brand. Once this is accomplished, AB InBev’s strategy is to familiarize these new consumers with smaller sized and higher priced premium brands.

This AB InBev strategy in South Africa – jumbo bottles and smaller sizes as well as multi-packs coupled with aggressive price promotions – serves as a blue print for other countries across Africa.

In South Africa, alcohol harm is pervasive and a heavy burden on the country’s sustainable development and poverty eradication efforts. The country ranks among the highest regarding “years of life lost” due to alcohol in the world.

Alcohol intake per capita of alcohol users is a staggering 29.9 liters per year.

- 3,466 liver cirrhosis deaths are due to alcohol per year.

- 3,614 road traffic deaths are due to alcohol.

- 2,673 cancer deaths are due to alcohol in South Africa, every year.

- 12.4% of the male adult population has an alcohol use disorder.

As the alcohol industry giants are fighting for markets, people in South Africa and other countries all over the continent are suffering from rampant alcohol harm. There remain three main ingredients that allow the South African alcohol industry to thrive, despite all the harm they cause:

- Extremely cheap beer,

- Widely available alcohol and largely unregulated alcohol trading, as well as

- Insufficient regulation of alcohol marketing.

These three main ingredients combined with access to the political elite through business links and strategic Corporate Social Responsibility partnerships with government and civil society provides the alcohol industry with social currency to continue aggressive marketing, supplying the largely unregulated market and lobbying to avoid any regulation.

Recent research has shown that bottle size does matter for alcohol consumption – and by extension levels of harm. The alcohol industry is clearly deploying a strategy that is harmful, especially given the already high numbers of alcohol use disorders and other types of alcohol harm. This strategy contradicts a commitment Big Alcohol has made to the World Health Organization in June 2018, at a “dialogue” meeting. For example, larger container size fuels binge alcohol consumption – a problem that is of grave concern in South Africa, where 59% of adult alcohol users and 65% of under-age alcohol users engage in heavy episodic alcohol consumption. It is with business strategies like this that the alcohol industry is manufacturing death, disease, disability and destruction.

For further reading

Overview: AB InBev Company Profile

SABMiller’s Tax Avoidance in Africa

Heineken Company Profile

Rwanda: Heineken Sells Beer Below $1

Ivory Coast: Beer Marketing War Rages

Impact of Bottle Size on In‐Home Consumption of Wine: A Randomized Controlled Cross‐Over Trial

Research article